PDS Limited (erstwhile PDS Multinational Fashions Limited) is a global end-to-end sourcing and manufacturing platform serving the world’s leading brands and retailers.

We believe PDS Limited provides a globally one-of-a-kind asset-light, platform play in the apparel sourcing industry through its unique entrepreneur-led growth model and its innovative business lines that prioritise solving customer problems. With the new asset light business lines slated to scale in the coming years and PDS Limited’s recent strategic entry into the US market, we feel that PDS Limited is on the cusp of entering a strong growth phase where its profits could outgrow its revenue growth handsomely.

PDS Limited Company Summary

PDS Limited is a small-cap company that provides various sourcing services to global apparel retail companies. PDS Limited acts as a sourcing platform for global apparel retail companies and enables the sourcing of garments for them from various garment factories around the world.

To the best of our knowledge, PDS Limited is the only apparel-sourcing platform company listed in India and maybe even worldwide (After Li & Fung delisted in 2020). PDS Limited offers apparel sourcing and apparel manufacturing services to its customers. An overwhelming majority of its revenues come from the sourcing segment, with only a small segment coming from manufacturing. The manufacturing segment was started by PDS Limited only in FY17. PDS Limited has certain very unique aspects to its business model, which we will discuss in detail in this note.

PDS Limited was listed in the stock exchanges in 2014 following the demerger from Pearl Global Industries Ltd. Pearl Global Industries Ltd. was founded by Mr. Deepak Seth in 1987 as a global apparel manufacturing and sourcing company. In 2014, the sourcing and marketing part of the business demerged from Pearl Global Industries Ltd. and became PDS Limited. The apparel manufacturing business continued to operate as Pearl Global Industries Ltd in the stock markets.

PDS Limited Company Structure

PDS Limited, by virtue of its business model, has a very high number of subsidiaries. As of FY24, the company had 127 subsidiaries (most of which are step-down subsidiaries), 5 joint ventures, 5 associate companies and 1 controlled trust.

Most of the step-down subsidiaries are business units of PDS Limited that transact business with one, two, or multiple customers of the PDS Group. Every year, several new subsidiaries are created, and several subsidiaries are closed down (More on this later). PDS Limited owns a majority stake in almost all subsidiaries and step-down subsidiaries. The total minority interest as a share of consolidated profits in 9M FY25 was 31%.

The top 10 sourcing subsidiaries contributing the most revenues and profits in FY24 of PDS Limited are mentioned below (figures mentioned below are in USD Mn)

You will notice that the total PBT of the top 10 verticals is 47.4 Mn USD (~INR 400 Cr @ 84 INR/USD), whereas the consolidated PBT reported by PDS Limited in FY24 was INR 232 Cr. This is because there are substantial inter-subsidiary transactions that get knocked off on consolidation, and also, there are some loss-making subsidiaries.

Clearly, understanding subsidiary relationships or mapping customer accounts to subsidiaries is quite difficult for PDS Limited because there are too many subsidiaries and step-down subsidiaries and limited information about them. A few relationships are well understood, as presented in the table below

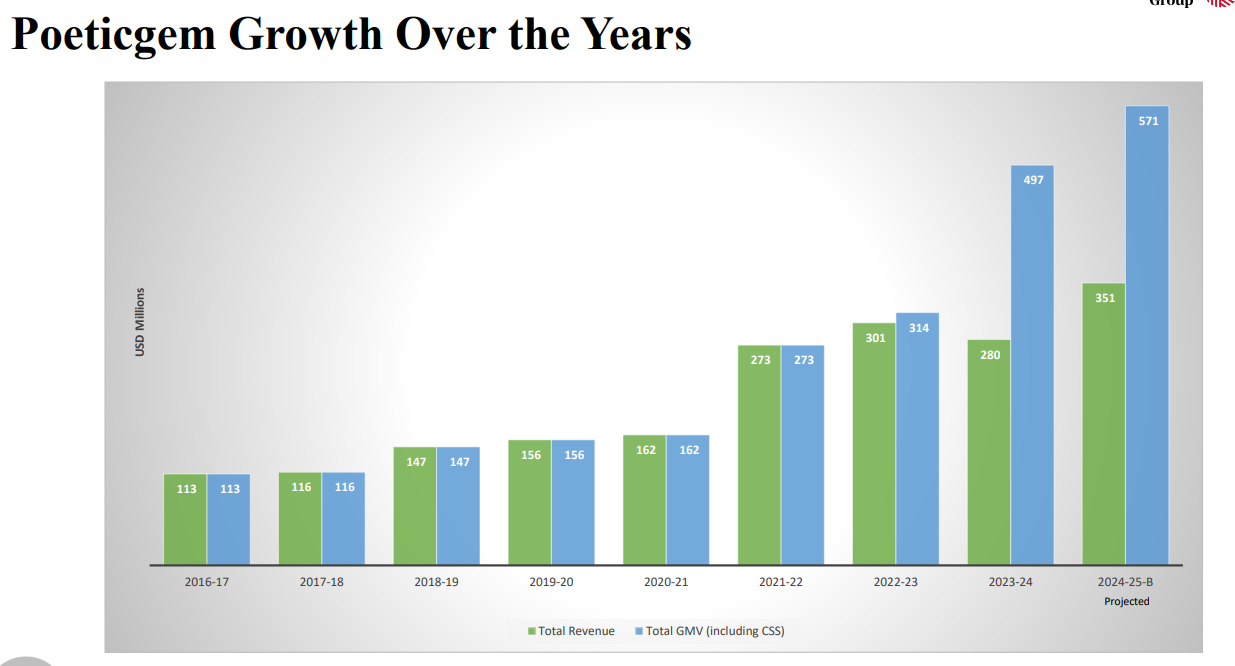

As an illustration of the importance of the subsidiary model for PDS Limited, here is how big Poetic Gem actually is. In FY24, it processed ~500 mn USD worth of GMV (Gross merchandise value) and recorded USD 280 mn revenues.

Poetic Gem aspires to become a 1bn USD GMV company on its own. It recently announced plans to move into a new HQ in London, UK.

PDS Limited Management Details

PDS Limited is helmed by Mr Pallak Seth, the son of Mr Deepak Seth. While Pearl Global Industries Ltd. is helmed by Mr Pulkit Seth, Mr Pallak Seth’s brother. Mr. Deepak Seth sits as Chairman of the Board of both companies. The two companies don’t have any cross-holdings with each other.

PDS limited Industry Landscape

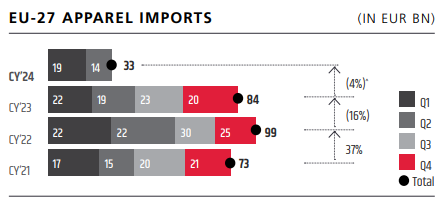

The total global apparel and textile traded value reached USD 910 bn in 2022 with apparel trade accounting for USD 540 bn (60%). Between CY22-CY25, global apparel trade is expected to grow at a CAGR of 3.5% from USD 540 bn to ~USD 600 bn. Of the USD 540 bn global apparel trade, USA accounted for USD 100 bn worth of imports, EU accounted for USD 99 bn worth of imports and UK accounted for USD 21 bn worth of imports in CY22.

The top 3 apparel exporting countries in the world are China, Vietnam and Bangladesh with India in 4th/5th place and Turkey and Indonesia being the other relevant global players.

CY23 proved to be a challenging year for the global apparel industry with consumption in key markets of USA, UK and Europe facing headwinds due to inflation and high retail inventory. This led to significant moderation of apparel imports in CY23 vs CY22.

Bangladesh enjoys twin advantages of low labour costs and no import duties in key markets of EU and UK over other competitors. The US tariffs apparel from all major supplying countries at rates between 11-28%.

Some key trends being observed in the global apparel industry right now are

- Sustainability and ethical fashion – The usage of sustainable materials, circular fashion and sourcing through ethically compliant factories are trends gaining strength in developed markets

- Rise of E-commerce – Online sales via e-commerce platforms and D2C brands keep gaining momentum versus traditional brick and mortar retailers

- Fast fashion and quick response – Brands are increasingly focusing on reducing lead times and improving their ability to respond quickly to changing consumer preferences

- Shift away from China – The industry continues to witness a shift away from China as the primary sourcing hub, driven by rising labour costs, geopolitical tensions, and trade issues. This ‘China Plus One’ strategy is creating opportunities for countries like India, Bangladesh, and Vietnam to expand their market share.

- Supplier consolidation – The apparel industry is witnessing a major trend towards supplier consolidation, where brands are reducing their supplier base and focusing on building deeper strategic partnerships with a few key suppliers. This shift is driven by several factors such as the desire for greater control, speed and flexibility in the supply chain. Also, the pursuit of cost efficiencies through economies of scale and reduced complexity and supply chain risk mitigation will help in having a more concentrated supplier network.

- Customisation and personalization – Advancements in technology are enabling greater product customisation, allowing brands to offer personalised products at scale. This trend is driven by consumer demand for unique and tailored experiences.

- Technology and data adoption – Automation and robotics are now revolutionising the apparel industry to assemble, pack and ship orders at production, distribution and warehousing facilities. It can increase production efficiency, reduce the incidence of errors and reduce the overall costs of production.

Apparel companies are increasingly integrating technology into their operations and using data analytics for informed decision-making; thereby achieving improved efficiency and data-driven consumer insights. Analysing consumer data is helping forecast demand and manage inventory while also enabling real-time tracking of products in transit.

Trends like supplier consolidation, fast fashion and quick response, higher propensity of brands to outsource sourcing services are driving growth for businesses such as PDS Limited.

The largest global apparel sourcing company is Li & Fung, based out of Hong Kong. They have a more than 100 year history and grew rapidly from the early 90s to the early 2010s on the back of China becoming the global supply hub of apparel. At their peak in 2011, Li & Fung were handling USD 20bn worth of apparel sourcing. After 2011, they faced a number of challenges such as growing labour costs in China, issues with compliance in their partner factories and sheer force of gravity due to their size. Their GMVs declined from USD 20bn in 2011 to ~USD 9bn in 2019 and further to ~USD 7bn in 2023. Today, PDS Limited is probably the second largest apparel sourcing company in the world after Li & Fung, and as Li & Fung is decelerating, PDS’s growth is accelerating. We haven’t been able to identify many other large, global, asset light apparel sourcing platforms such as PDS Limited or Li & Fung.

The other source of competition for PDS Limited is large manufacturing houses based in India, Bangladesh, Vietnam and China who have the marketing, financial and human resource bandwidth to sustain direct relationships with global apparel brands. Some of the largest apparel manufacturing and exporting companies out of India are Shahi Exports, Welspun Group, Himatsingka Group, Arvind Group, Gokaldas Exports, Pearl Global Industries (sister company of PDS Limited) etc.

PDS Limited Business Details

PDS Limited operates across three segments

Sourcing – The sourcing segment is the main business segment of PDS Limited, accounting for 95% of its revenues and almost 98% of the consolidated PBT of PDS Limited. Under this segment, PDS Limited provides various apparel design and sourcing services to global apparel retail companies. The main services under this segment include their bread and butter offering of design-led sourcing and newer offerings such as sourcing-as-a-service (SaaS) and brand management (BM). Directionally, the GMV (Gross merchandise value) being sourced under the new business lines of SaaS and BM are expected to increase, leading to the expansion of margins for the segment as a whole.

In apparel sourcing, PDS Limited provides the following services to its retail clients.

- It works with retail companies to finalize apparel orders. In some cases, PDS Limited also helps in designing apparel for retail companies.

- Once the design is finalized, PDS Limited places manufacturing orders on its 600-strong network of apparel manufacturing factories spread across Asia and ensures that the orders are executed on time and as per requirements; in some cases, PDS Limited also extends working capital or raw material sourcing support to its partner factories to ensure execution as desired.

- Once the order is shipped directly by the partner factory to the end client, PDS Limited pays its partner factory and coordinates until timely delivery happens to its client. Thereafter, it gets paid by the client, usually within 60 days from when it pays its manufacturing partner. PDS Limited has factoring lines with banks, which allows it to factor a large chunk of receivables for many of its clients and thus get paid much faster, leading to the low debtor days that we see for the company. Also, PDS Limited doesn’t have to take physical delivery of inventory.

- In the background, PDS Limited maintains an on-ground vendor management team in major sourcing countries such as Bangladesh, Sri Lanka, India, Turkey, China etc. This team is responsible for maintaining the partner factory network – adding to it or removing from it. One of its key KPIs is to ensure that the partner network of factories is following all compliances regarding safety, worker exploitation, suitable working conditions, environmental norms, etc, at all times. This is a critical function in the apparel industry as clients are very particular about not getting their brands tarnished by associating with factories employing unfair practices such as employing child labor or operating out of unfit factory premises, which could potentially lead to disastrous accidents.

Manufacturing – PDS Limited has a small manufacturing segment, contributing about 5% of revenues and 2% of PBT at the consolidated level. PDS Limited operates two factories out of Bangladesh, one factory out of Sri Lanka, and another recently acquired factory out of TN, India. PDS Limited has no intention of scaling up the manufacturing segment massively, as it plans to remain an asset-light and sourcing solutions player. However, having some owned manufacturing capacity must surely help PDS Limited in terms of flexibility and some skin in the game while approaching clients. Running their own factories also helps them stay keenly aware of challenges and pitfalls in the local industry and stay abreast of local developments, which must have a positive rub-off effect on their dealings with their partner factory network. The manufacturing segment has improved PBT margins from 2-3% levels to 4%+ in FY25. With the addition of its India unit (Knit Gallery, acquired in Q3 FY25), the expectation is that PBT margins will further improve.

PDS Ventures and Others – Under this segment, PDS Limited clubs its investments in PDS Ventures, real estate, and treasury instruments. PDS Ventures is a subsidiary that acts like a Venture Capital firm, investing in innovative startups in the apparel and related supply chain space. The total capital employed in this segment as a % of gross capital employed by PDS Limited is ~17%, of which ~9% is in PDS Ventures, 3% in real estate, and the rest in treasury instruments. PDS Limited has a policy of recording M2M gains in its investments via PDS Ventures directly in the balance sheet via OCI, avoiding the P&L. In FY24, this segment reported zero PBT.

We have more to say about PDS Ventures in the risks section later in the note.

Understanding the Sourcing segment in detail

Now that we have an understanding of the key segments in which PDS Limited operates, let’s deep dive into the 3 separate business lines they have in the sourcing segment. It is important to understand the nuances of the two new business lines – SaaS and BM – as they are going to be major drivers of profitability in the years to come.

Design Led Sourcing (DLS) – Under this model, PDS Limited works on orders received from its clients. In some cases, clients provide exact specifications of the clothing items they want to order, including measurement, materials to be used, etc. (This is called a tech-pack – short for technical package – in the apparel industry). In other cases, the client doesn’t design the tech pack but just gives broad directions to PDS Limited on the kind of item it is looking to procure (For example, a red dress made of XYZ material with a reference image). In this case, the PDS Limited in-house design team makes the tech-pack. PDS Limited employs about 250 designers in-house. This design element is what they call this segment design-led sourcing. Once the tech pack is ready, PDS Limited places orders on its manufacturing network and sees the order through from manufacturing to delivery. The details involved in the operations after the design stage are already covered in detail above, where we described their sourcing operations.

Sourcing as a Service (SaaS) – This is a business line which PDS Limited started in FY22. In the design-led sourcing business line, PDS Limited transacts with its clients on an order to order basis. In contrast, when it cracks a SaaS deal with a client, PDS Limited takes over the entire sourcing operations of the client for a particular sub-brand or geography and in the process functions as the extended procurement arm of the client.

Usually, when such a deal is cracked, PDS Limited starts a new subsidiary and performs all operations via this subsidiary. The subsidiary operates on an open costing basis and sometimes even has dual reporting to the end client. The intent is to be completely transparent with the client. The nature of operations themselves is quite similar to the DLS segment but with a much wider remit. PDS Limited gets reimbursed 100% for the costs incurred by the subsidiary in performing these operations for the client and, in addition, is paid a certain % of the GMV sourced through this subsidiary as fees. The part of revenues that cover operating costs results in zero gross profits for PDS Limited, but the part of revenues that are paid as a % of GMV is a 100% pass-through to gross profits, and most of it is also a straight pass-through to EBITDA and PBT.

By our estimates, if any SaaS contract, the total revenue earned by PDS Limited is likely to be in the ballpark of 3-4% of the GMV sourced under the deal. Roughly half of the revenues would comprise reimbursements, and the remaining half would represent the fees. Hence, SaaS deals are capable of delivering 35-50% PBT margins on revenues recognized and 1-2% on GMV processed. This is in contrast to 5% PBT levels in DLS and manufacturing verticals. Hence, SaaS has the potential to power-charge profit growth while not adding to revenues much.

The key SaaS deals cracked by PDS Limited thus far include deals with George by ASDA (USD 400 mn+ annually), Gerry Weber, Silver, and Hanes (This deal has since been discontinued; more details are covered in the risks section).

Brand management – PDS Limited does a bunch of things under the brand management business line. Let’s try to understand them in some detail

- Managing design and supply for a brand end-to-end – The best way to illustrate this business model is to go through the Ted Baker Design Group deal that PDS Limited signed with Authentic Brands Group (ABG) in 2023.

Ted Baker is a British luxury fashion brand that primarily makes premium office-wear products. Due to financial challenges, ABG acquired Ted Baker’s brand (minus the physical assets) in 2022. As part of this deal with PDS Limited, PDS Limited took over the 100-person design team of Ted Baker, and PDS Limited became the official design and merchandising partner for the Ted Baker brand for all its distribution partners globally, which meant that all design and merchandising decisions globally would flow through PDS Limited only. In addition to this, PDS Limited also received wholesale rights for selling Ted Baker products to distribution partners in Europe and the UK. While the wholesale business would earn PDS Limited a wholesale margin, the global design and merchandising functions allowed PDS Limited to earn an agency fee on all Ted Baker GMV sourced by global partners.

Thus, under this model of brand management, PDS Limited would strive to take control of the back-end operations of a brand (design and sourcing), typically from a brand roll-up like ABG, and earn an agency fee (and wholesale income in some cases) through it. The agency part of the business is asset-light, much like SaaS, and has a disproportionately high PBT margin.

- Private label brand creation – Under this business model, PDS Limited helps create private label brands for large retailers like ASDA or Tesco. PDS Limited has a 250-member strong design team that has the capability to do market research to understand customer preferences, match them with gaps in the client’s portfolio, and then come up with a suitable brand and all aspects of the brand language, including look and feel, messaging, what the brand stands for, pricing, etc. Post this exercise, once the brand is greenlit by the client, they proceed to perform DLS operations for the brand.

They also have a business line wherein they in-license IPs for popular characters belonging to the Marvel/DC/Disney universes and design products based on these characters for their clients.

The unique entrepreneur led growth model

With a detailed understanding of their lines of business, let us now look at PDS Limited’s innovative growth model. This model has enabled PDS Limited to grow to a global USD 2 bn apparel sourcing company in the span of a couple of decades.

PDS Limited is not a monolithic company. As we have discussed above, it is, in fact, a sum of parts of its numerous subsidiaries. Why does PDS Limited have so many subsidiaries? That’s because of the company’s unique entrepreneur-led growth model, which looks something like this.

- PDS Limited management identifies (This role is typically played by Pallak Seth)

- Promising senior executives working in either sourcing or merchandising functions at big global apparel retailers. Such an executive would typically have a decade or more of sourcing experience in the industry and has a deep understanding of the business requirements and challenges faced by large apparel retailers

- Senior sales Directors with a number of years of experience or entrenched relationships with some global apparel brands who are working for competitor sourcing companies, such as Li & Fung

- Small-scale entrepreneurs who are running promising sourcing operations for global brands

- PDS Limited pitches an entrepreneurial vision to these executives wherein they could be in charge of running their own companies in a fairly low-risk manner. They are promised competitive market salaries, a small budget to build out their teams, and access to PDS’s working capital lines and corporate infrastructure across procurement, legal, compliance, and other functions. The entrepreneur is offered a stake between 15-35% of the new company (subsidiary) so that he/she has sufficient skin in the game.

- The new company is either given responsibility for servicing a customer sourced by the PDS team or, in some cases, the entrepreneur comes with his/her own set of customers.

For example, PDS recently cracked a new account in the USA called Fashion Nova, which is into fast fashion. Mr. Andrew Reaney, ex-head of sourcing at Boohoo, a competitor of Fashion Nova, was responsible for running this account.

On the other end of the spectrum, in FY22, PDS Limited acquired a majority stake in DBS Lifestyle India Pvt. Ltd., which supplied private label brands to Amazon, among other companies. This opened up a relationship with Amazon for PDS Limited.

- The new company is given 3 years’ time to breakeven at an operating level. The expectation is to start growing using self generated cash flows from year 4 onwards. If the company is not on a successful trajectory, then it is shut down. The subsidiary’s CFO is appointed by PDS Limited and monthly financials and business trajectories are discussed with PDS management and the corporate finance team to make sure things are on track. This approach ensures close monitoring of subsidiary profitability.

This is a unique model of partnership-based growth followed by PDS Limited. By bringing in experienced executives and turning them into entrepreneurs with significant skin in the game and allowing them to focus on a limited set of clients, PDS Limited optimizes for high accountability and initiative and hyper-focus on servicing the client’s needs. In the process, PDS Limited is willing to sacrifice minority stake and in certain cases, economies of scale. Subsidiary heads are allowed to make independent decisions within reasonable bounds in order to serve their customers in the best possible manner. For example, if a customer or an entrepreneur feels that sourcing from factory A in Bangladesh would be the right decision for the brand, then PDS Limited is likely to agree to it even though sourcing from factory B may lead to better economies of scale.

Over time, PDS Limited has found good success with this approach, with only 20% of incubated companies being shut down and the rest turning profitable. The consolidated return on capital ratios of ~20% is proof that this model is working quite well so far.

Recent developments

Big push into the USA market – PDS Limited is making a big push into the US apparel retail market. PDS Limited is a well-entrenched sourcing solutions provider in the UK and Europe, but so far, it has not had a very significant presence in the USA. That has started changing over the last couple of years, with an active push into the market and some high-profile entrepreneur hirings. They already have footholds in 5 key US customers – Walmart, Target, Kohl’s, TJ Maxx, and Fashion Nova. Fashion Nova is, so far, the largest US customer, with a revenue potential of USD 100- 200 million, according to management. Fashion Nova is PDS Limited’s first large fast-fashion customer (as opposed to traditional retailers who stock large quantities and churn less often). A successful scale-up in Fashion Nova can open many more doors in the fast-growing fast-fashion segment. Revenues from the USA have grown at ~70% YoY in 9M FY25.

SaaS GMV Growth – SaaS and agency GMVs have grown from ~170mn USD in FY23 to a run-rate of ~800mn USD in FY25, a growth rate of more than 100% each year. SaaS and agency revenues have grown at a more sedate pace of 50% per annum, largely due to a slowdown in the Ted Baker account in FY25 due to issues with the front-end partner. Normalized for that, revenue growth also would have been ~100% year on year. While this pace of growth may not continue in the future, growing SaaS and agency GMVs at 40-50% should be possible as more retailers buy into the model and go asset-light.

Brand management outlook – PDS Limited had a brilliant first year with Ted Baker, clocking ~INR 500 Cr revenues in FY24 and a PAT of ~INR 21 Cr. FY25 has seen a small setback due to issues with front-end retail partners in the UK and Europe, leading to flattish revenues for the year and a reduction in the high-margin agency revenues. ABG has appointed new retail partners since then, and it remains to be seen whether revenues will resume their growth trajectory in FY26. Management has indicated that many such brand management deals are coming their way, but they don’t want to take on more than they can chew and would prefer to stabilize Ted Baker first before making further deals in this space.

The emergence of brand roll-up PE firms – Distress in brick-and-mortar fashion retailers in Western geographies has resulted in many of them going bankrupt. This phenomenon has seen the emergence of PE firms like brand licensing and management companies, which have tended to buy out the brands of these troubled retailers. Post-buy-out, they set about appointing front-end (retail) and back-end (design and sourcing) partners for these brands in various geographies. The largest such brand roll-up company is Authentic Brands Group, which has ~USD 32bn worth of GMV under its brand portfolios. PDS Limited is increasingly receiving offers for more and more such back-end partner deals in the UK and Europe. This is a trend that is expected to sustain as brick-and-mortar retail companies face competition from their e-commerce counterparts and have a dire need to optimize operations.

PDS Limited Corporate governance

Board Composition – The Board of Directors for PDS Limited comprises 10 directors, of whom 5 are Independent and 5 are non-independent. The patriarch, Mr. Deepak Seth, is the Non-executive Chairman of the Board, whereas Mr. Pallak Seth is the Executive Vice-Chairman of the Board. Mrs. Payel Seth (Mr. Deepak Seth’s wife) is also on the board. The non-executive/independent Directors on the board bring diverse and relevant experience to the company across the domains of apparel manufacturing & sourcing, retail, mergers & acquisitions, and banking & finance.

Promoter Remuneration – The total remuneration to promoters for FY24 amounted to INR 10.3 Cr, paid to Mr. Pallak Seth as remuneration. No other promoter family member drew any remuneration from PDS Limited in FY24. Total promoter remuneration as % of PAT amounted to ~5% in FY24.

Apart from the promoters, the professional management team drew a remuneration of INR 14.4 Cr via salaries and stock-based payments, amounting to an additional 7% of FY24 PAT.

The total compensation to promoters and executive management amounted to ~12% in FY24, which is on the higher side. However, FY24 PAT was depressed due to P&L-based investments. Adjusting for the investments, the total remuneration to promoters and executive management amounted to 8.5% PAT, a more comfortable figure.

Related Party Transactions – Due to a myriad of operating subsidiaries, the standalone entity of PDS Limited reports a very large number of related party transactions. Most transactions are in the nature of payments received by PDS Limited for rendering corporate and sourcing services, payment of dividends by subsidiary companies, procurement of finished goods from subsidiaries and brokerages, or commissions either paid or earned from subsidiaries (It is not clear which). Most year-end balances are also in the nature of payables or receivables to subsidiaries. No transaction stood out as abnormal to our eyes.

Contingent Liabilities – According to the annual report FY24, the total amount of contingent liabilities amounts to ~INR 1.5 Cr only and is thus immaterial

Complicated subsidiary structure – Not only does PDS Limited have 130+ subsidiaries, JVs, and associate companies, but it is very difficult to decipher the relationship between them. PDS Limited does not clearly declare which direct subsidiaries are direct subsidiaries and which are step-down subsidiaries under each of the direct subsidiaries. For example, Poetic Gem is a subsidiary. The Poetic Gem group itself probably has multiple subsidiaries of its own. Due to this structure, there are also multiple layers of consolidations and knock-offs of transactions during consolidation, making it very difficult to get an intuitive understanding of subsidiary numbers. We understand that the business model warrants this kind of corporate structure and don’t think there is any intent on the part of management to intentionally create opacity. However, the fact remains that markets find such businesses tough to understand, analyze, or even trust, which may lead to many participants staying away from investing in PDS Limited, leading to some valuation discounts.

PDS Ventures gains M2M directly into equity – PDS Ventures is the venture capital arm of PDS Limited, which invests in startups alongside larger apparel retail companies or PE funds by taking minority stakes in these startups. PDS Limited follows an accounting policy of recognizing M2M gains on these investments (presumably by virtue of a new funding round getting closed after their investment). These gains are not recognized in the P&L but are routed directly to equity in the balance sheet via OCI. From FY24, we could understand that between FY23 and FY24, an amount of INR 33Cr has been recognized as additional equity due to such M2M gains in the balance sheet. Since the figure is only 3% of the total equity of the company as of FY24, we don’t consider this material as yet, but it merits continued observation.

Foreign currency exposure – As of FY24, PDS Limited’s net exposure to foreign currencies across multiple heads is below. The largest long exposures are to GBP and EUR, respectively. If there is a 10% adverse movement in GBP and EUR against INR, the net loss on the exposure of INR 97 Cr will amount to ~10 Cr, which is ~5% of FY24 PAT. On an adverse movement of 5%, the net loss would be ~2.5% of FY24 PAT.

PDS Limited Financial Performance

Since FY15, PDS Limited has grown revenues at 12% CAGR, EBITDA at 25% CAGR and PAT at 24% CAGR. Over the last decade,PDS Limited has steadily increased its gross margins from 14-15% levels to 20% in FY24. EBITDA margins have likewise increased from 1-2% to ~4% during this period.

As PDS Limited increases its share of platform revenues via its offerings of sourcing-as-a-service and brand management their profitability margins should keep improving. The current profitability margins seem depressed due to P&L based growth investments made by the company in FY24 and 9M FY25. These are expected to ease off from FY26. The company aims to deliver 3% PAT margins in FY27 and has an aspirational goal of delivering 5% PAT margins in FY29.

PDS limited Return Ratios, Working capital, Debt and cash flow Analysis

By virtue of being a platform company, PDS Limited has operated with very low net working capital days, with NWC days averaging between 10-20 over the last decade. PDS Limited generates very healthy cash flows with CFO/EBITDA averaging 150% over the last decade and 114% in the last 5 years. Debt on the balance sheet has always been under control for PDS Limited. Interest coverage ratio has dropped from 8.6x in FY22 to 3.2x in FY24 mainly due to the hike in interest rates in Europe and USA in the recent past. Most of PDS Limited’s debt is denominated in USD and GBP. As a result of the improved profitability, PDS Limited’s return on capital metrics have improved significantly over the last 5 years. The 5Y average return on equity is 26% vs the 9Y average of 17% and the 5Y average return on capital employed is 19% vs the 5Y average of 13%.

PDS Limited Comparative Analysis

To understand PDS Limited investment potential, we have conducted a comprehensive analysis. This analysis includes comparing PDS Limited to its competitors (peer comparison) on various fundamental parameters and PDS Limited share performance relative to relevant benchmark and sector indices.

PDS Limited Peer Comparison

There are no like-for-like peer companies of PDS Limited listed in India. Hence, we chose a couple of apparel manufacturing companies and an asset-light B2B digital marketplace as peers to benchmark against PDS Limited’s business performance metrics.

*Indiamart Intermesh has a lot of investments on its balance sheet. Gross asset turns net of investments is 2.2x

All three apparel companies have had very good growth over the last 3 years. All three companies are making healthy returns on capital. PDS Limited has the highest ROCE and ROE numbers thanks to its high gross asset turns number. Compared to its fellow platform company, Indiamart Intermesh, PDS Limited has delivered a superior return on capital over the last 3 years, although both companies have healthy ratios.

PDS limited Index Comparison

PSD Limited share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why you should consider investing in PDS Limited

PDS Limited offers some compelling reasons to track closely and to consider investing if one is looking to play on Global apparel sector

Unique business model and a proven track record – PDS Limited is one of the world’s only asset-light platform-based apparel sourcing companies. Its business model of bringing in industry veterans as entrepreneurs, giving them minority stakes in their own subsidiaries, and allowing them the necessary freedom to operate their subsidiary (within the framework of PDS Group guardrails) in the manner best suited to deliver the best possible outcomes for the client(s) they know best, is truly unique.

Their 10-year track record of generating 20%+ PAT CAGR at 20%+ ROE levels with strong cash flows and a debt-light balance sheet is a testament to the fact that they have cracked this business model and know how to scale through it. Successful businesses with unique business models that cannot be easily replicated always tend to get a scarcity premium in the markets.

Asset light models scaling up – In recent years, PDS Limited has successfully managed to scale up the proportion of GMV through asset-light and more profitable business lines such as sourcing-as-a-service and brand management agency business. The GMV under these business models used to be ~11% of total GMV in FY23, but as of 9M FY25, they contribute 35%+ GMV.

Sourcing-as-a-service and the agency business have 30%+ PBT margins in contrast to the 4-5% PBT margins at the consolidated level. Hence, as these business lines scale up, profitability is expected to be positively impacted non-linearly. Revenue growth will lag behind profitability growth as only 3-5% of GMV gets recognized as revenue under these business lines.

Aggressive growth targets – PDS Limited has a stated goal of achieving 333 by FY27, which implies reaching a GMV target of 3bn USD in 3 years (from the base year of FY24) at 3% PAT margins. This would imply a PAT level of USD 63mn (~INR 540 Cr @ USD/INR rate of 86) by FY27.

PDS Limited also has a more aspirational goal of 555 by FY29, which implies reaching a 5bn USD GMV at 5% PAT margin by FY29.

Entering the USA in a big way – So far, PDS Limited has been dominant as a sourcing solutions provider in the UK and Europe. They are often the first player invited to the table when a large apparel retailer in the UK or Europe is looking for supply-side solutions. However, that has not been the case in the USA, where PDS Limited has had a limited presence so far.

However, management has clearly articulated that entering the USA and building big business with the big retailers in the country is a strategic priority for them now. Towards this end, they have also hired several senior industry folks, either as full-time employees or as consultants, who could help open doors with the big US retailers. PDS Limited has also started seeing some early signs of success, having cracked the Fashion Nova account and making inroads at big-box US retailers like Walmart and Target

Acceptable valuations – While optically, valuations look expensive with a TTM PE of 37x, one has to adjust for investments being made via the P&L to arrive at the true profitability of business operations. Adjusting PAT for these investments, the FY25E PE ratio would likely be in the range of 20x. Given the 20%+ return on capital generated by PDS Limited, their track record of growing profits at 20%+ since listing, and their ability to manage balance sheet risks comfortably, we feel a unique company like PDS Limited should trade conservatively at 25x PE multiples.

What are the Risks of Investing in PDS Limited

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Global business exposed to all sorts of global risks – The biggest risk factor for PDS Limited is that its customers are located in Western geos of the UK, Europe, and the USA, and its sourcing partners are located all over Asia. PDS Limited is truly a global supply chain business and is thus exposed to the myriad of global economic risks, such as an economic slowdown in various parts of the world, worsening geopolitical relationships between countries which may affect their supply chains, currency fluctuations, exposure to various global interest rates, etc. For example, between FY23 and FY25, the interest rates on their foreign-denominated debt have gone up almost 5x. Growth disappeared in FY24 as retailers re-assessed demand and inventory levels in the backdrop of high inflation and economic slowdowns.

But this is the nature of the business, and there is no wish to take this risk away. What makes PDS Limited valuable is also what brings the most risk to it.

Complicated subsidiary structure – By virtue of its business model of partnering with entrepreneurs and creating separate lines of sourcing businesses targeted at specific customers, PDS Limited has a myriad of subsidiaries and associate companies – 130+ as of FY24. But this is a feature of their business model and not a bug. It is the customer relationships sourced via these entrepreneurs and these subsidiaries that have allowed PDS Limited to penetrate into the largest global apparel retailers and scale its business over the years.

However, given the number of subsidiaries and the complicated relationships between them (Sourcing and supplying to each other resulting in a criss-cross of transactions, impossible to trace from the outside), the opacity around this business is definitely much higher than normal. While we know which of the largest customers are supplied by which subsidiaries, it is difficult to track quarterly progression in accounts. One has to depend on the quarterly commentary provided by the management to gauge that. An unscrupulous management team could also potentially siphon money via the complicated network of subsidiaries, but PDS Limited’s global industry reputation, coupled with its long track record of profitability and declaring dividends, gives us confidence in the management.

Free cash may not be fungible – As PDS Limited is a collection of subsidiaries that are transacting real business with customers, most of the free cash flows generated also accrue with the subsidiaries. While PDS has > 60% stake in most of these subsidiaries, the entrepreneur often owns between 20-40% and thus has a big say in what happens to the cash generated by his/her company. Thus, it may not be easy for PDS Limited management to move cash from one subsidiary to another easily or quickly. No minority-share-owning entrepreneur would want to give away most of their free cash reserves as dividends because they are better used in another subsidiary. They’d want to convince PDS Limited management to undertake investments in their subsidiary itself.

This lack of cash fungibility is probably the reason why the short-term debt at PDS Limited appears to be unoptimized with respect to the consolidated net working capital requirements and also why PDS Limited has raised money via QIP when its free cash generation and cash reserves have both been otherwise healthy.

Setbacks in a couple of asset-light deals – PDS Limited had signed a SaaS deal with Hanes for sourcing from Bangladesh for their Champion brand in FY22. Under this deal, PDS Limited management was expecting to source as much as USD 400mn worth of GMV annually over the next 3-4 years. However, in FY25, the deal was discontinued as the Champion brand was sold by Hanes, and the new owners decided they’d move back to manufacturing in-house and thus no longer needed a sourcing partner like PDS Limited.

Similarly, PDS Limited entered into a brand management deal with Authentic Brands Group to manage global sourcing and design as well as manage wholesale operations for the UK and Europe for the Ted Baker brand. While FY24 was a very strong year for this business under PDS Limited, the retail front-end partners appointed by Authentic Brands Group to sell Ted Baker in stores in the UK and Europe went bankrupt in FY25. This led to the loss of revenues for PDS Limited.

These examples illustrate that many of the deals PDS Limited is entering into in its asset-light verticals, such as SaaS or BM, involve brands with whom all may not be healthy in terms of operations or finance. Hence, building a linear growth rate from such deals may not be the right thing to do. We should expect such deals to have unexpected disruptions from time to time. We hope that PDS Limited’s management, through its subsidiary network, will be able to keep winning many more deals and increase the sourced GMV under these business lines.

The trappings of a flashy industry – The promoters and top management of PDS Limited constantly interact with top executives and owners of global retail companies, as well as PE firms, which are increasingly playing a larger role in buying out struggling retail companies. While this dynamic couldn’t be any better for PDS Limited shareholders, we feel that the glitz and glamour and deal-making going on in the top echelons of the fashion and apparel retail industry could also have its own traps.

For example, we are ambiguous about PDS Ventures, the subsidiary through which PDS makes venture capital-style investments into innovative, early-stage fashion companies. On the one hand, it could help them get exposed to the latest developments in global fashion supply chain innovation and even lead to investments in truly innovative companies that multiply their invested capital manifolds. On the other hand, it could easily become a vanity project for the promoters or executive management, where they lose sight of the commercial goals and instead get caught up in the thrill of deal-making and rubbing shoulders with the who’s-who of the industry. Our assessment of promoters and management seems to suggest that they have a sound head on their shoulders, and there is no impending risk of the latter scenario playing out. However, we’d be happier if not much incremental capital was invested into such ventures in the future and instead directed towards their wonderful sourcing business lines.

Key man risk – Mr. Pallak Seth is the heart of the organization. PDS Limited is very much his baby, and he is the glue holding the diverse set of entrepreneurs and subsidiaries together by driving them towards a larger purpose and helping resolve internal conflicts smoothly, which are bound to arise from time to time. Mr. Pallak Seth is whole and soul involved in building PDS Limited into a much larger organization than it is today, so we don’t anticipate any risk of him stepping away from the business in the near future.

Apart from Mr. Pallak Seth, a few key entrepreneurs running the largest contributing subsidiaries also pose key-man risks, albeit to a lesser degree than Mr. Pallak Seth. Mr. Anuj Banaik (Poeticgem), Mr. Sunny Malhotra (Simple Approach), and Mr. Rajive Ranjan (Techno Design) are a few that come to mind.

PDS Limited Future Outlook

PDS Limited has a stated goal of achieving 333 by FY27, which implies reaching a GMV target of 3bn USD in 3 years (from the base year of FY24) at 3% PAT margins. Since about 70% of the GMV gets converted to revenue (USD 2.1bn), achieving the 333 goal would imply a PAT level of USD 63mn (~INR 540 Cr @ USD/INR rate of 86) by FY27.

Reaching the FY27 GMV goal would imply a GMV growth CAGR of ~17% between FY25 and FY27, a reasonable target given that GMV growth between FY22 and FY25E has been 16%+. Management has said that the 333 target would be achieved largely via growth from their existing customers in the UK and Europe with a marginal contribution from the USA. They expect serious non-linear growth from the USA to kick in after FY27.

Currently, profitability is depressed due to growth investments made via the P&L. PDS Limited invested ~INR 100 Cr via the P&L in growth initiatives in FY24 and ~INR 116 Cr in 9M FY25. Adjusted for these growth investments, PDS Limited would be on track to deliver ~3% PAT margins. PDS Limited demonstrated earlier in FY22 and FY23 that it can deliver 3% PAT margins.

PDS Limited Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

PDS Limited Price charts

On weekly charts, PDS Limited stock decisively broke out of the horizontal consolidation between 285-360 levels, with volumes in Sep, 2023. Thereafter PDS Limited stock quickly ran up to 620 levels in the span of a month. Following the sharp rise, there was an inevitable phase of profit booking which bottomed out around 409 levels in May 2024. From June-Dec 2024, PDS Limited stock once again moved to the previous highs and then created a double top before breaking through key support levels and moving down ~30% along with the broader markets in the early 2025 market sell-off. 409 is a strong support level and should hold unless PDS prints unexpectedly poor numbers or revises its 333 guidance. The next key support level after 409 is the Sep 2023 breakout level of 360.

On daily charts, PDS Limited stock is near the major support level of 400, which was formed during the election results week panic. Since making a double top in Dec 2024, PDS Limited stock has moved down almost in a parallel channel, making lower lows and lower highs one after the other. The move has been on low volumes like most of the broader markets, suggesting a lack of buyers rather than large shareholders rushing to sell. The daily RSI suggests that PDS Limited stock may be close to finding a bottom. Of course this assumes no further worsening or uncertainty in the macro environment and no negative surprises or earnings or guidance. While moving up, PDS Limited stock has to take out resistance levels at 453 and 513. Since these resistances were created on low volumes and during a broader market level fall, they should not prove to be too difficult to take out if business performance remains robust.

PDS Limited Latest Latest Result, News and Updates

PDS Limited Quarterly Results

PDS Limited came out with another strong quarter in Q3 FY25, logging a GMV growth of 16%, revenue growth of 21%, EBITDA growth of 27%, PBT growth of 31%, and PAT growth of 61% YoY. North America continued its strong growth, logging 80% YoY growth in Q3 FY25 and 69% YoY growth in 9M FY25. GMV growth was slower in Q3 FY25 due to Ted Baker’s revenues getting impacted due to issues with the retail partner.

PDS Limited continued to invest via the P&L, investing INR 32 Cr in Q3 FY25 and INR 116 Cr in 9M FY25. Adjusted for these investments, the Q3 and 9M PBT margins would be 2.5% and 3.3% instead of 1.5% and 2%, respectively. PDS Limited has started an engagement with the consulting firm BCG to optimize costs at the corporate and procurement levels. In Q3 FY25, PDS Limited also acquired a 55% stake in Knit Gallery, a Tirupur-based apparel manufacturer specializing in baby wear, children’s wear, and innerwear. This acquisition is expected to significantly improve PBT margins in the manufacturing segment as Knit Gallery is much more profitable than PDS Limited’s in-house manufacturing factories in Bangladesh and Sri Lanka.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.