Pokarna Ltd is one of India’s renowned exporters of granite and quartz surfaces, supplying both raw and processed granite, with raw granite blocks being exported to China and the majority of its finished granite products directed to the United States. Pokarna Ltd operates two granite processing units in the Hyderabad region, along with quarrying operations in Telangana, Andhra Pradesh, and Tamil Nadu. Additionally, Pokarna Ltd has discontinued the operations of its Apparel Division.

Pokarna Ltd could present an opportunity due to its aggressive capacity expansion, focus on high-margin quartz products and adoption of cutting-edge technologies. Pokarna Ltd’s strong export orientation to the US positions it to capitalize on the growing global demand for premium surfaces. Pokarna Ltd appears to be poised for continued growth and market leadership in the quartz surface industry.

Pokarna Ltd Company Summary

Pokarna Ltd supplies both raw and processed granite, with raw granite blocks being exported to China and the majority of its finished granite products directed to the United States. Pokarna Ltd operates two granite processing units in the Hyderabad region and quarrying operations in Telangana, Andhra Pradesh, and Tamil Nadu. Additionally, Pokarna Ltd has discontinued its Apparel Division operations.

PESL, a wholly-owned subsidiary of Pokarna Ltd, is a prominent global producer of premium quartz surfaces. PESL focuses on key strategies such as product innovation, design excellence, superior quality, competitive pricing, advanced performance technology, and exemplary customer service to maintain competitiveness in this industry.

Pokarna Ltd aims to distinguish its quartz surfaces in the market by creating distinctive products with premium features and a superior value proposition. Its competitive edge lies in its ability to compete based on performance, quality, style, and service rather than solely on pricing.

This advantage is reinforced by Pokarna Ltd’s investments in state-of-the-art production technology and strategic marketing resource allocation. During FY25, PESL will commercialize two cutting-edge technologies from BRETON S.p.A of Italy: the KREOS and CHROMIA lines.

Pokarna Ltd Management Details

Starting his career in 1974, Gautam Chand Jain initially ventured into the textile business, quickly becoming India’s one of the largest distributors of premium fabrics for men. In 1991, Gautam expanded into the natural stone industry by acquiring a granite quarry, a move that led him to discover Breton’s cutting-edge machinery. This partnership played a pivotal role in transforming his business and soon set the stage for his next major venture in the engineered stone industry. His exploration into quartz slabs was driven by the growing demand in the U.S. market, leading to the establishment of Quantra in 2009.

Pokarna Ltd – Industry Overview

Pokarna Ltd operates within the nonmetallic mineral product manufacturing sector, specifically focusing on granite and engineered quartz surfaces. This industry involves extracting, processing, and finishing natural stones (like granite) and producing engineered stone products (such as quartz surfaces) for use in construction, interior design, and infrastructure projects. The global stone industry is driven by demand for durable, aesthetically appealing materials in residential and commercial applications, including countertops, flooring, and cladding.

Overview of the Granite market in India

In India, the granite industry is valued at $40 billion and significantly impacts the economies of states such as Tamil Nadu, Andhra Pradesh, Telangana, Karnataka, and Rajasthan. The total granite resources in India stood at an estimated 46,320 million cubic meters as of April 1, 2015. Regarding classification by grade, ~7% of total resources are black granite, while 92% are colored granite. About 1% of the resources remain unclassified.

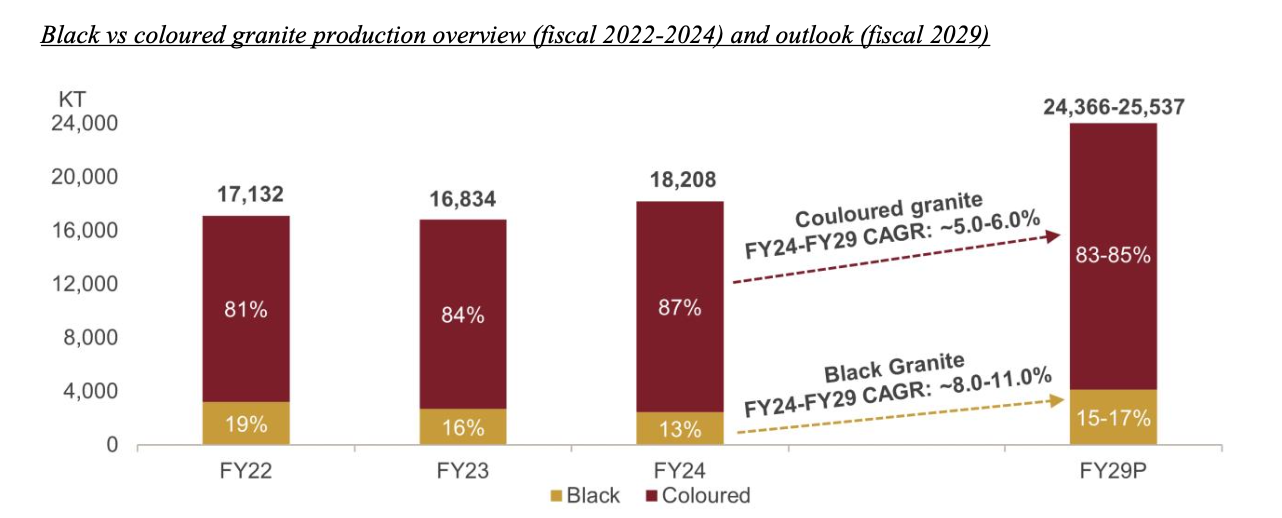

Granite production is projected to grow to 24,366-25,537 KT in fiscal 2029, logging a CAGR of 6.0-7.0% between fiscal 2024 and 2029.

Out of the total production of 18,208 KT in fiscal 2024, coloured granite accounted for 87% (~15,755 KT) and black granite for 13% (~2,453 KT). By black granite type, Black Galaxy Granite, which is exclusively produced in Andhra Pradesh, accounted for 31% (~771KT) of overall black granite production in fiscal 2024. Absolute Black Granite, produced in Karnataka, accounted for 47% (~1,162 KT), and Absolute-Black Granite, produced in Andhra Pradesh and Telangana, accounted for 21% (~520 KT) of overall black granite production in fiscal 2024.

Average Realisations

According to the Andhra Pradesh’s mining and geology department’s data, the average sale price for Black Galaxy Granite is Rs 50,000-1,00,000 per cubic meter, black granite is Rs 30,000-75,000 per cubic meter, and coloured granite is Rs 15,000-35,000 per cubic meter. The price range for black granite is wide and varies as per its quality, size, look and appeal. Among all the granite categories available in India, average realisations are the highest for Black Galaxy Granite.

Trade overview of Granite

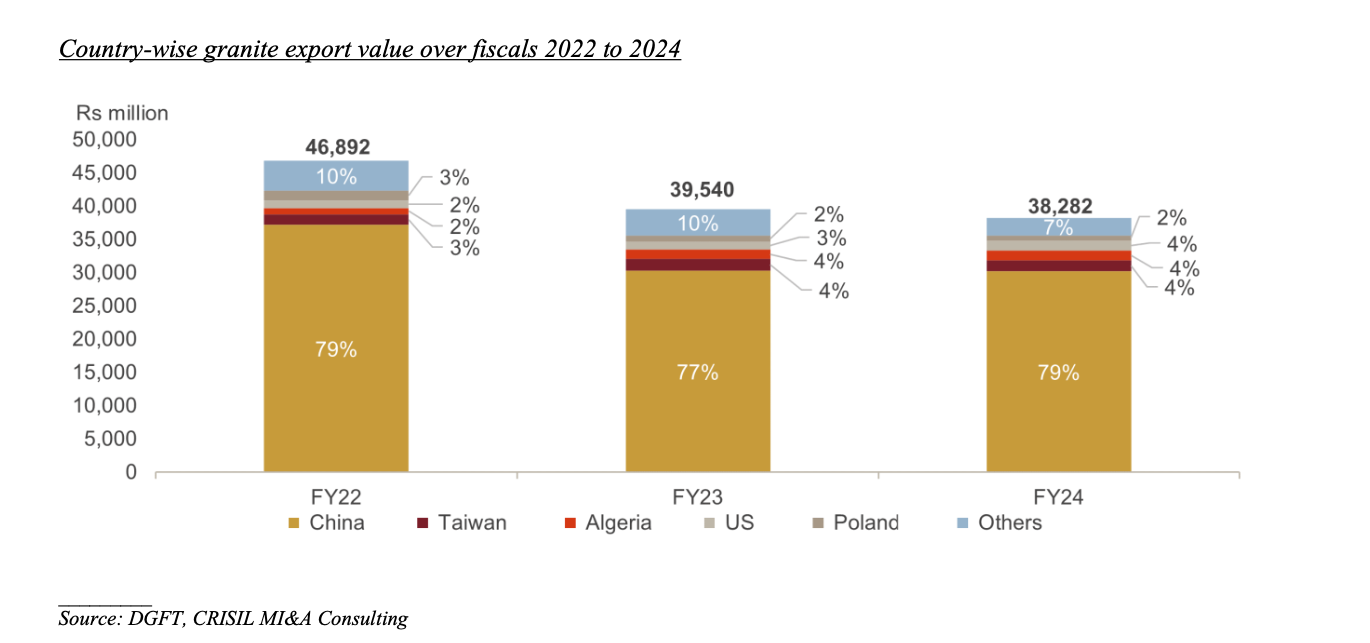

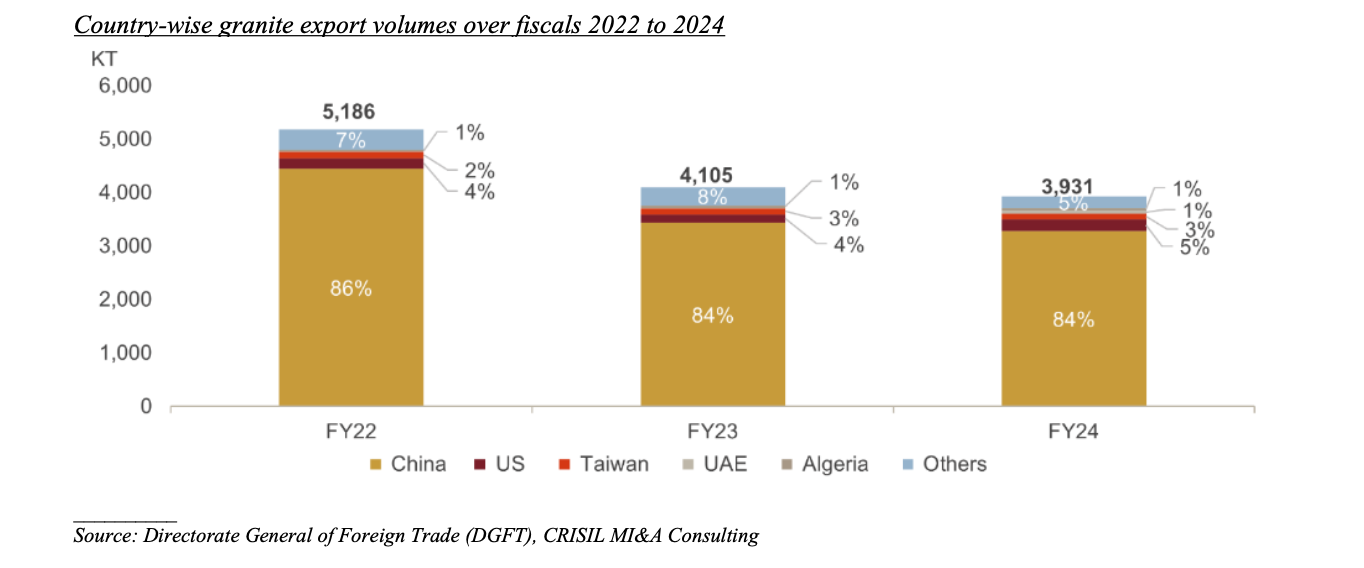

In FY22, India exported 5,186 KT of granite, valued at Rs 46,892 million. In FY23, the export volume dropped 1,081 KT to 4,105 KT, corresponding to Rs 3,954 Cr, indicating an on-year decrease of 20.84% in volume and 15.68% in value.

The downward trends in exports are due to increased domestic consumption, which can be attributed to the rising demand in the construction sector. Moreover, conversion time is faster for domestic supply.

A significant proportion of raw materials in the granite industry is commonly sent to China for processing before being distributed to the rest of the world.

As much as 90-93% of India’s granite exports head to five countries: China, Taiwan, Algeria, the US and Poland. Among these, China is the largest importer, maintaining a significant share of 77-79% of the total exports over fiscal 2022 to 2024.

In fiscal 2024, coloured granite accounted for 85% of the overall granite exports, and black granite accounted for 15%.

Overview of quartz

Value chain of quartz

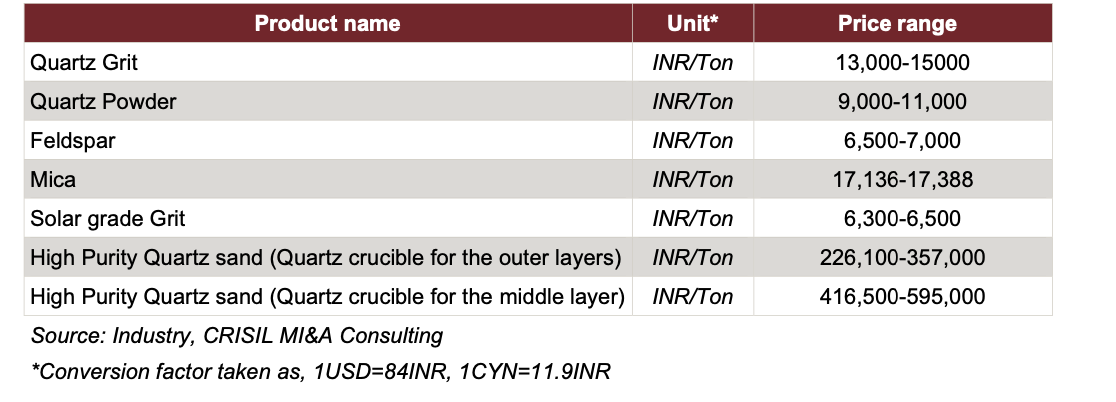

Prices of different types of quartz by grade and related products are as follows:

Overview of the quartz market in India

Out of the total resources of 3,908 million tonnes, ~11% (~433 million tonnes) are proven reserves-resources that have been discovered, have a known size, and can be extracted at a profit. Around 215 million tonnes of the total resources are probable reserves- with odds of commercial extraction over 50-90%, with 3,260 million tonnes accounting for the rest. Rajasthan houses 55% of the proved reserves, followed by Andhra Pradesh (~22%), Tamil Nadu and Gujarat (~6% each).

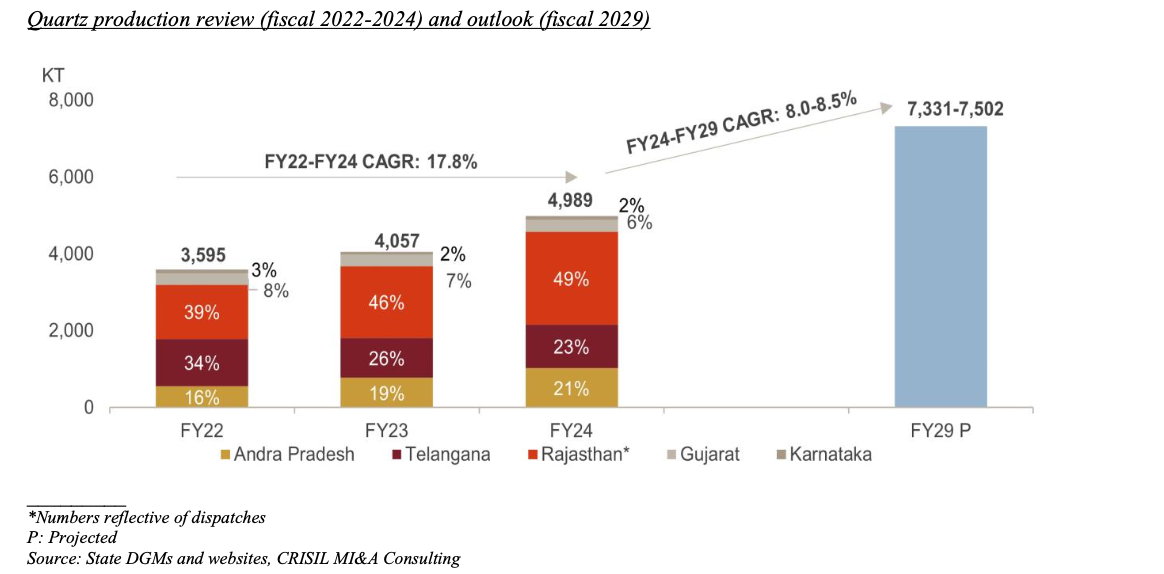

Quartz production review (fiscal 2022-2024) and outlook (fiscal 2029)

Quartz production saw a tremendous increase over fiscal 2022-2024, logging a CAGR of 17.8% to 4,989 KT in fiscal 2024 from 3,595 KT in fiscal 2022. The increase is mainly derived from higher exports and domestic demand for quartz and its products in the glass, foundry, ferroalloys, refractory, and building materials industries.

Rajasthan is India’s largest producer of quartz and accounted for almost 49% (~2,420 KT) of the produce in fiscal 2024. Other significant quartz-producing states include Telangana and Andhra Pradesh, which accounted for 23% (~1,133 KT) and 21% (~1,029 KT) of the production in fiscal 2024. Andhra Pradesh’s share of production has significantly increased over the years from 16% (~561 KT) in fiscal 2022 to 21% in fiscal 2024.

Engineered Quartz Slabs

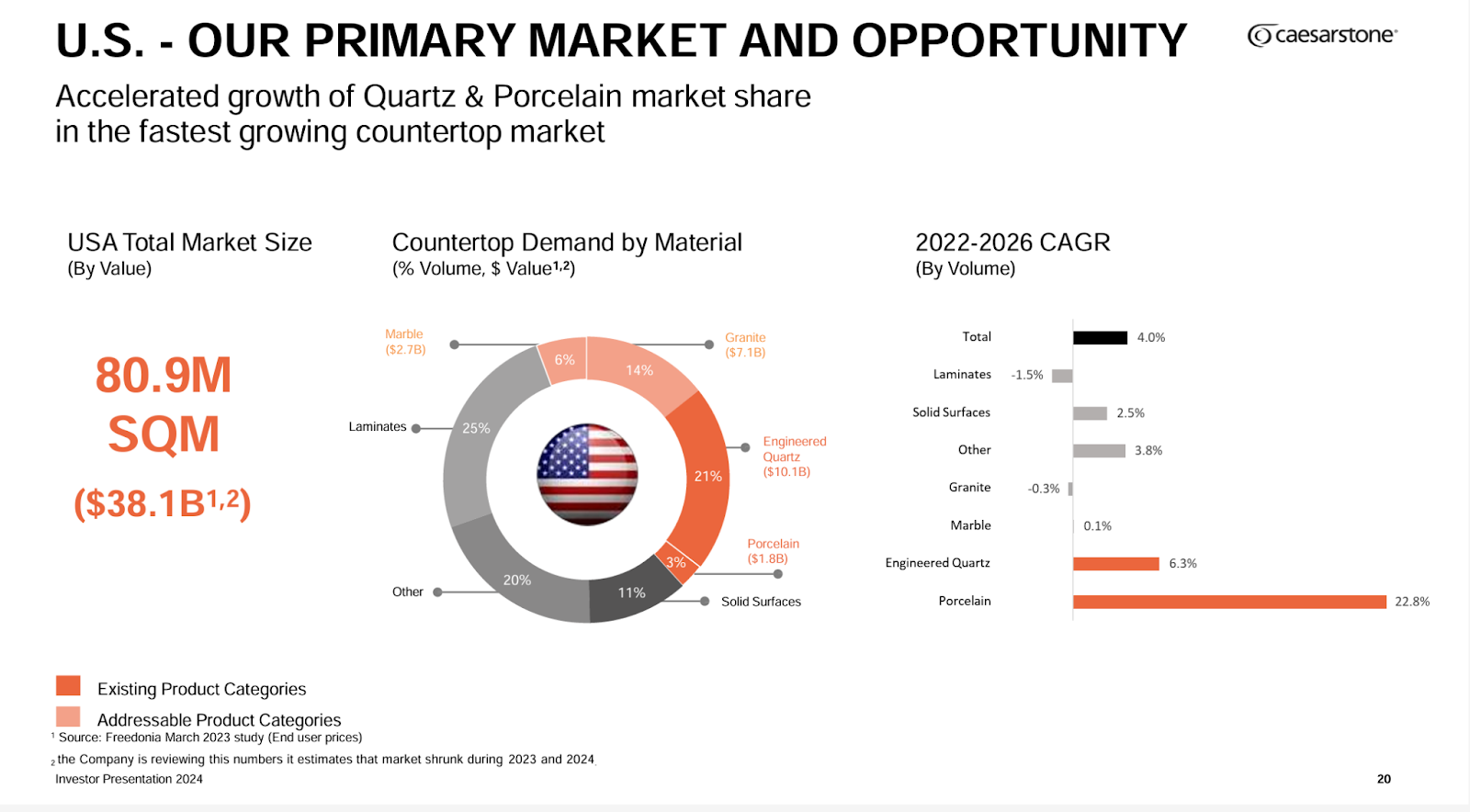

- On a comparative level, there is still room for quartz penetration in the US market. Interestingly, quartz is losing market share in Israel to porcelain countertops.

- Caesarstone is also positioning itself with porcelain countertop offerings with its recent acquisition of Lioli in India. Caesarstone is roughly 5-6% of the global quartz market share. At Quantra’s level, it’s still sub-1 % of the American quartz market, with big box channels yet to be tapped.

- The primary drivers of sales are home renovation and remodeling, new residential construction, and, to a lesser extent, commercial construction. Approximately 60- 70% of revenue in the main markets (U.S., Australia, Canada) is related to residential renovations and remodeling activities, while 30-40% is related to new residential construction.

- Caesarstone’s gross margins have been trending down in the 26-27% range compared to ~65% for Pokarna.

- Quartz is one of the principal raw materials. Approximately 62% of the total quartz was from several suppliers in Turkey, with the major part acquired from Mikroman and Polat. Accordingly, fluctuations in quartz prices significantly impact the cost of sales and overall results of operations. The increase was primarily due to an increase in shipping costs.

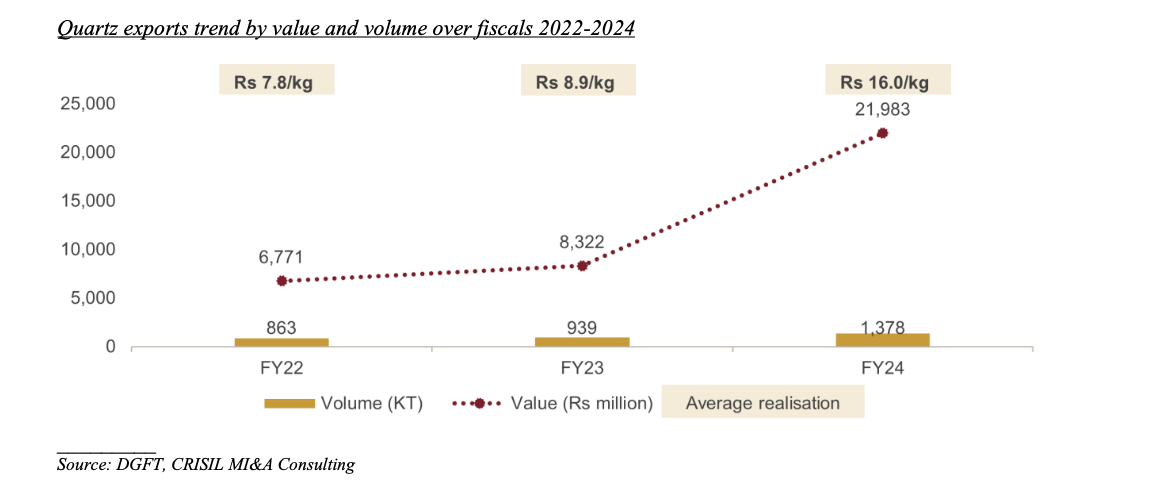

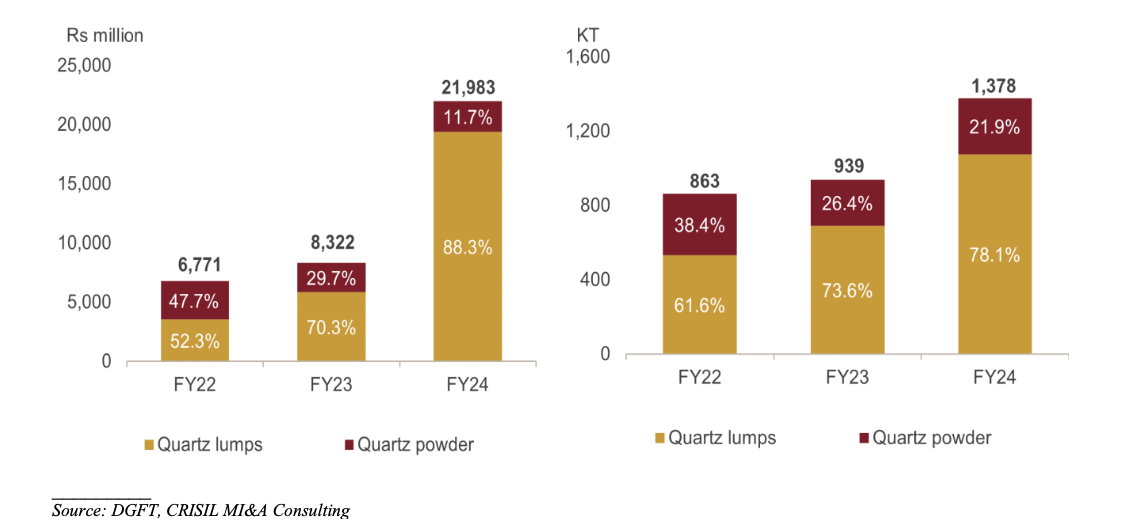

Trade overview – Quartz

In fiscal 2022, India exported 8.63 lakh tonnes of quartz worth Rs 677.1 crore, which grew steadily over the following years. In fiscal 2023, exports rose to 9.39 lakh tonnes (8.82% growth), valued at Rs 832.2 crore. In fiscal 2024, exports further surged to 13.78 lakh tonnes (47% growth), with a significant value increase to Rs 2,198.3 crore (164% growth).

Quartz from India is exported in the form of lumps and powder.

The share of quartz lumps exports in total quartz exports grew significantly from fiscal 2022 to 2024. In fiscal 2022, quartz lumps accounted for 61.6% of export volume and 52% of export value, rising to 78.1% and 88% in fiscal 2024, reflecting higher average export realizations.

Engineered quartz slabs exports from India- by value for fiscals 2023 and 2024

The total export market for Quartz Slabs increased significantly by 21.5% from Rs 29,541 million in fiscal 2023 to Rs 35,894 million in fiscal 2024.

The US, United Kingdom, Canada, and the UAE are the top importers of Indian Quartz Slabs. The US market accounted for ~93% (Rs 27,474 million) and ~91% (Rs 32,663 million) of total engineered quartz slabs exported from India in fiscal 2023 and 2024, respectively. India is a significant exporter of quartz slabs to the US market and has a long-standing reputation for quality craftsmanship and innovative designs.

The surge in India’s quartz slab exports to the US can be attributed to several key factors, including its vast manufacturing capacity, competitive pricing, and a well-established network of exporters and distributors. By capitalizing on these strengths, Indian manufacturers can offer a diverse range of high-quality quartz slabs that meet the exacting standards of the US market.

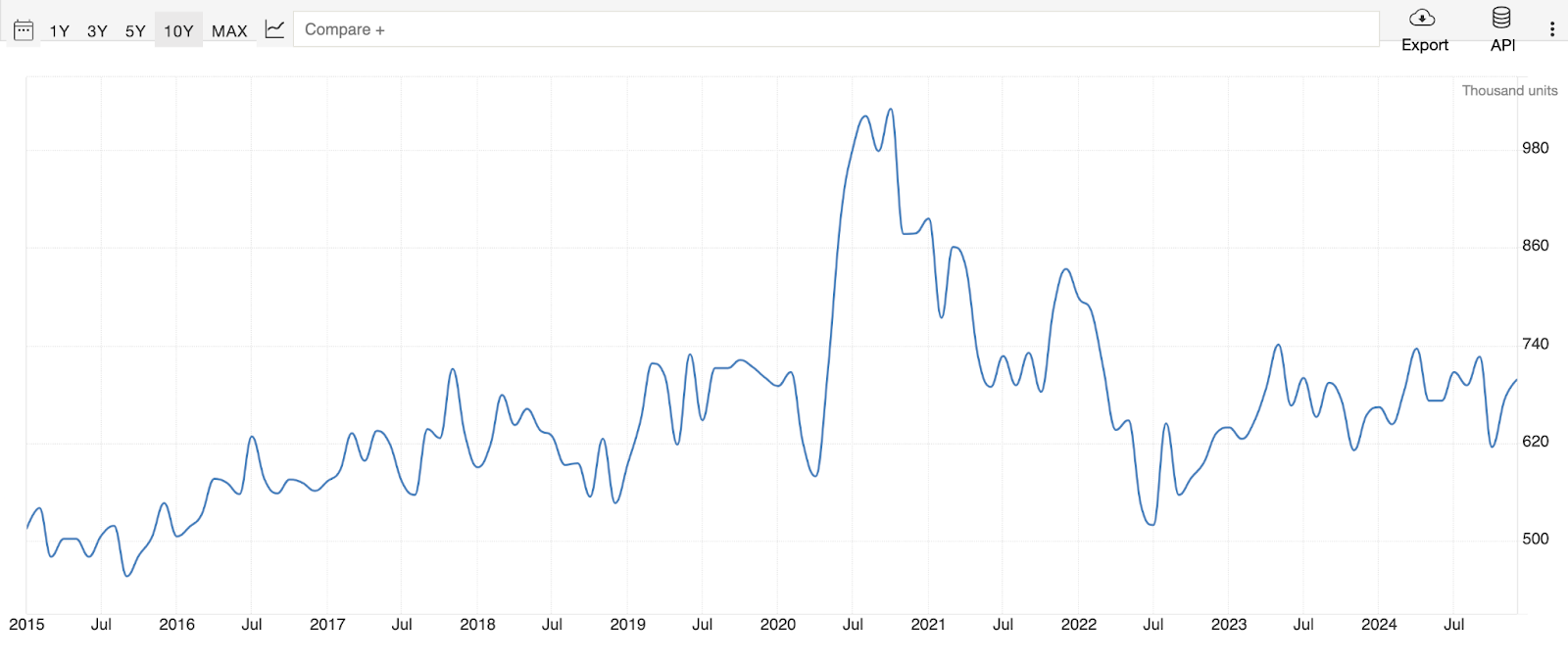

United States New Home Sales – 10 Years

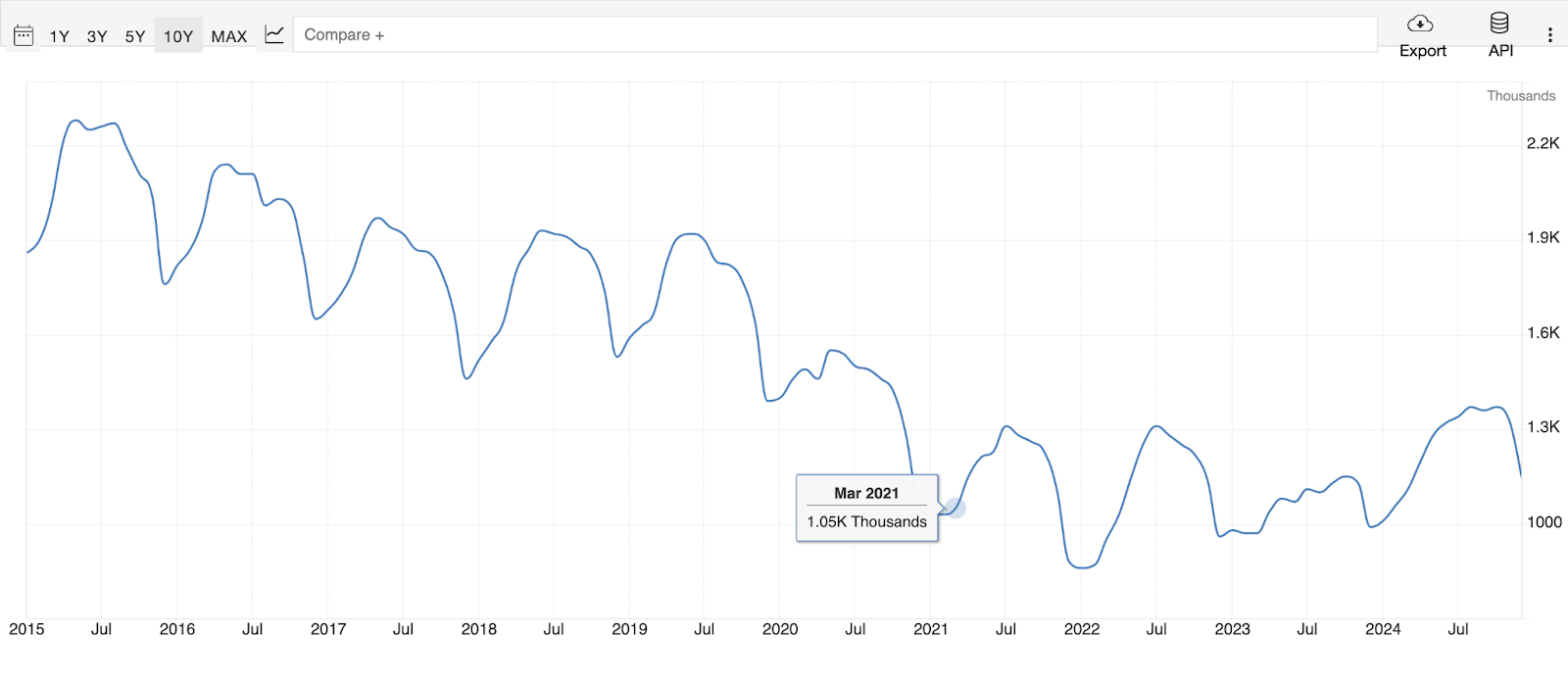

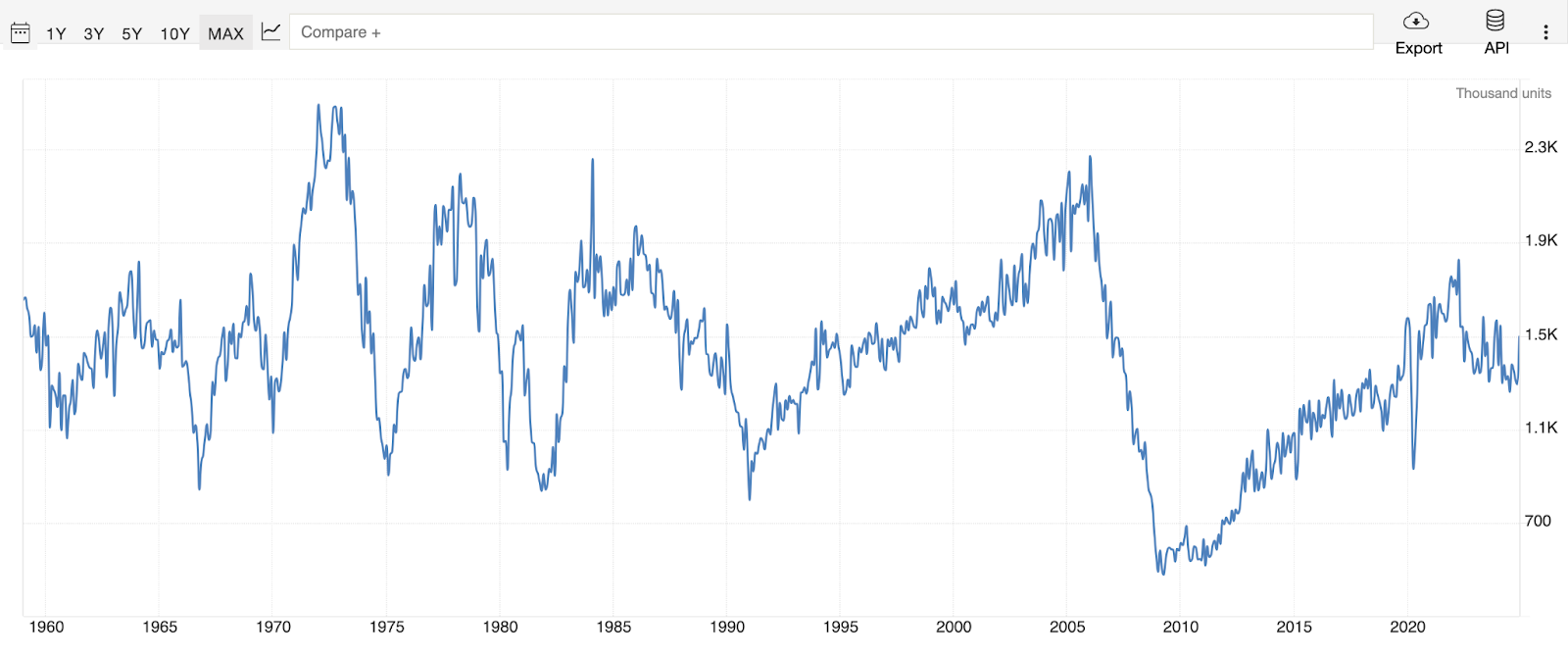

United States Total Housing Inventory –

10 Years

50 Years

The US total housing inventory is at decadal-low levels, which shows that the supply of existing homes has been very limited. The current inventory is about 1.2 million less than it was before the 2008 housing crash.

United States Housing Start – 10 Years

United States 30-Years Mortgages Rate

Source: Tradingeconomics.com

Pokarna Ltd Products

Pokarna Ltd has historically had 3 key business segments: Quartz, Granite, and Apparel.

Pokarna Ltd has scaled the Quartz business from 23% in FY13 to 94% in FY24. Quartz is a high-margin business; Pokarna is India’s largest exporter of Quartz surfaces/slabs. Quartz Surfaces are substitutes for natural stone surfaces such as Granite and Marble. These are used primarily in countertops and wall cladding for kitchens and bathrooms.

Granite’s contribution to revenue has declined over the years to 6% in FY24. Additionally, Pokarna Ltd has discontinued its Apparel Division operations.

Geography-wise – The US is the largest market for its countertop products, contributing around 83% to Pokarna Ltd’s revenue as of FY24. Most of the demand for Quartz Surfaces comes from the residential (new construction & home improvement) segment, followed by some from the hospitality segment. Pokarna Ltd uses imported Italian machines from Breton Systems vs. the Chinese machines used by many other players. Many exporters of Quartz Surfaces cater to the low end of the market with low realizations, whereas Pokarna Ltd commands higher realizations and gross margins.

Granite Business

Pokarna Ltd supplies both raw and processed granite. Raw granite blocks are exported to China, and the majority of its finished granite products are directed to the United States. Pokarna Ltd operates two granite processing units in the Hyderabad region and quarrying operations in Telangana, Andhra Pradesh, and Tamil Nadu.

Pokarna Ltd offers a collection of over 75 varieties of granite sourced from India and around the world. The Granite division is backed by advanced technology and a strong distribution network, ensuring the global delivery of high-quality products. Pokarna Ltd processes its granite at two state-of-the-art manufacturing facilities and has its quarries in the most sought-after colours like Black Galaxy, Black Pearl, Black Coffee, Coffee Brown, Flash Blue, Golden Dream, Golden Spring, Hailstorm, Pokarna Green, Red Sapphire, Silver Pearl, Silver Waves, Tan Brown, Tan Brown Classic and Vizag Blue.

The Granite division’s business mix share has been reduced from 71% in FY13 to 6% in FY24 as Pokarna Ltd focuses more on quartz, which has higher growth potential and much higher profitability relatively, coupled with strong export demand, particularly in the United States.

Quartz surfaces

Pokarna Ltd has developed a state-of-the-art facility at a CAPEX of 200 Cr for producing its own line of quartz surfaces- named Quantra- in Visakhapatnam, India, in 2009-10. The manufacturing capacity of Pokarna Ltd for quartz surfaces is approx. 885,000 sq. Mt. per year. The quartz products are commercially supplied and distributed across the globe under the brand name QUANTRA, the registered trademark of Pokarna Engineered Stone Ltd, a wholly owned subsidiary of Pokarna Ltd. Finished products have a quartz content of approximately 93%, and elements like steel, copper, mother-of-pearl, and glass can be added to the mix for a unique aesthetic. Quantra quartz surfaces are acid-resistant, stain- and scratch-resistant. They are also slip-resistant, have exceptional durability, and are design-friendly.

Pokarna Ltd. has increasingly prioritized its engineered quartz surfaces, which are marketed under the Quantra brand. These now account for a significant portion of its revenue—97% of sales in the first nine months of FY25, up from 24% in FY13. In March 2021, Pokarna Ltd commenced commercial operations at its second quartz surface manufacturing facility in Mekaguda, Telangana, near Hyderabad. This state-of-the-art plant, inaugurated in July 2021, was built with an investment of approximately Rs 500 Cr.The facility spans 160,000 square meters with a 6 lakh square feet built-up area. It increased Pokarna Ltd’s total installed capacity to 15 million square feet annually, doubling its previous quartz production capacity. The plant focuses on producing Super Jumbo (346×200 cm) and Jumbo (330×165 cm) slabs, targeting a turnover of Rs 400 Cr at full capacity.

In November 2024, Pokarna announced a Rs 440 Cr investment to further expand its Mekaguda facility by adding a third Breton stone production line. This expansion will increase its quartz surface production capacity by an additional 8.1 lakh square meters (approximately 8.7 million square feet) annually. The new production line is slated to be operational by March 2026 and will be funded through internal accruals and debt.

Pokarna Quartz surfaces Product categories

Application Of Quartz – Jewellery, Glassmaking, Kitchen countertops, Electronics, Abrasives, Ceramics

Quartz Countertops Advantages – Look attractive, don’t stain, won’t crack, have a lot of options, and clean easily.

Difference between Quartz and Granite

Breton Stone technology

Pokarna Ltd uses Breton Stone technology to manufacture quartz slabs and tiles. BRETONSTONE® SYSTEM is the patented technology of Breton s.p.a, Italy, and Pokarna Ltd has the exclusive right to use this technology in manufacturing quartz surfaces in India. Breton Stone Technology manufactures superior-quality Quartz products. Globally, only 10-12 sizeable manufacturers produce quartz using Breton Stone technology.

Breton stone technology, developed by the Italian company Breton S.P.A., is a proprietary process for manufacturing engineered stone products. Several factors could influence the decision not to supply this technology to China:

Intellectual Property Protection: China has faced scrutiny over intellectual property rights enforcement. Breton may be cautious about the potential unauthorized replication of its proprietary technology, which could undermine its competitive advantage.

Export Control Regulations: Various countries, including China, have implemented export control regulations concerning dual-use technologies—items that can serve both civilian and military purposes. For instance, China has revised its Catalogue of Technologies Prohibited or Restricted from Export, affecting the transfer of certain technologies.

Pokarna Ltd is the only company in India with a license to use Breton stone technology. It has an individual agreement with Breton S.P.A. to use the technology in India. China has access to less expensive alternatives to Breton stone technology. While less advanced, these alternatives have allowed Chinese producers to expand their capacity significantly.

Anti-Dumping Duties

The U.S. imposed anti-dumping duties on certain quartz surface products from India following a petition by Cambria Company LLC in May 2019, alleging unfair trade practices. These duties aim to counteract the sale of goods below normal value, which can harm domestic industries in the importing country.

In June 2020, the U.S. Department of Commerce established initial anti-dumping duties. Pokarna Ltd’s duty was set at a low rate of 0.33% (adjusted from a calculated dumping margin of 2.67% after accounting for export subsidies), significantly lower than the countrywide rate of 3.19% for other Indian exporters. This reflected Pokarna Ltd’s minimal or no dumping during the investigation period.

In January 2023, the U.S. Department of Commerce finalized the results of its first administrative review, covering December 13, 2019, to May 31, 2021. It determined that Pokarna Ltd did not sell quartz surfaces below normal value, resulting in a final anti-dumping duty rate of 0% for that period. This was a significant win for Pokarna Ltd, as it avoided duties while other reviewed companies faced rates up to 161.56% due to averaging higher dumping margins.

Preliminary results announced in 2023 (finalized later) for the period June 1, 2021, to May 31, 2022, again found Pokarna Ltd’s dumping margin to be 0%, indicating no anti-dumping duty was warranted. Final results were expected by December 2023, but updates beyond that are not detailed due to the knowledge cutoff.

November 2024 shows the U.S. Department of Commerce’s final results for the period June 1, 2022, to May 31, 2023. Pokarna Ltd, alongside another mandatory respondent, Marudhar Rocks International Pvt. Ltd., received a dumping margin of 0%. Consequently, no anti-dumping duties were applied to Pokarna Ltd exports for this period, and this rate was also extended to 44 non-selected companies.

Current Status (As of March 2025) – Pokarna Ltd faces no anti-dumping duties on its quartz surface exports to the U.S., a status that has held since the first review was finalized in 2023. This is notable given that the U.S. market accounts for a significant portion (around 98%) of Pokarna Ltd’s revenue, with quartz contributing roughly 68%. However, duties can change with future reviews, typically conducted annually.

Pokarna Ltd Manufacturing Facilities

Pokarna Ltd has several state-of-the-art manufacturing facilities contributing to its granite, quartz, and apparel production. Pokarna Ltd has 10 plus Captive Quarries in Andhra Pradesh, Telangana, and Tamil Nadu. With two units of Granite manufacturing located in Telangana

Quartz manufacturing units – Two facilities, one in Telangana and another in Andhra Pradesh. These plants utilize Breton technology. Pokarna Ltd is the only one in India that uses this technology within its manufacturing ecosystem. A new quartz production line in the Telangana facility is scheduled to be operational by March 2026.

Apparel manufacturing unit – One facility located in Telangana and Pokarna Ltd is divesting from this division

New Capex

Technology Upgrades – Pokarna is currently focused on investing in technology to enhance product design and enter new market segments. Pokarna Ltd is investing up to 10 million euros (approx Rs 90 Cr) in technological upgrades; these upgrades include –

KREOS Line: A new-generation mixture extrusion and distribution system from Breton (Italy) designed to produce ultra-thin slabs, along with unique designs and various thicknesses. This system was commercialized in Q3 FY25. The KREOS line can create products with unique aesthetics, as well as produce 7mm thin products for applications like furniture tops and cladding in markets like Europe.

CHROMIA Line: This high-definition digital printing technology will enable Pokarna Ltd to decorate quartz slabs with precise, intricate patterns and vibrant colours. It is expected to be operational by Q4FY25.

New Production Line: Pokarna Ltd is expanding its state-of-the-art quartz manufacturing facility in Telangana by adding a third Breton stone production line at a cost of ₹440 Cr. This new line is scheduled to be operational by March 2026 and will significantly enhance Pokarna Ltd’s capacity while maintaining high standards of sustainable manufacturing. The investment will be funded through a mix of debt (approximately ₹300 Crs) and internal accruals (approximately ₹140 Crs).

The company anticipates an EBITDA of ₹145-165 Crs and a PAT of ₹100-110 Crs from this new line.

Pokarna Ltd Corporate Governance

Board Composition – The Board of Directors of Pokarna Ltd comprises 11 Directors, 8 of whom are Independent. Mr Gautam Chand Jain is the Chairman & MD, and Mr Rahul Jain is the Managing Director. Both have extensive experience in the Granite and fabric business. The one Non-Executive Director members of the Board are promoter family members.

Promoter Remuneration – The total remuneration of promoters in salaries to ~INR 2.2 Cr in FY24. This amounted to ~2.5% of the PAT of Pokarna Ltd. for FY24. For FY23, the corresponding figures were INR 2.2 Cr and ~2.6% of PAT. Mr Gautam Chand Jain, Chairman & Managing Director, voluntarily decided not to accept any remuneration during the FY24 & FY23.

Related Party Transactions – There were no significant related party transactions for Pokarna Ltd in FY24.

Contingent Liabilities – The total contingent liabilities amount to INR 86 Cr and are mostly related to tax disputes and corporate guarantees. The total contingent liabilities amount to ~13% of Pokarna Ltd’s net worth.

Pokarna Ltd Financial Performance

Over the last 3 years, Pokarna Ltd. has grown revenues at a CAGR of 33%, EBITDA at a CAGR of 31%, and PAT at a CAGR of 46%, demonstrating a steady growth trajectory. During this period, EBITDA and PAT margins have remained steady, staying between 25%-32% and 9-13%, respectively. Over the 5 years, Pokarna Ltd has grown revenues at a CAGR of 8%, affected due to COVID-19, EBITDA at a CAGR of 13%, and PAT at a CAGR of 2%.

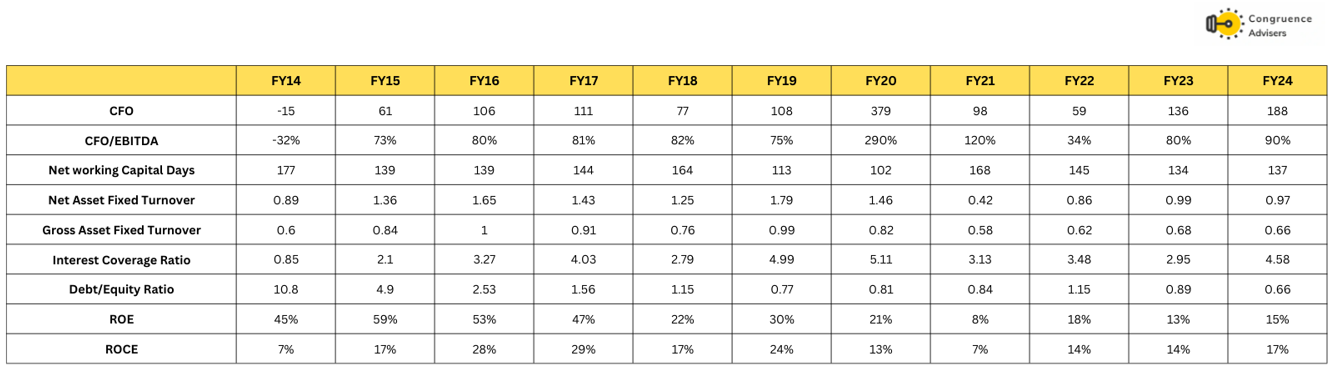

Pokarna Ltd Working Capital, Return ratios, Cash Conversion, and Debt ratios

Over the last 10 years, Pokarna Ltd has consistently maintained a very strong Cash flow conversion and has converted 80%+ of its EBITDA into operating cash flows. The debt-to-equity ratio has been reduced over the last 10 years, and an interest coverage ratio of ~5x. Net working capital days have also been well under control, averaging under 140 days for 10 years, which is a very healthy figure for export business. Pokarna Ltd has maintained strong return on capital metrics, with ROCE and ROE averaging ~30% and ~17% over the last 10 years.

Pokarna Ltd Comparative Analysis

To understand Pokarna Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Pokarna Ltd to its competitors (peer comparison) on various fundamental parameters and Pokarna Ltd share performance relative to relevant benchmark and sector indices.

Pokarna Ltd Peer Comparison

There are no strong peers of Pokarna Ltd in the Indian markets. Hence, we thought it appropriate to benchmark Pokarna against its Caesarstone, Dupont de Nemours, and Vicostone Other global players which are private companies are Cambria, Wilsonart, and Cosentino.

Pokarna Ltd scores much better than global peers on all aspects due its lower cost advantage and access to raw materials. Even Pokarna Ltd has printed good growth numbers with higher profitability as compared to global peers. All of them are struggling to print growth growth numbers since the last few years. Which clearly indicated Pokarna Ltd gaining market share from them.

Pokarna Ltd Index Comparison

Pokarna Ltd share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Pokarna Ltd

Pokarna Ltd offers some compelling reasons to track closely and to consider investing if one is looking to play on Exports and growth of US housing sector

Big Capex Announcement – Pokarna Ltd will invest 440 Crore to expand quartz manufacturing capabilities at its state-of-the-art facility in Telangana, India. This new line is the third Breton stone production line from Italy and is expected to be operational by March 2026. New capex expects revenue potential from the new capacity of ₹450-525 Cr with an asset turn of 1x to 1.25x. Pokarna Ltd anticipates an EBITDA of ₹145-165 Cr and a PAT of ₹100-110 Cr from this new line.

Focused Management – Management is clearly prioritising quarts due to its higher margin over other segments and As part of this shift, the apparel segment has been phased out. Capital allocation is now being directed towards high-growth, high-margin opportunities, ensuring a more focused and profitable future.

Technology Partnership and new products launches – Pokarna Ltd is the only company in India with Breton stone. To enhance its quartz offerings, Pokarna Ltd has invested in two state-of-the-art technologies from Breton, Italy: KREOS and CHROMIA.

KREOS introduces a next-generation extrusion and distribution system that allows for the creation of full-body, ultra-thin slabs with stunning aesthetics. This innovation will expand Pokarna Ltd’s product range, offering customers more refined and visually appealing choices. Pokarna Ltd started trial production of KREOS-based products in Q3FY25, which will go live on Feb 25.

Meanwhile, CHROMIA brings high-definition digital printing to quartz slabs, enabling intricate patterns and vibrant colours that enhance both customization and visual appeal. This technology also supports the production of ultra-thin slabs, adding another dimension to Pokarna Ltd’s design capabilities. CHROMIA is expected to be commercialized in Q4FY25. While Pokarna Ltd will be the first to introduce CHROMIA, KREOS has already been adopted by a competitor in Korea.

Management expects KREOS products to command slightly higher prices than its current mid-range offerings. With these advanced technologies, Pokarna Ltd. is set to elevate its product portfolio, strengthen its market presence, and drive growth in FY25 and beyond.

Export-Driven Growth – Pokarna Ltd exports to over 20 countries, including major markets like the United States, Canada, China, and the UK. A significant portion of its revenue comes from the U.S., where demand for premium quartz surfaces is strong due to construction and renovation activity. With a strong distribution network and partnerships (e.g., with IKEA India and Dekker Zevenhuizen for the Benelux market) and it can also benefit from recent surge in value of dollar

What are the Risks of Investing in Pokarna Ltd

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Market and Sector Volatility – Pokarna Ltd operates in the mining and granite processing sector, with additional exposure to quartz surfaces and apparel. The mining and construction materials industry is sensitive to economic cycles, commodity price fluctuations, and infrastructure spending. A downturn in global or Indian economic conditions could reduce demand for granite and quartz products, impacting revenue.

Export Dependency – Pokarna Ltd is a significant exporter, with a strong presence in over 20 countries, particularly North America and Europe. This reliance on international markets exposes it to risks such as currency exchange rate fluctuations, trade tariffs (e.g., antidumping duties on quartz surfaces), and geopolitical tensions that could disrupt export markets. Pokarna Ltd derived 83% of its revenues from the United States in FY24.

Competition – Pokarna Ltd faces competition from both domestic players and international manufacturers. Losing market share to competitors with lower costs or innovative products could pressure margins. Vietnam benefits from a lower cost structure compared to India and, unlike India and Turkey, is not subject to antidumping duties, potentially attracting Chinese manufacturers to relocate there and driving growth.

Raw Material – Margins fluctuate due to volatile prices of key inputs like quartz, resins, pigments, and additives. Resin and pigment costs are tied to unpredictable crude oil prices. Forex rate changes also affect profitability.

Operational Risks – Quarrying and manufacturing granite and quartz involve regulatory compliance, environmental concerns, and supply chain risks. Any disruptions—such as delays in raw material sourcing, labour issues, or stricter environmental regulations—could increase costs or halt production.

Pokarna Ltd Future Outlook

The Pokarna Ltd Capacity is currently operating at peak efficiency, with both utilization and product mix optimized. As a result, EBIT margins for the segment are at their highest levels in the last few quarters compared to the past few years.

Looking ahead, the business is expected to benefit from new technologies—Kreos and Chromia—starting in the H2FY26. Additionally, the third Bretonstone line is projected to commence operations in March 2026. New capex expected revenue potential from new capacity: ₹450 Cr – ₹525 Cr with asset turn of 1x to 1.25x. However, ramping up this new line to full efficiency may take time, potentially impacting short-term earnings. Given these factors, unless Pokarna Ltd sees a significant upside from Kreos and Chromia, near-term earnings are likely limited in FY26.

On the risk side, there are concerns regarding potential US tariffs and ongoing investigations into the health risks, particularly Silicosis, associated with Quartz manufacturing and fabrication.

Pokarna Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Pokarna Ltd Price charts

Over the last 5 years, on weekly charts, one can see that Pokarna Ltd stock has tended to move in a strong uptrend with one break to the downside from 2022 to 2024 by forming an inverse head and shoulder pattern and cup-handle pattern breakout with a strong volume in June 2024, backed by good results After strong up moves, currently, Pokarna Ltd stock trading around 1000-1400 price level and 960 acts as a good support level and 1300 level acts a resistance level.

On the day chart, the current level of 1150 and the next level of 950 would be important levels to watch for. In the face of the heightened tariff threat in recent times, the bias could be toward consolidation so long as the level of 950 holds. Since February beginning, the 50 DMA is acting as a short term resistance for the price. The increased volatility at muted volumes needs to be observed for a few weeks before concluding anything about the trend.

Pokarna Ltd Latest Latest Result, News and Updates

Pokarna Ltd Quarterly Results

Pokarna Ltd Consolidated revenues grew by 36% YoY. EBITDA and PAT grew by 47% and 143% YoY, respectively. On a QoQ basis, revenues and EBITDA declined by -11% and -9%, and PAT was up by 13%, respectively.

Numbers are slightly impacted due to one of the 2 units being closed for around 15 days in October on account of the installation of KREOS technologies. New product launches at KBIS 2025, including engineered stone products from Kreos and Chromia lines, are set to debut on February 25, 2025. Demand in the US for engineered stone is slowly picking up, with expectations for 2025 to be a better year.

EBITDA margins are expected to be around 35%+ in the near term, with margin improvement expected as new product lines stabilize. The Kreos and Chromia lines are anticipated to positively contribute to margin profiles over time, with meaningful contributions expected starting Q2 or Q3FY26.

Capex for ₹440 Cr expansion in Telangana for a third engineered stone production line is on track.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.