The consumer discretionary sector in India has historically been a consistent wealth creator for long-term investors. Over the last decade, it enjoyed strong tailwinds driven by rising incomes, premiumization, and limited listed investment options. We have been tracking the consumer discretionary sector in India for more than a decade now and have observed how the investor view of this sector has steadily changed over the period.

Till five to six years ago, the consumer discretionary sector was a near-consensus buy. However, the current environment presents a materially different picture. Recent macroeconomic shifts and changes within consumption patterns warrant a nuanced and selective approach to investing in this sector.

What Stocks are part of the Consumer Discretionary sector?

Consumer Discretionary stocks (also known as Consumer Cyclicals) represent companies that sell non-essential goods and services. These are “wants” rather than “needs”—things people buy when they have extra cash (discretionary income) after paying for essentials like rent and groceries.

Because these purchases depend on the health of the economy, these stocks tend to perform very well during economic booms and struggle during recessions.

Let’s analyze this sector based on 3 parameters

1) Current macroeconomic context

2) Implications for listed consumer businesses as a result of these shifts

3) Our preferred investment framework to invest in the consumer discretionary sector

Current Macroeconomic Context for the Consumer Discretionary Sector

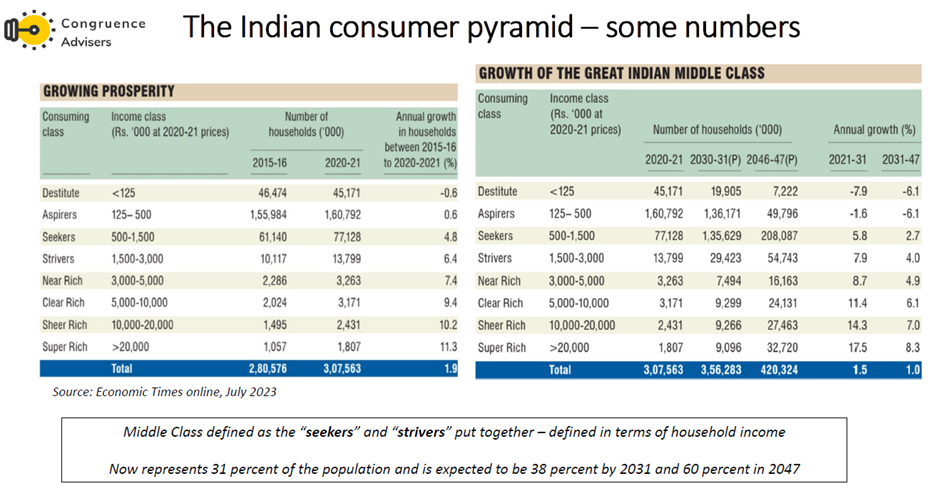

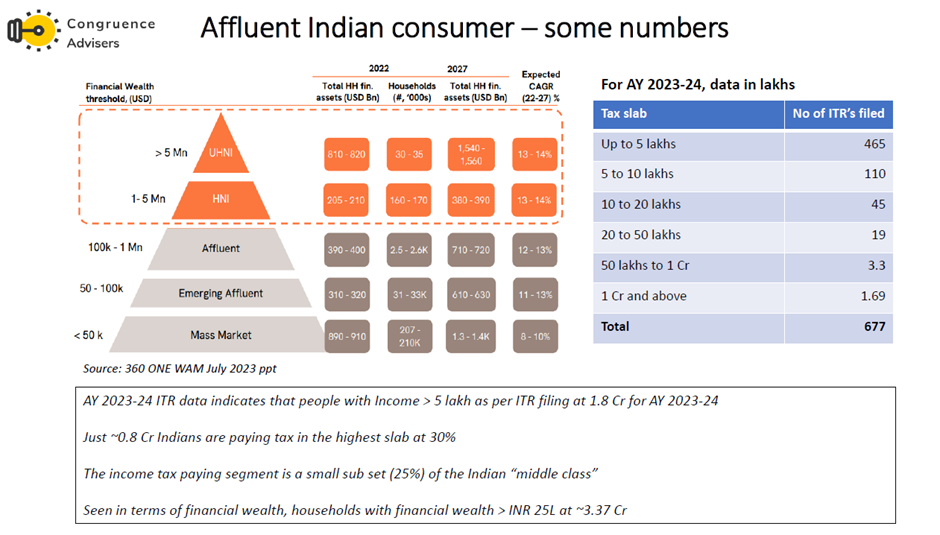

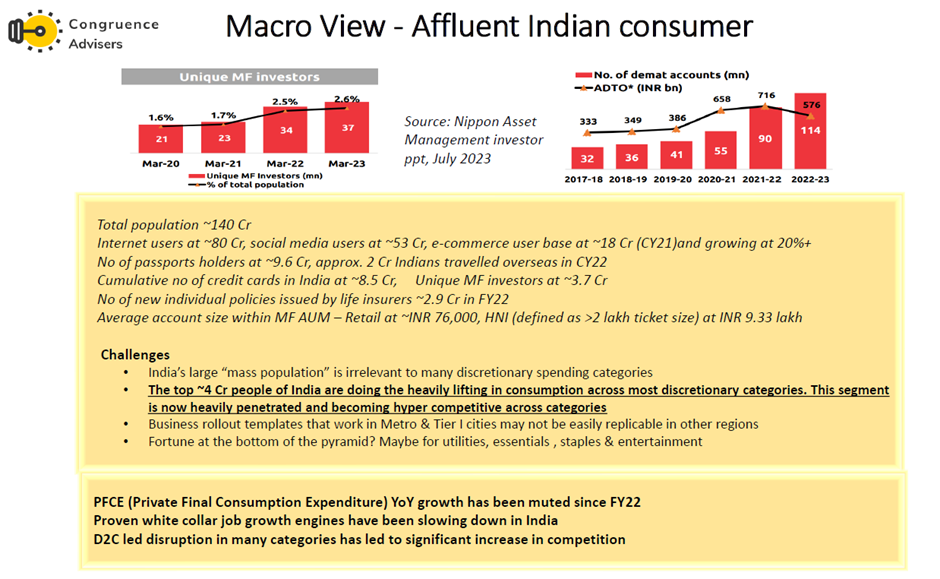

A defining characteristic of discretionary consumption in India today is the increasing concentration of demand. The top 4–5 crore Indians are now responsible for the bulk of discretionary spending across categories. While this cohort has driven growth over the last several years, it is also now highly penetrated and intensely competitive across many segments. Incremental growth from this base has become harder to achieve.

Extracts from our presentation at the Investor Accelerator Summit, Goa 2023 below

Another critical variable to track is private final consumption expenditure (PFCE), a key component of GDP that reflects underlying consumption demand. PFCE growth has remained subdued since FY22, which marked a cyclical high for the sector on the back of pent-up demand post COVID. This moderation is closely linked to slower growth in traditional white-collar employment engines. Net hiring in the IT sector, for instance, has been close to zero over the past 18 months, while AI-led disruption introduces further uncertainty around future job creation and wage growth in the services sector in India.

In parallel, the disruption caused by direct-to-consumer (D2C) brands has already played out across several discretionary categories. This has significantly intensified competition, and reduced the estimated durability (competitive advantage period, as defined by Michael Mauboussin) of incumbent advantages.

Taken together, these factors suggest that the macro environment for consumer discretionary is different than it was during the previous growth cycle. Investors will hence need to be nuanced in their assessment of sub sector, themes and businesses within the consumer discretionary sector in 2026.

What are the Implications of these macroeconomic changes for Consumer Discretionary Stocks?

The investment landscape within listed consumer discretionary has expanded dramatically over the past six to seven years. Earlier, investors were constrained to a small set of names across footwear, apparel, QSR, and hotels.

Some of well-known stocks that have seen a lot of investor interest in the past decade are:

- Page Industries

- Jubilant Food

- Relaxo Footwear

- Bata India

- VIP Industries

- Indian Hotels

- Trent

Scarcity value played a major role in sustaining premium valuations for these businesses since investors did not have a plethora of options to take exposure to the consumer discretionary sector in India. Today, investors have access to a much broader opportunity set across hotels and travel, footwear, QSR, jewellery, ethnic wear, luxury retail, online platforms, contract manufacturing, and alcohol. Most categories now offer four to six listed options, fundamentally changing the competitive and valuation dynamics in the listed space.

As a result, scarcity-driven valuation premiums have largely disappeared. Valuations are now determined more explicitly by growth visibility, unit economics, and execution quality rather than category leadership alone.

Just look at the number of businesses that have listed in India over the past few years across sub segments within the consumer discretionary sector –

- Garments – Vedant Fashions, Campus Footwear, Raymond Lifestyle, Aditya Birla

- Lifestyle, Arvind Fashions

- Footwear – Metro Brands, Campus Footwear, Redtape demerger

- QSR – Devyani International, Sapphire Foods, Restaurant Brands

- Platforms – Eternal, Swiggy, Nykaa, Meesho

- Luxury – Ethos

- Hotels – ITC Hotels demerger, Samhi Hotels, Chalet Hotels, Leela Hotels

- Travel – Yatra, TBO Tek, Dreamfolks, Travel Food Services

And this list isn’t even comprehensive, just indicative of the plethora options investors have today. Many more to come in the next few years!

Another important structural shift has been the new found abundance of capital willing to back emerging, digital first consumer businesses. Dedicated consumer venture funds and family offices actively fund D2C and niche consumer brands, lowering entry barriers to capital across categories. While this has increased innovation and novelty in the market, it has also shortened product cycles and intensified competition for incumbents.

In addition to the just the product portfolio, the digital first economy has impacted so many other aspects of building and running a consumer discretionary business in India. Distribution, Marketing, and the Go-To-Market (GTM) Model Indian consumers in the top income (the top 4-5 Cr Indians) cohorts, have become far more discerning today. Exclusivity, novelty, and brand differentiation now matter more than legacy or scale alone.

Just imagine the implications of this for brand freshness, positioning and relevance for a legacy brand that was immensely successful in the past but has to figure out how to relevant to Millennials and Gen Z today.

Digital marketing has fundamentally altered how brands are launched and scaled. Today, digital advertising accounts for over 30% of total advertising spend even for large FMCG players. This was hardly 10% pre-COVID for the FMCG sector.

The rising salience of modern trade, e-commerce, and influencer-led marketing has enabled new entrants to target narrow customer cohorts with high precision and measurable returns. Businesses no longer need extensive field forces or broad-based mass advertising to scale. This has reduced the capital intensity of brand creation but increased the pace of competitive disruption. Today a new age brand can execute very targeted online campaigns to reach their preferred customer segment and measure ROI and brand activation almost immediately, while this would take months in the pre-digital era.

Influencers give new age brands access to very engaged and motivated customer cohorts who are very receptive to their messaging. The bulk of the work of brand marketers has been taken over by some of these influencer cohorts, though this comes at an obvious price. Scaling a new brand has become much easier than in the past, though hitting profitable scale at good unit economics has become much more challenging than before.

Investors today will need to consider the sum total of all these factors and not just rely on historical growth rates and excel sheet driven calculations of total addressable market. So how do we go about this at Congruence Advisers today?

Characteristics to look for in Consumer Discretionary sector Stocks

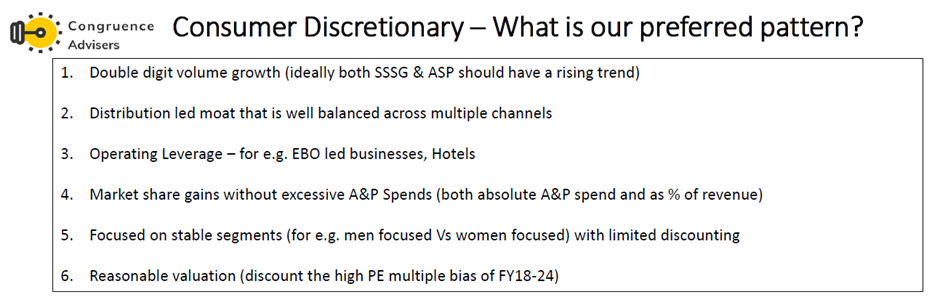

In a nutshell these are the preferred characteristics we like to see in consumer discretionary stocks as of today. This overall framework gives us enough flexibility to consider all of the perspectives we have touched upon in this post

In the current environment, selectivity is paramount. Preferred businesses are those capable of delivering double-digit volume growth alongside steady pricing improvement, resulting in sustainable low-teens revenue growth. A healthy mix of same-store sales growth and average selling price expansion is essential.

It should go without saying that healthy revenue growth hinges on how well the management team is able to grow the product portfolio through category expansion over time. We would in fact go as far to say that well executed category expansion is one of the most important patterns we look for in a consumer business.

Distribution diversification is another key criterion. Overdependence on a single channel introduces fragility. Strong businesses typically operate across exclusive brand outlets, large format stores, multi-brand outlets, online platforms, and direct-to-consumer channels, supported by proprietary customer data and technology infrastructure. We like to see business that have > 25% revenue coming from at least two channels and Operating leverage, while rare in the sector, remains an important differentiator.

Asset-heavy models such as hotels are better positioned to benefit from operating leverage than asset-light consumer brands with high variable costs. In small consumer businesses, operating leverage can sometime come from optimized A&P spends over time (as a % of revenue) even if the absolute A&P spend increases.

From a business quality standpoint, we prefer to see market share gains without disproportionate advertising and promotion spend. While young brands may require elevated A&P spending initially, this ratio should decline meaningfully with scale. Models that demonstrate improving marketing efficiency over time are structurally more attractive.

Our experience of tracking multiple businesses within the FMCG and Consumer discretionary sectors indicates that an absolute spend of 40-50 Cr per year is the norm for national level brands. As brands scale volumes, the ability to spread A& P cost over more customers leads to significant operating leverage for consumer businesses.

We also have a clear preference for stable segments with limited discounting. Excessive reliance on promotions often signals weak brand equity. Additionally, historical evidence suggests that men-focused categories, which tend to be more homogeneous in demand, have scaled more successfully in India than women-focused categories.

We believe this is due to higher number of SKU’s (higher inventory, more working capital intensive) and higher price sensitivity of the women’s focused brands compared to men focused ones. We prefer to see reasonable valuation, if not cheap valuation; the sector’s historical bias toward high price-to-earnings multiples must be reassessed.

Multiples that appeared reasonable in the past cycle may no longer be justified given slower growth and higher competition. The market’s willingness to pay 60 PE multiple for a consumer business that grows at 10-12% p.a. has been absent for 3+ years now.

Watch the video here

How do we see Sub Sectors within the Larger Consumer Discretionary Sector?

Within QSR, the potential for operating leverage remains significant, but near-term fundamentals are weak due to negative trends in same-store sales growth and average daily sales. A sustained recovery is necessary before the segment becomes attractive.

Footwear shows pockets of strength, with select players delivering healthy growth, though valuations remain elevated.

Alcohol is fundamentally strong but is already the most crowded trade within consumer discretionary, limiting incremental upside.

Hotels, after a period of rich valuations, have seen some multiple compression in recent months without a corresponding deterioration in growth outlook. This has improved the risk-reward balance for the segment.

Contract manufacturing offers strong growth potential and some operating leverage, but valuations are only beginning to approach reasonable levels.

Jewelry continues to benefit from elevated gold prices, which currently mask underlying volume weakness. Sustainable volume growth of 7–8% remains elusive in the Jewelry segment at elevated gold prices.

We can go on about more sub segments but the intent here is to communicate the top-down thought process when it comes to picking individual stocks to focus on. With this thought process as the backdrop, we will conclude with a limited list of some stocks that have made it to our current coverage list within the consumer discretionary sector.

Do note that the below list has a small cap bias since microcap investing will remain a priority for us. Also note that these are NOT recommendations, though a few of them are part of the Flexicap research & Emerging Business research offerings as of 2025 end.

Our List of Good Stocks to Track within the Consumer Discretionary Sector

The below is not a comprehensive list, this is a just a subset of our coverage universe within

the consumer discretionary sector.

- Lemon Tree Hotels

- Samhi Hotels

- Arvind Fashions

- Goldiam International

- Hindustan Foods

- Allied Blenders and Distillers

- Radico Khaitan

- Westlife Foodworld

At Congruence Advisers we are constantly adding and pruning from the coverage universe based on our investment framework. Every decision is a function of time, portfolio construct and valuation.

We have also written detailed business research notes on some other stocks in the consumer discretionary sector, though they aren’t part of our active tracker right now

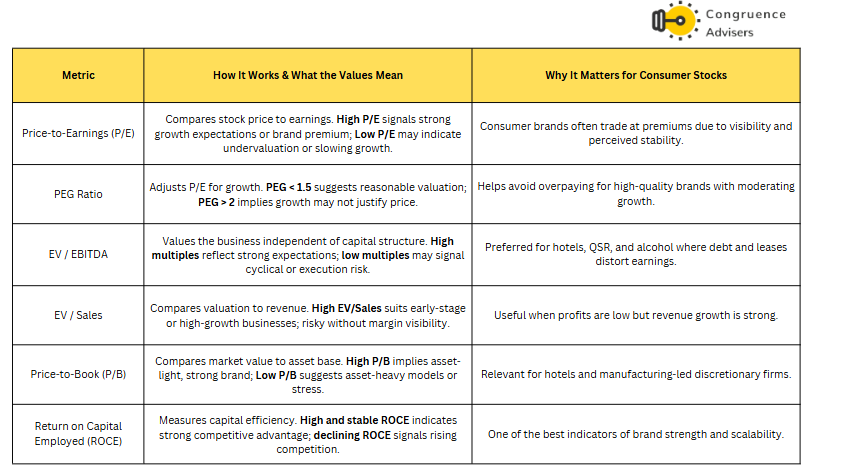

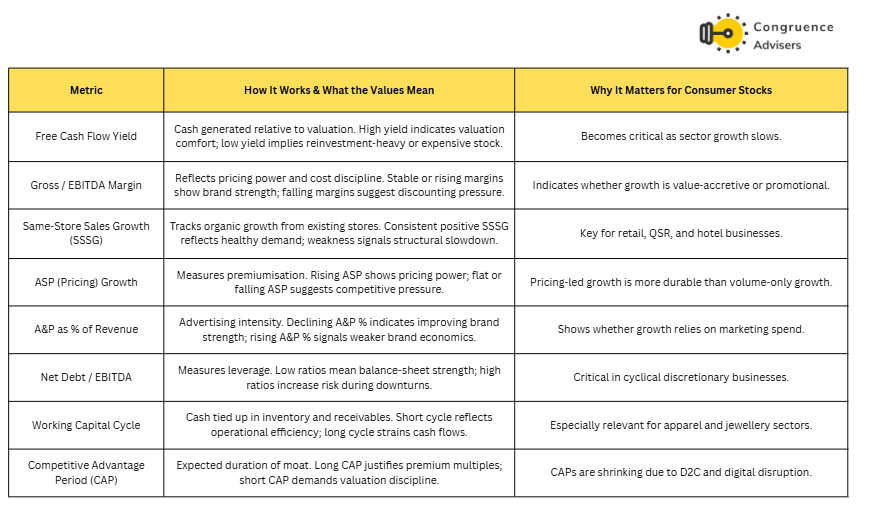

Consumer Discretionary Sector Valuation Metrics

How Does the Consumer Discretionary Sector Perform across Economic Cycles?

The consumer discretionary sector is inherently cyclical, as spending on non-essential goods and services depends heavily on income growth, employment stability, interest rates, and consumer confidence. Its performance tends to vary meaningfully across different phases of the economic cycle.

Early Recovery Phase: In the early stages of an economic recovery, discretionary spending is usually one of the first areas to improve as job losses stabilize and consumer confidence begins to return. Spending typically picks up in categories such as travel, affordable discretionary products, and quick-service restaurants. From a market perspective, this phase often leads to strong earnings upgrades and valuation re-rating for discretionary stocks, driven by operating leverage after a weak cycle.

Expansion / Growth Phase: During periods of sustained economic expansion, rising incomes and easy access to credit support broad-based growth across discretionary categories. Premiumisation accelerates as consumers spend more on branded apparel, lifestyle products, dining, and travel. Stock performance in this phase is usually strong, with high-quality consumer brands outperforming the broader market and commanding premium valuation multiples.

Late-Cycle / Peak Phase: As the economy approaches the later stages of the cycle, growth begins to slow and cost pressures rise due to inflation and higher interest rates. Discretionary consumption becomes more concentrated among higher-income consumers, while volume growth moderates. Competition intensifies and discounting increases, leading to margin pressure. For investors, returns become more selective, and valuation multiples typically start to compress.

Slowdown / Recession Phase: In an economic slowdown or recession, discretionary spending is among the most affected areas. Consumers prioritize essentials, postpone big-ticket purchases, and reduce spending on travel and lifestyle categories. Companies with high fixed costs or weak balance sheets face significant pressure. During this phase, consumer discretionary stocks generally underperform, and investor focus shifts toward cash flow stability and balance sheet strength.

Post-Recession Reset: After a downturn, the sector often emerges structurally changed. Weaker players exit or consolidate, while survivors benefit from improved market share and leaner cost structures. Digital adoption, changes in distribution, and evolving consumer preferences shape the next growth cycle. Stock performance becomes increasingly differentiated, with long-term winners emerging based on execution quality and adaptability rather than category leadership alone.

In summary, the consumer discretionary sector performs best in the early-to-mid stages of economic expansion and worst during slowdowns. In the current cycle, disciplined stock selection—focused on pricing power, operating leverage, and resilience—is far more important than broad sector exposure.

Final Thoughts on Consumer Discretionary Sector

The consumer discretionary sector is no longer a straightforward structural growth story that investors can ride irrespective of the valuation. The combination of concentrated consumption, slower employment growth, abundant capital access to new age brands and intensified competition has materially altered the investment landscape. Each business needs rigorous bottom-up analysis and an appreciation of all of these factors before an investor decides to bet on the consumer discretionary sector based purely on the historical stock price performance of the sector.

A small set of businesses across apparel, food services, hotels, and consumer manufacturing currently appear well-positioned if macro stability persists. However, broad-based sector exposure is unlikely to deliver outsized returns unless consumption (PFCE) picks up tangibly in the remainder of FY26 and FY27.

In the current cycle, disciplined valuation, execution quality, and structural resilience matter more than category narratives. Any investor who fell for the quality business narrative in the previous cycle of 2018-22 has paid a very heavy price already. We take pride in the fact that we were able to flag some of these investor blind spots in this post of ours from 2022, well before the valuation multiple derating started playing out in the consumer sector.

Disclaimer

The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.