Samhi Hotels Ltd is one of India’s leading branded hotel ownership and asset management companies. Samhi Hotels Ltd has 31 hotels with an inventory of 4,801 keys spread across 13 cities (largely metro/tier I cities), including Bangalore, Pune, Hyderabad, Delhi NCR, and Chennai, with no city contributing to more than 20% of the inventory. Samhi Hotels Ltd has a diversified presence across upper upscale, upscale, and midscale segments under various brands, including Courtyard by Marriott, Renaissance, Sheraton, Hyatt Regency, Fairfield by Marriott, and Holiday Inn Express, among others. Samhi Hotels Ltd is India’s third largest owner of hotel rooms by number of rooms.

Can Samhi Hotels Ltd be a Turnaround Candidate?

We believe Samhi Hotels Ltd presents a compelling turnaround opportunity and is well positioned to tap the hotel industry upcycle backed by experienced management, excellent execution track record with healthy inventory additions and renovations planned for the coming years. Samhi Hotels Ltd has multiple growth levers and large operating leverage potential in the P&L. Additionally, Samhi Hotels Ltd is one of the cheaper hotel stocks compared to its peers, making it a good candidate for a potential re-rating.

Samhi Hotels Ltd Company Overview

Samhi Hotels Ltd. is a recently listed small-cap company that is into hotel asset management. Samhi Hotels Ltd. owns a portfolio of 31 hotels pan India with more than 4800 keys under its management.

Samhi Hotels Ltd. was founded in 2010 by Mr. Ashish Jakhanwala (current CEO and MD) and Mr. Manav Thadani (current board member and non-executive director). The founders managed to raise ~200mn USD over the next three years from illustrious international investors like Equity International (founded by renowned American real estate investor Sam Zell) and GTI Capital. Samhi Hotels Ltd. constructed its first hotel assets with these raised funds and started commercial operations in 2012. Since then, in a short span of 13-14 years, Samhi Hotels Ltd. has managed to grow its portfolio to ~4800 keys, becoming one of the fastest-growing hotel asset ownership companies in India. Over the course of its journey, Samhi Hotels Ltd. pivoted from a strategy of constructing hotels from scratch to buying distressed hotels and turning them around into healthy assets. 26 out of the current 31 hotel assets owned by Samhi Hotels Ltd are purchase-and-turnaround assets. This decision was influenced by Mr. Sam Zell’s vast experience in real estate. Samhi Hotels Ltd claims that this strategy has enabled it to grow fast with less risk and by committing fewer resources. Samhi Hotels Ltd. also has a clear strategy of owning primarily business hotels (as opposed to leisure hotels) which are located in Metros and Tier 1 cities of India. They want to be present in the top cities of India where business activity is robust and growing, commercial office space is expanding, and air traffic is increasing.

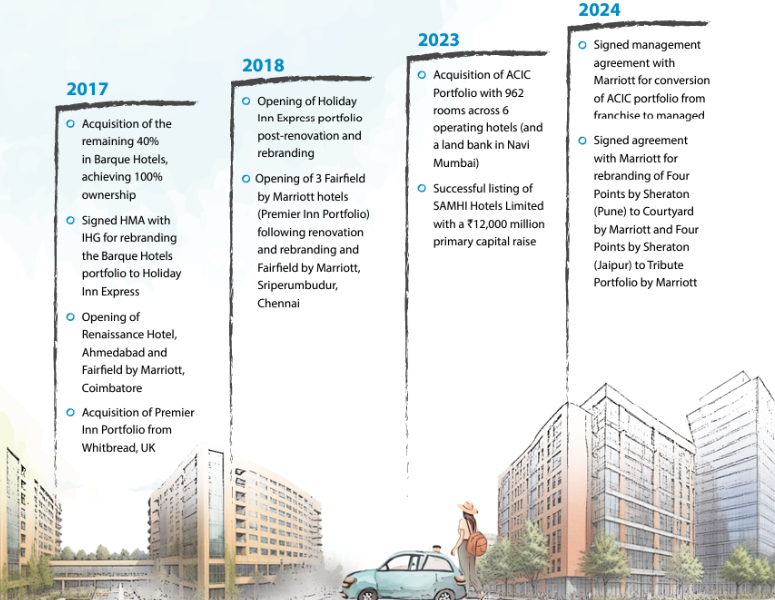

Samhi Hotels Ltd history and growth journey from inception to IPO

Samhi Hotels Ltd. started by raising seed capital amounting to ~200mn USD from the likes of Equity International and GTI Capital. While initially they constructed hotels from the ground up, they soon changed their strategy to acquisition-and-turnaround. Under the acquisition-led strategy, Samhi Hotels Ltd focused on identifying and buying out stressed or underperforming hotel assets with good potential at attractive valuations, modifying or renovating the said assets, deciding which operator/brand to operate the hotel under, and then turning them around gradually to extract the assets’ full potential. Some significant milestones of Samhi Hotels Ltd 13-year-old journey are highlighted below.

Source – Samhi Hotels Ltd FY24 AR, *Samhi Hotels Ltd Incorporated on 28 December 2010

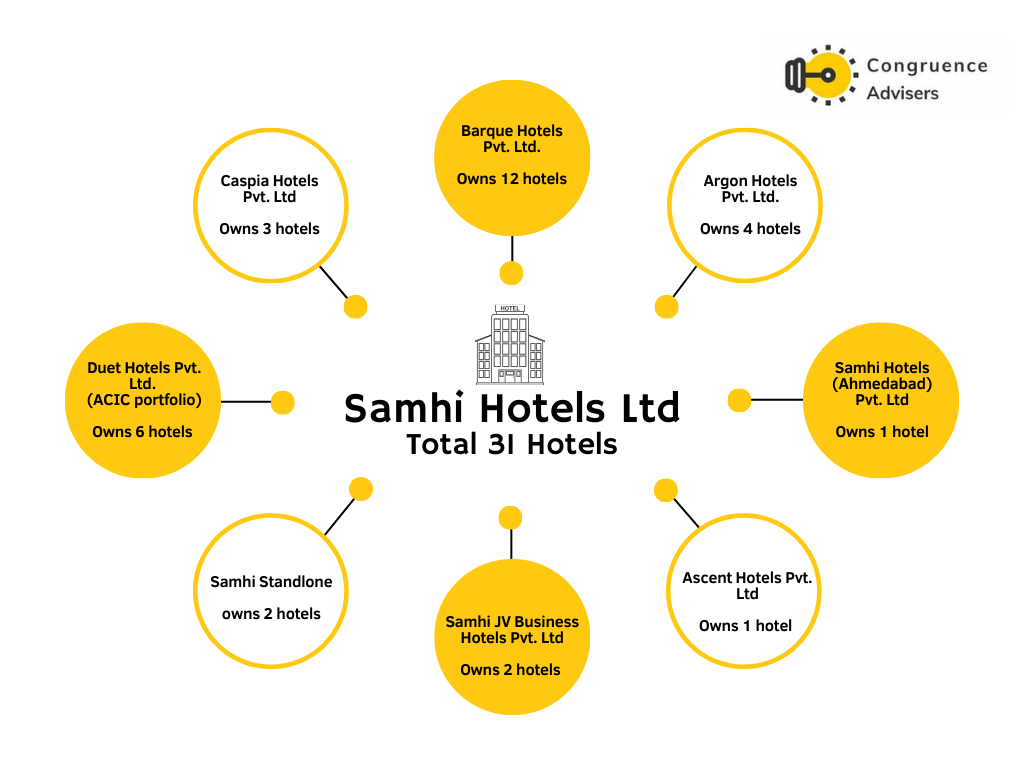

Samhi Hotels Ltd. Company structure

Samhi Hotels Ltd. has several subsidiaries, each owning one or more hotels in the Samhi Hotels Ltd portfolio. The major subsidiary groups consolidated under Samhi Hotels Ltd are:

- The standalone Samhi entity owns 2 hotels.

- Caspia Hotels Pvt. Ltd. – Owns 3 hotels

- Barque Hotels Pvt. Ltd. – Owns 12 hotels

- Samhi JV Business Hotels Pvt. Ltd. – Owns 2 hotels

- Samhi Hotels (Ahmedabad) Pvt. Ltd. – Owns 1 hotel

- Ascent Hotels Pvt. Ltd. – Owns 1 hotel

- Argon Hotels Pvt. Ltd. – Owns 4 hotels

- Duet Hotels Pvt. Ltd. (The ACIC portfolio) – Owns 6 hotels

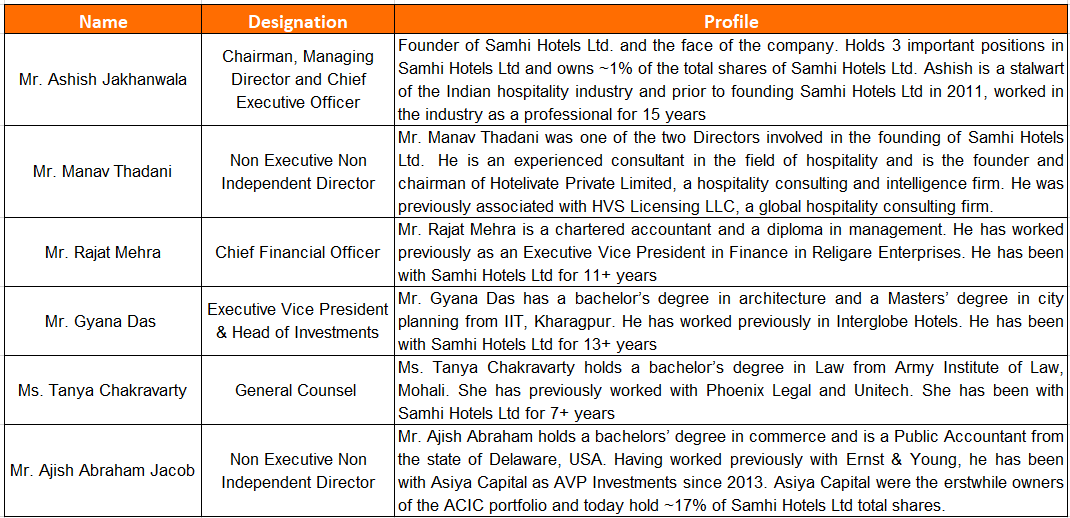

Samhi Hotels Ltd Management details

Founder Mr. Ashish Jakhanwala, a 1996 postgraduate from the Institute of Hotel Management, Lucknow, had 15 years of professional experience in the hotel industry, working across multiple roles such as hotel operations, asset valuations, hotel design, consulting, etc. From 2004 to 2010, Mr. Jakhanwala worked for the leading global hospitality company Accor and played a key role in establishing the IBIS Hotel chain in India. In the early days of his entrepreneurial venture, Samhi Hotels Ltd, Mr. Jakhanwala invested his personal savings of ₹70 lakhs before securing first funding of $70 million (₹350 Cr) from Equity International and $30 million (₹150 Cr) from GTI Capital.

Samhi Hotels Ltd Industry Overview

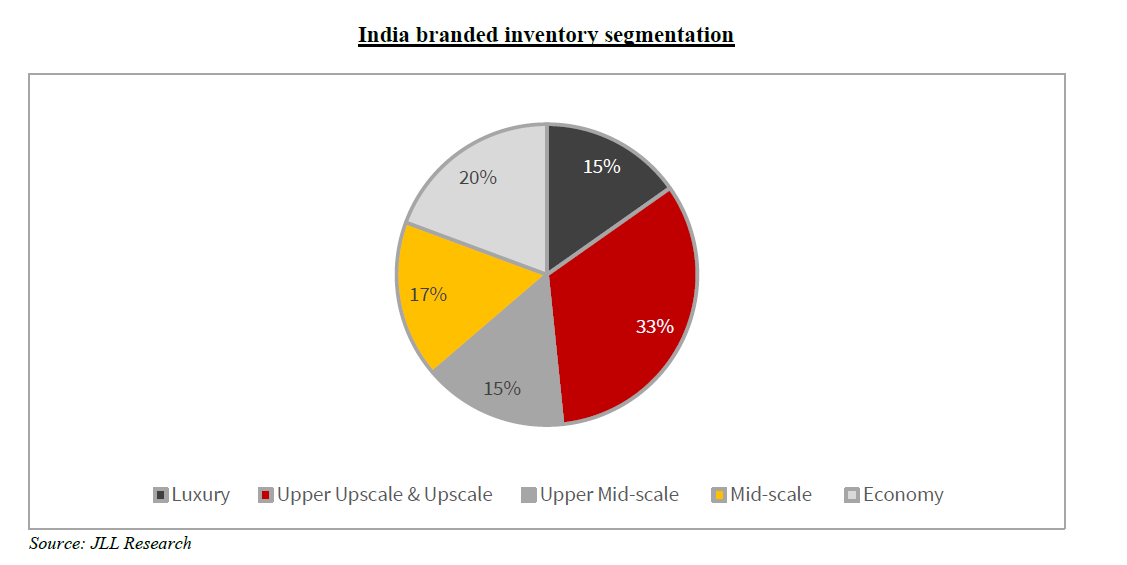

The domestic branded hotel industry in India consists of approximately 2,12,000 rooms with an industry size of ~INR 82,000 Cr per year [Source: Axis Securities report, Aug 2024]. The rooms are split into various categories such as luxury, upper upscale and upscale, upper midscale, midscale, and economy with the following distribution [Source: SAMHI Hotels Ltd. DRHP, Sep 2023].

The largest number of rooms are in the upper upscale and upscale category, where brands like Courtyard by Marriott, Hyatt Regency, and Novotel are positioned.

The next largest cohort is the economy cohort, with a number of local brands. This is followed by the midscale cohort with brands like Holiday Inn Express, Ginger Hotels, Ibis Hotels, Sarovar Portico, etc.

The upper midscale consists of brands like Fairfield by Marriott, Four Points by Sheraton, Lemon Tree Premier, etc.

The luxury cohort consists of brands like JW Marriott, Grand Hyatt, certain Taj hotels, Oberoi hotels, Sofitel, Leela Palace, etc.

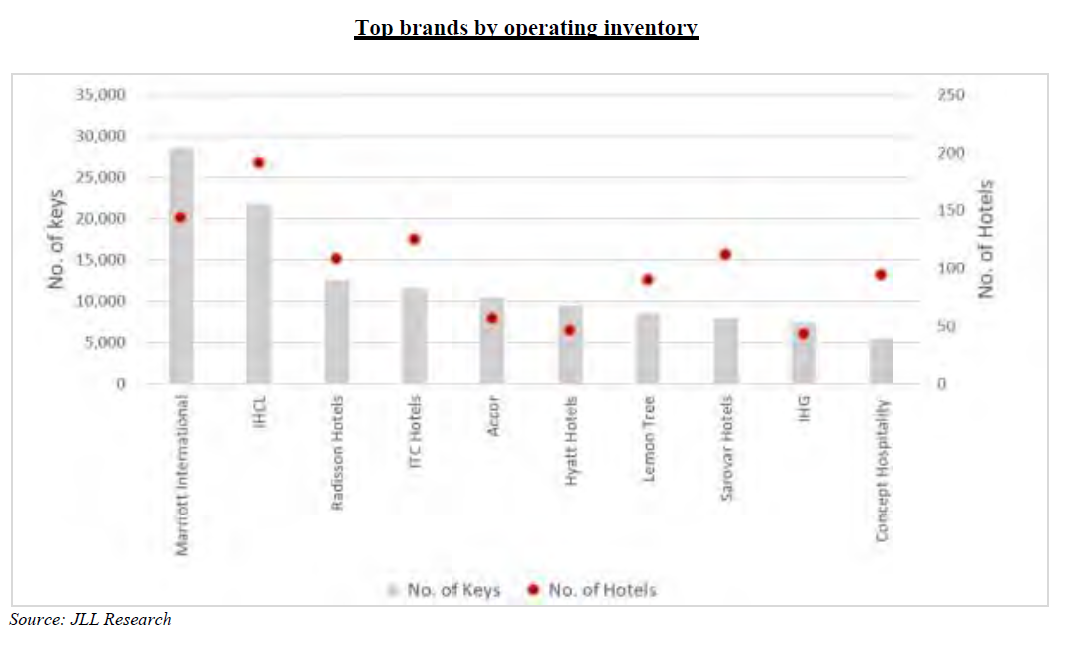

Among branded rooms, the largest inventory in India operates under various Marriott brands – JW Marriott, Courtyard by Marriott, Fairfield by Marriott, 4 Points by Sheraton, etc. IHCL (Taj Hotels) and Radisson Hotels have the largest inventory in India after Marriott. ITC Hotels, Accor, Hyatt, and Lemon Tree are other large brands operating in the Indian market.

In terms of pure hotel asset owners who don’t own a proprietary brand, Samhi Hotels Ltd. owns the largest number of rooms in India, followed by the likes of Chalet hotels ltd, Saraf, Brigade, Prestige, Juniper, Panchsheel, etc. Companies such as Indian Hotels Co. Ltd. and Lemon Tree (which both own assets and have proprietary brands, too) each own more rooms than Samhi Hotels Ltd.

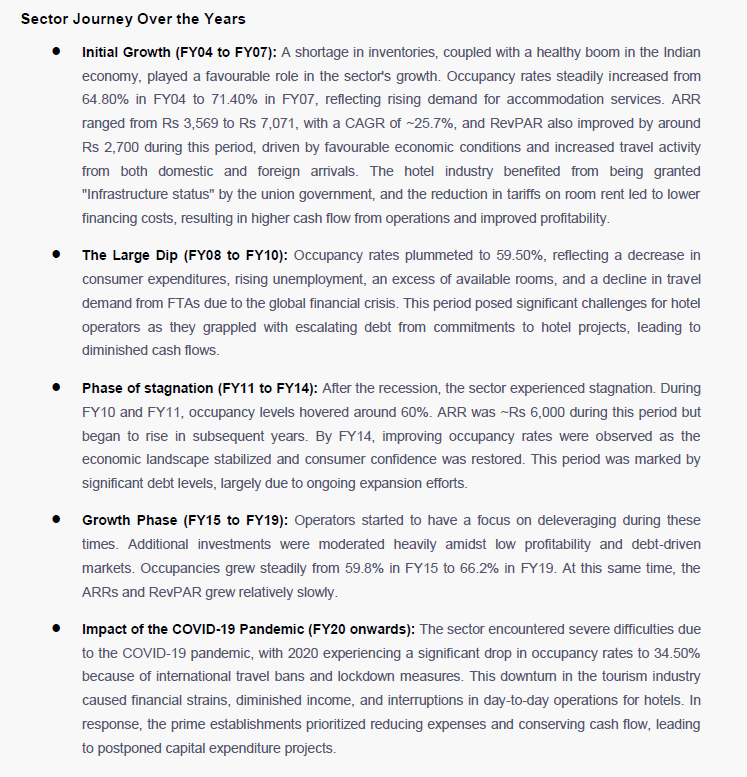

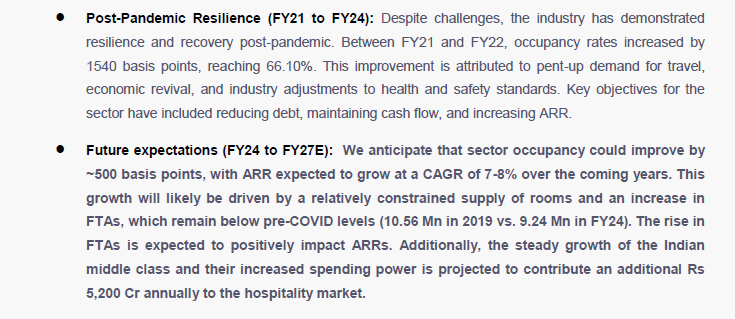

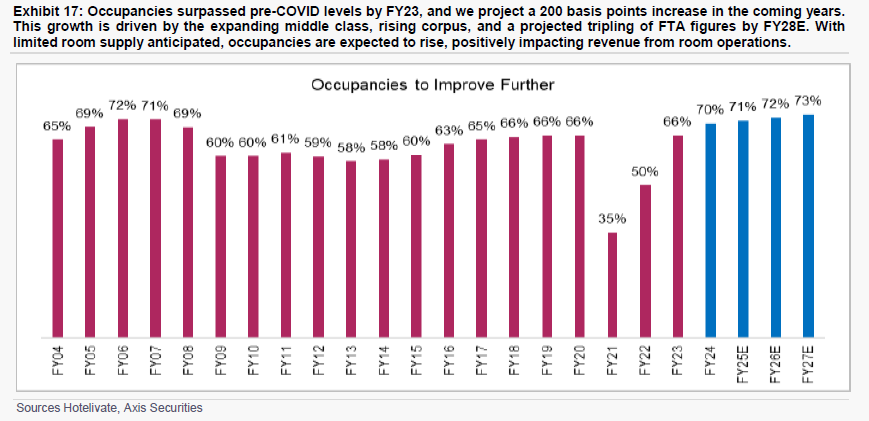

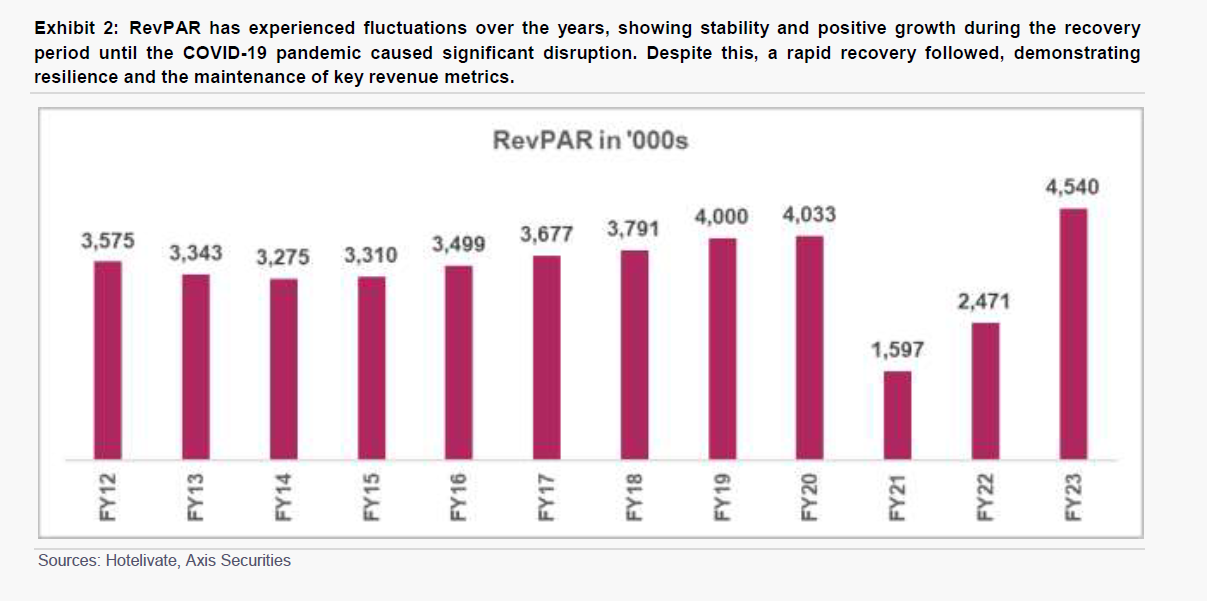

The hotel industry in India has gone through several ups and downs in the last couple of decades, as documented in the image below [Source: Axis Securities report, Aug 2024]. After recovering from the post-GFC contraction in the early 2010s, the industry was on its way to recovery when COVID-19 hit. Covid put severe pressure on hotel cash flows and balance sheets, forcing the industry to reduce expenses and conserve precious capital by postponing capex plans.

Since mid-2022, as Covid subsided, demand came back in the industry, and average room rates (ARR) and occupancy levels both increased. The lack of CAPEX during the COVID period further curtailed new supply and enabled existing hotel inventory to post healthy RevPARs. RevPAR is an industry term that means Revenue per Available Room and is calculated as RevPAR = Average Room Rate X Occupancy %.

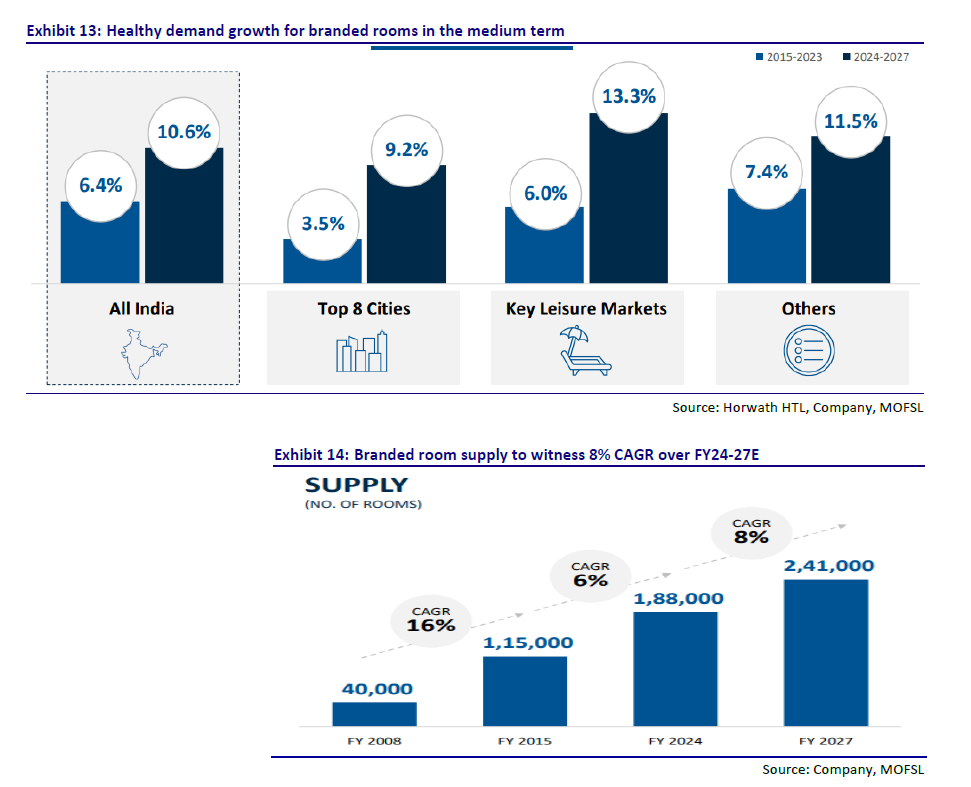

As evident from the graphs above, RevPARs are expected to stay healthy for the hotel industry for the upcoming few years due to sustained high ARRs and occupancy levels. This is because hotel demand is expected to remain ahead of hotel supply for the medium term. Pan India hotel demand is expected to grow at 10.6% CAGR between FY24-FY27, while supply is expected to grow only at a CAGR of ~8% in the same period. In Samhi Hotel Ltd.’s relevant market of top 8 cities, demand is expected to grow at a CAGR of 9.2% in this period while supply is expected to grow at a CAGR of ~8% [Source: MOSFL report, August 2024]

Demand is expected to be robust for branded hotels in India in the medium for several reasons, such as the increasing spending power of the Indian middle class, increasing propensity of leisure travel amongst Indians, increasing business travel led by a growing economy, and higher penetration of global capability centres, recovery of foreign tourism to pre-Covid levels, etc.

Coupled with robust demand-supply dynamics, the hotel industry also benefits from strong balance sheets, cyclically low debt levels, and robust free cash flow generation.

All the factors mentioned above seem to be pointing towards a continuation of the domestic hotel industry upcycle in the medium term.

Samhi Hotels Ltd Product Portfolio details

Samhi Hotels Ltd. is one of India’s largest pan-India hotel asset owners. With 4801 keys across 31 hotels in 12 cities of India, it is the 3rd largest owner/lessor of hotel keys in India after Indian Hotels Co Ltd (IHCL) and Lemon Tree Hotels Ltd. Samhi Hotels Ltd. focuses on owning business hotels in Metro and Tier 1 cities of India. Apart from one hotel in Goa, all the other 30 hotels of Samhi Hotels Ltd. are primarily business hotels catering to business demand in prime urban locations of India.

Only 665 keys out of the 4801 keys owned by Samhi Hotels Ltd. were built organically; the rest were all acquired assets. Throughout its 13 years of history, Samhi Hotels Ltd. has been one of the fastest-growing hotel asset owners in India, adding an average of 370 rooms per year since its inception. They especially grew very rapidly between FY18 and FY20, adding 2590 rooms in these 3 years. This was the period when the hotel industry was starting to come out of a period of sluggish growth and losses and starting to show resilience and growth in terms of ARR and occupancies. Unfortunately, Covid hit the industry badly in early 2020, and Samhi Hotel Ltd’s debt-fueled acquisitions during FY17-FY20 caused them a lot of balance sheet stress as revenues and cash flows vanished and debt kept mounting up. They did remarkably well to recover from this situation starting FY23 as hotel demand started coming back. A very well-executed non-cash, share-based acquisition of the ACIC hotel portfolio comprising 960+ keys in early 2023, as well as a very well-timed IPO in Sep 2023, brought in the much-needed equity infusion that was needed for Samhi Hotels Ltd. to deleverage its balance sheet to a significant extent. The share-swap-based ACIC acquisition was done on very favourable terms for Samhi Hotels Ltd. as Samhi Hotels Ltd shares were valued at ₹ 230+/share for the acquisition, whereas the IPO happened at a much lower price band of ₹119-126/share. The ACIC portfolio can generate close to ₹ 200 Cr sales and ₹80 Cr EBITDA at full potential, so the acquisition was done at an EV/EBITDA multiple of 11x, which is very reasonable.

Presence across hotel segments

Samhi Hotels Ltd. has hotels positioned across various segments:

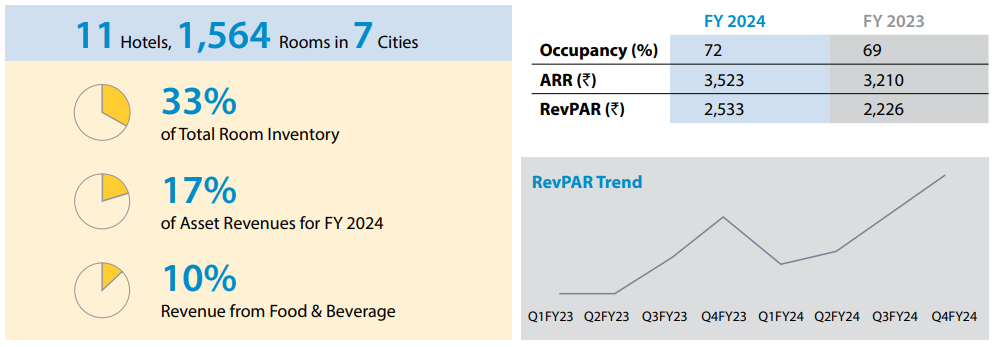

Mid-Scale segment – The mid-scale segment offers smart and comfortable lodging with moderate room sizes and room rates. Under the midscale segment, Samhi Hotels Ltd. operates 10 Holiday Inn Express hotels across 6 cities in India. An 11th Holiday Inn Express Hotel is about to commence operations in Q3 FY25 in Kolkata. The total number of rooms in the mid-scale portfolio is 1564. While the midscale segment accounts for ~33% of the total room inventory of Samhi Hotels Ltd, it accounts for only 17% of its total asset revenues. Most of the revenues in the mid-scale segment come from the room tariffs with food and beverage contributing only 10%. The average room rate in FY24 for Samhi Hotels Ltd mid-scale hotels was ₹3500, with an occupancy of 72%, leading to a RevPAR of ₹2500.

Upper midscale segment – The midscale segment prioritises tailored experiences to suit the needs of modern travellers. These hotels provide larger rooms and essential amenities to ensure a comfortable stay for travellers without the extravagance of higher-tier hotels. Under the upper midscale segment, Samhi Hotels Ltd. operates 15 hotels under the Fairfield by Marriott and Four Points by Sheraton brands, with 1 hotel in Delhi operating under Samhi Hotels Ltd.’s own brand (Caspia). These hotels are spread across 10 cities of India. The total number of rooms in the upper mid-scale portfolio is 2163. The upper midscale segment accounts for ~45% of the total room inventory of Samhi and 39% of its total asset revenues. About ~25% of the total revenues from this segment come from food and beverage, while ~75% comes from room tariffs. The average room rate in FY24 for Samhi Hotels Ltd upper midscale hotels was ₹5600 with an occupancy of 72%, leading to a RevPAR of ₹4000

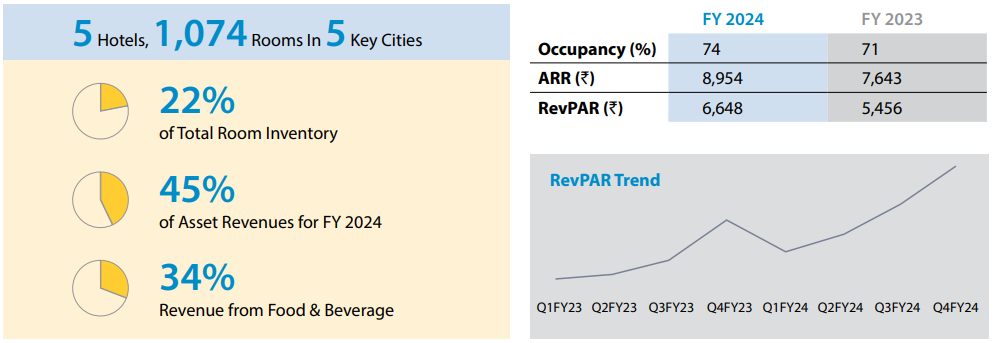

Upscale and Upper-upscale segment – The upper upscale and upscale segment is positioned between the upper midscale segment and the luxury segment and provides the perfect blend of luxury and accessibility to discerning travellers. Under the upper upscale and upscale segment, Samhi Hotels Ltd. operates 5 hotels under the Sheraton, Courtyard by Marriott, Hyatt, and Renaissance brands across 5 cities in India. The total number of rooms in the upper upscale and upscale portfolio is 1074. While the upper upscale and upscale segment accounts only for ~22% of the total room inventory of Samhi Hotels Ltd, it accounts for a whopping 45% of its total asset revenues. About 1/3rd of the total revenues in the segment come from food and beverage, thanks to premium restaurants and cafes in these assets. The average room rate in FY24 for Samhi Hotels Ltd upper midscale hotels was ₹8900, with an occupancy of 74%, leading to a RevPAR of ₹6700.

Samhi Hotels Ltd. wants to stay focused on owning hotel assets in premium Metro and Tier 1 urban locations in India. Samhi Hotels Ltd uses air traffic growth and commercial space absorption in cities as key metrics to evaluate potential new city candidates and to evaluate the health of the cities it is already present. To take a call on acquiring a hotel asset, Samhi Hotels Ltd assesses multiple parameters, including hotel location profile, demand/supply dynamics in the city and the micro-market, competition – present and future, future business potential, product or brand profile, development costs, and development timelines.

Management contracts

Samhi Hotels Ltd. does not operate the hotels it owns. Instead, Samhi Hotels Ltd enters into management contracts with established global hotel brands such as Marriott, International Hotel Group, and Hyatt, who operate the assets under long-term agreements. The agreements typically span 20+ years and are extendable by mutual consent.

Under the terms of hotel management contracts, Samhi Hotels Ltd. is responsible for

- Maintaining clean title and ownership rights on the asset

- Making sure all Government compliance requirements for the asset are current and are renewed on time

- Making funds available for the day-to-day operations of the hotels, including staff salaries

- Making funds available for hotel renovations and upgrades from time to time, as agreed between the hotel operator and Samhi Hotels Ltd

Under the terms of the agreement, the hotel operator sets the standard operating procedures for hotel operations, including staffing requirements. The hotel budgets are prepared jointly by the operator and Samhi Hotels Ltd and are signed off annually. The operator provides access to its loyalty programs, booking infrastructure, and sales and marketing infrastructure to enable the hotels to attract and retain demand. In exchange for providing these services, the hotel operator is entitled to a management fee, which is usually in the range of ~5% of the hotel revenue. In addition, the operator may be entitled to additional incentives or commissions as a % of PAT based on performance. This model is a win-win for both parties as Samhi Hotels Ltd gets to focus on what it does best – capital allocation and asset management; while the operator brands focus on what they know best – satisfying travellers with world-class hotel operations.

Upcoming growth triggers

Occupancy levels across Samhi Hotel Ltd’s hotels in FY24 were ~72%. Both occupancy levels and average room rates are expected to keep inching higher for the hotel industry in the medium term, as demand is expected to outstrip supply. This will lead to organic revenue growth for Samhi Hotels Ltd. in FY25 and FY26. In addition, there are some inorganic growth triggers in the years to come.

FY25

- Opening of Holiday Inn Express, Kolkata with 110+ rooms

- Addition of 56 rooms in Holiday Inn Express, Whitefield, Bengaluru

- Renovation and rebranding of Caspia Pro as Holiday Inn Express in Noida

FY26

- Renovation & rebranding of Four Points by Sheraton, Pune

- Renovation & rebranding of Four Points by Sheraton, Jaipur

- Renovation & rebranding of Hyatt Regency, Pune to a luxury hotel

- Opening of additional rooms at Sheraton, Hyderabad

FY27

- Opening of additional rooms at Fairfield by Marriott, Sriperumbudur, Chennai

- Opening of Upper Upscale and Upper midscale hotel in Navi Mumbai (The land for this hotel was acquired as part of the ACIC portfolio and is currently under litigation with MIDC at Bombay High Court)

Renovation and rebranding have historically significantly increased average room rates for Samhi Hotel Ltd and have caused asset EBITDA margins to improve significantly.

Samhi Hotels Ltd Corporate governance

Board Composition – As of FY24, the Board of Samhi Hotels Ltd. had 8 members: 4 Independent Directors, 3 non-executive non-independent Directors, and Mr. Ashish Jakhanwala, who is the Chairman of the Board and the Managing Director and Chief Executive Officer of Samhi Hotels Ltd. The Independent Directors bring relevant industry experience to the Board, having served in roles across commercial real estate, banking, and tourism in their professional careers. Independent Directors chair the Audit Committee and the Nomination and Remuneration Committee.

KMP Remuneration – Samhi Hotels Ltd KMP (key management personnel remuneration) In FY24, the remuneration to key management personnel was quite elevated due to a one-time allocation of ESOPs linked to the IPO. The total payout to CEO and CFO in FY24 was ₹41 Cr, a whopping 4.3% of the FY24 Revenue. The corresponding payout in FY23 was only ₹8 Cr. A bulk of the payout in FY24, ₹28 Cr, was through share-based payments. The total ESOP cost incurred by Samhi Hotels Ltd. in FY24 was ₹46 Cr. This ESOP cost will come down to ₹18 Cr in FY25.

Related Party Transactions – Samhi Hotels Ltd has an outstanding loan balance of ₹5 Cr to Mr. Ashish Jakhanwala. The loan was given in March 2014 and has since then been extended to March 2024 and, most recently, to March 2029. There is an accrued interest balance of ₹3 Cr against this loan. This is a case of the CEO and MD enjoying special perks from Samhi Hotels Ltd. While not a big concern at this point; it is definitely worth noting

Contingent Liabilities – The total contingent liabilities outstanding for Samhi Hotels Ltd. as of FY24 amounted to ₹28 Cr, primarily pertaining to Income Tax and Service tax-related demands from the Government and certain disputes with third parties. The total contingent liabilities are less than 3% of the book value of equity of Samhi Hotels Ltd. as of FY24 and are thus of not much concern.

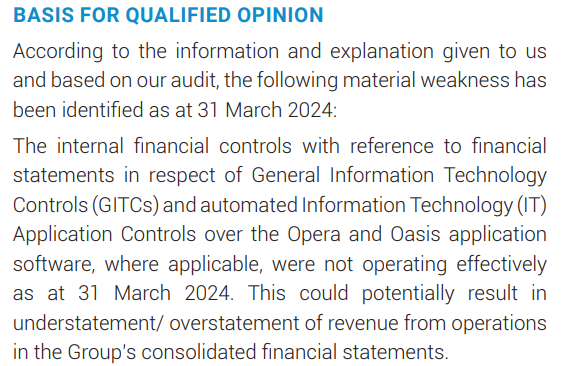

Audit observations – The auditors have provided a qualified opinion with regard to the robustness of internal financial controls at Samhi Hotels Ltd. based on one observation regarding their IT system control over their automated financial statement generation. This seems like a fairly standard IT process that should not go wrong for a company like Samhi Hotels Ltd. We hope Samhi Hotels Ltd rectifies this without delay.

Samhi Hotels Ltd Financial Performance

Samhi Hotels Ltd. went through a tough time during COVID-19 due to weak demand in the hotel industry and burgeoning debt on Samhi Hotels Ltd’s balance sheet. The hotel business is an extremely high fixed-cost business and hence can lead to significant operating deleverage when demand decreases significantly. This can increase balance sheet pressure and cause a rise in debt levels. This is exactly what panned out in Samhi Hotels Ltd. from FY19-FY22, with revenues collapsing and debt and interest costs rising. Starting in FY23, as COVID subsided, the hotel industry demand started recovering. This was reflected in Samhi Hotels Ltd revenues as well, which showed impressive YoY growth of 129% and 29%, respectively, in FY23 and FY24, comfortably surpassing pre-Covid revenue levels

However, even after a recovery in revenues following COVID-19, the PAT, debt-to-equity ratio, and ROCE numbers of Samhi Hotels Ltd might still look scary to the casual observer, even for FY23 and FY24. However, one needs to look deeper into Samhi Hotels Ltd’s business to understand the large amount of operating leverage playing out in the P&L. In fact, Samhi Hotels Ltd has reported positive PAT in the last two quarters, and We believe Samhi Hotels Ltd will continue to report higher PAT numbers in the upcoming quarters.

Samhi Hotels Ltd Comparative Analysis

To understand Samhi Hotels Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Samhi Hotels Ltd to its competitors (peer comparison) on various fundamental parameters and Samhi Hotels Ltd share performance relative to relevant benchmark and sector indices.

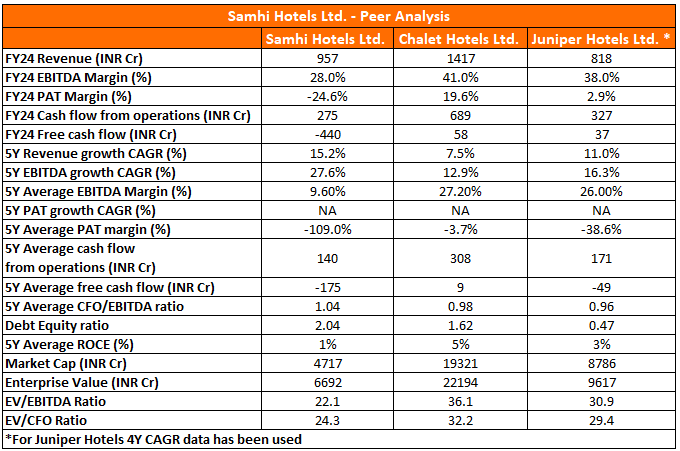

Samhi Hotels Ltd Limited Peer Comparison

The two closest peers for Samhi Hotels Ltd. would be Chalet Hotels Ltd. and Juniper Hotels Ltd. Both companies are hotel asset owners, but unlike Samhi Hotels Ltd which is majorly owned by institutional investors, both are promoter-driven. Chalet Hotels Ltd. is promoted by the K Raheja Group, and Juniper Hotels Ltd. is jointly promoted by Saraf Hotels and Hyatt Hotels

It’s clear to see that Samhi Hotels Ltd, along with its peers, suffered badly during the Covid years. All 3 companies have negative average PAT margins over FY20-24, and two out of three have negative free cash flows from FY20-24. However, Chalet Hotels Ltd has clearly been the strongest performer during this period, with the highest average ROCE and positive free cash flow generation. Samhi Hotels Ltd was the laggard with the lowest average EBITDA and PAT margins during this period due to an inability to reduce its cost base quickly as revenues vanished during Covid and due to burgeoning debt on its balance sheet, which resulted in onerous interest costs on the P&L.

However, we believe looking backward at Samhi Hotels Ltd historical numbers will not serve as an accurate guide for its numbers going forward. The significant deleveraging post-IPO and strong demand momentum for its hotels, including the newly acquired ACIC portfolio, has turned operating deleverage firmly into strong operating leverage for Samhi Hotels Ltd starting from the H2FY24. The full effect will be visible in FY25. FY25 onwards, we firmly believe that Samhi Hotel Ltd’s numbers will be much closer to that of Chalet Hotels Ltd and Juniper Hotels Ltd than in previous years

Samhi Hotels Ltd Index Comparison

Samhi Hotel Ltd share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Samhi Hotels Ltd?

Samhi is an asset owner signed up with premium hotel brands for the long duration – Samhi hotels Ltd. owns and leases 31 hotels in premium locations in Metro and Tier 1 cities of India, such as Bengaluru, Hyderabad, Pune, Chennai and NCR. All its hotels are signed up with globally renowned brands such as Marriott, Hyatt and IHG. All the management contracts with these brands are long duration in nature spanning 15-20 years each. In some cases, Samhi Hotels Ltd. owns a large chunk of such branded hotels operating in India. For example, Samhi Hotels Ltd. owned ~40% of all Fairfield by Marriott and Four Points by Sheraton Hotels in India as of 2023.

Similarly, Samhi Hotels Ltd. owns more than 70% of all Holiday Inn Express hotels operating in India. This provides Samhi Hotels Ltd. leverage with the brands as well. These dynamics provide long-term visibility on earnings for Samhi Hotels Ltd’s portfolio of assets and provide a reasonable amount of certainty to future cash flows.

Management with a proven track record – Mr. Ashish Jakhanwala is a veteran of the Indian hotel industry. His track record of helping establish Accor in India in the 2000s, then raising ~200mn USD as seed capital from illustrious real estate investors like Equity International and GTI Capital to set up an entrepreneurial venture in Samhi Hotels Ltd. and subsequently scaling it to ~5000 rooms within a span of 13 years and getting it listed in the public markets, is immaculate. The senior management team accompanying Ashish are also hotel industry veterans who have been with the company for several years. Their track records do give confidence in their ability to steer Samhi in the right direction in the future.

Clear strategy – Samhi Hotels Ltd has a clear strategy of focusing on owning hotel assets in the business segment in the Metro and Tier 1 cities of India. This is a very focused strategy that rules out expansion in non-Tier 1 cities and the leisure segment. Over its history of 13-14 years, Samhi Hotels Ltd has stuck to its strategy and executed accordingly. We like clear-thinking management teams that know what they want to do exactly and then set about doing things in the best way possible in their chosen strategic domain rather than spreading themselves too thin by trying out multiple strategies and eroding their moats and identities.

Attractive valuations – Thanks to robust demand in the industry, the continuing assimilation of the newly acquired ACIC portfolio, and having deleverage significantly via the IPO, Samhi Hotels Ltd. is now on a clear trajectory towards printing ₹400 Cr+ EBITDA with decent free cash flow generation. At a 1Y forward EV/EBITDA multiple of ~15x, Samhi Hotels Ltd. is significantly undervalued compared to its peers, such as Juniper Hotels Ltd. and Chalet Hotels Ltd., which are trading at 1Y forward EV/EBITDA multiples of 25-28x.

What are the Risks of Investing in Samhi Hotels Ltd?

Samhi Hotels Ltd. does not have an identifiable promoter – Samhi Hotels Ltd. is a professionally managed company with no identifiable promoter. While the founder, Mr. Ashish Jakhanwala, very much continues to be the key man in the company as CEO and MD and also the face of Samhi Hotels Ltd, he owns < 2% stake in Samhi Hotels Ltd. The Indian market tends to prefer promoter-driven companies as minority shareholders feel more comfortable knowing that their interests are aligned with those of the promoter. However, the same alignment of incentives can also be achieved in a professionally managed company like Samhi Hotels Ltd. by linking management payouts to Samhi Hotels Ltd’s performance via instruments such as ESOPs.

Land ownership and title deeds in India can be uncertain – Title deeds and land ownership in India are unfortunately not water-tight and are often prone to claims, counterclaims, and litigation. Samhi Hotels Ltd. has declared several Govt and 3rd party claims on parts of its title deeds in the draft red herring prospectus. These are unlikely to materialise, as highlighted by Samhi Hotels Ltd., but are risks to be aware of nonetheless. One such risk did materialise for Samhi Hotels Ltd. in Q4 FY24 when MIDC refused to grant an extension on a piece of land in Navi Mumbai, which the Samhi Hotels Ltd had acquired as part of the ACIC portfolio acquisition in 2023, citing a delay in development by the previous party, i.e., ACIC. The company appealed against MIDC’s decision in the Bombay High Court but had to take an ₹70 Cr write-off in the P&L in the meantime.

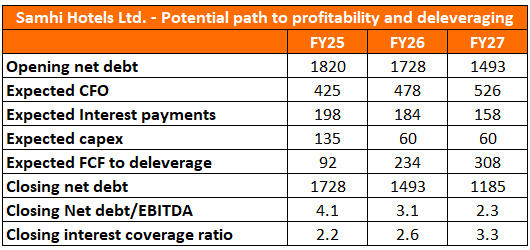

Samhi Hotels Ltd. still has relatively modest debt coverage metrics – While the debt coverage metrics of Samhi Hotels Ltd. have improved by leaps and bounds since the IPO, as per the latest quarterly results (Q1 FY25), Samhi Hotels Ltd. has an interest coverage ratio of 1.5x and a net-debt-to-equity ratio of 1.8x. These ratios aren’t suggestive of a company that is completely out of the woods yet. However, the trajectory is expected to keep improving over FY25 and FY26. By the end of FY26, we expect Samhi Hotels Ltd. to report an interest coverage ratio of 3x+ and a net debt-to-equity ratio of ~1.1x.

The hotel industry is cyclical – The hotel industry is a very fixed, cost-intensive industry that is prone to very high degrees of operating leverage in a robust demand environment and very high degrees of operating deleverage in a weak demand environment. While demand in the medium term is expected to remain robust by all accounts, it is worthwhile to be aware of the deeply cyclical nature of the industry itself. An unforeseen event like COVID-19 can once again wreak havoc on hotel cash flows and balance sheets. However, Covid was a once-in-a-century event, and one hopes that the hotel industry will have a relatively smooth sailing period for a few years now.

Possible near-term selling pressure from institutions – The post-IPO 18-month lock-in period for institutional shareholders will be over in March 2025. So we may see some near term profit booking by institutions around then, depending on the stock price at that time. However, if valuations remain comfortable, that should not be a cause for concern.

Samhi Hotels Ltd Future Outlook

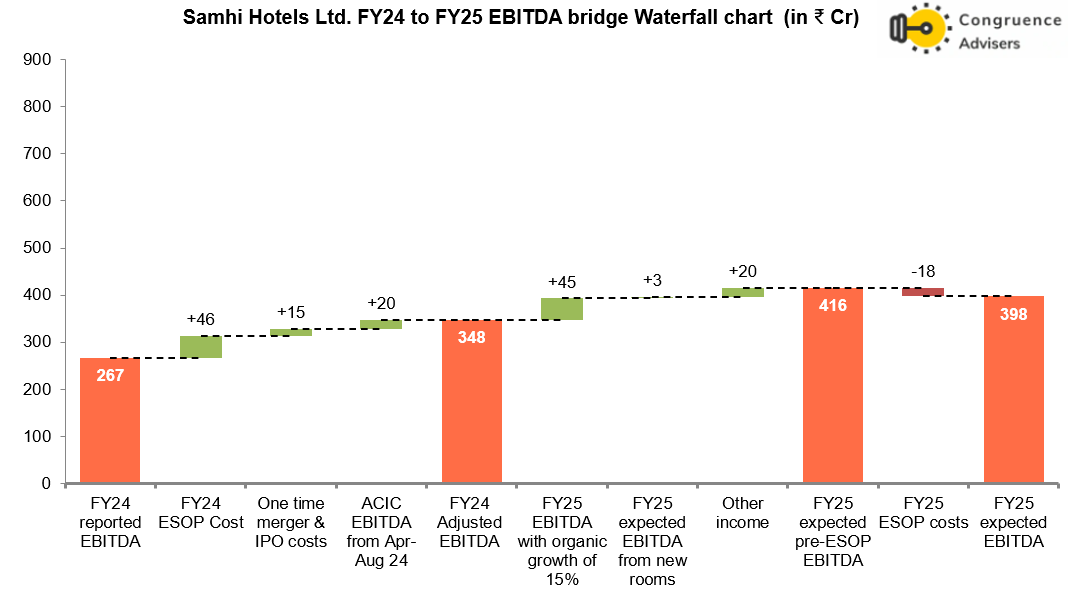

There is significant operating leverage at play for Samhi Hotels Ltd in FY25, and Samhi Hotels Ltd could potentially report an EBITDA of ₹ 400Cr+ in FY25. Let us try to decipher the bridge to ₹400 Cr+ EBITDA in FY25 from the reported EBITDA of ₹267 Cr in FY24:

- FY24 adjusted EBITDA

- reported EBITDA was ₹ 267 Cr

- There was an IPO related ESOP cost of ₹46 Cr in FY24 and one time merger and IPO related expenses of ₹15 Cr in FY24. Adjusting for these, EBITDA in FY24 was ₹328 Cr

- The ACIC portfolio was not consolidated in Samhi Hotels Ltd financials between Apr-Aug FY24. Adding the ₹20Cr EBITDA from the ACIC portfolio for that period, the adjusted EBITDA for FY24 was ₹348 Cr

- Growth in FY25

- We can expect an organic EBITDA growth of 12-15% in FY25. On an adjusted EBITDA base of ₹348 Cr for FY24, assuming a 13% organic EBITDA growth, the FY25 pre-ESOP EBITDA could be ₹393 Cr.

- In addition, in H2 FY25, Samhi Hotels Ltd. is launching 160 new rooms and renovating a hotel in the midscale segment. This can lead to an incremental revenue of INR 10 Cr and an incremental EBITDA of INR 3 Cr. Taking this into account, the FY25 pre-ESOP EBITDA could be ₹396 Cr.

- We can expect an organic EBITDA growth of 12-15% in FY25. On an adjusted EBITDA base of ₹348 Cr for FY24, assuming a 13% organic EBITDA growth, the FY25 pre-ESOP EBITDA could be ₹393 Cr.

- Other income and ESOP costs

- Going by Q1 FY25 numbers, Samhi Hotels Ltd could report ₹20 Cr other income in FY25. ESOP costs are going to be ₹18 Cr in FY25. Accounting for other income and ESOP costs, the post-ESOP EBITDA for FY25 for Samhi Hotels Ltd. could be ₹398 Cr

The interest cost for FY25 should be ₹190 Cr and depreciation around ₹120Cr. Therefore, PBT for FY25 could be in the range of ₹90 Cr. Since Samhi Hotels Ltd has a lot of accumulated losses over the years, they will likely not be paying taxes for a while. So, in FY25, one can expect a PAT of ₹90Cr.

Samhi Hotels Ltd has a good track record of converting EBITDA to operating cash flows. Therefore, one can expect close to ₹400Cr of operating cash flows in FY25. Accounting for ₹190 Cr of interest payments and ₹130 Cr of capex spend in FY25, that should leave about ₹90 Cr of free cash flows for deleveraging. For the next few years, Samhi Hotels Ltd. can keep generating free cash flows to pay down debt every year. Samhi Hotels Ltd also has an option of raising equity via a rights issue or a Qualified Institutional Placement and paying down a larger chunk of debt upfront.

Samhi Hotels Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Samhi Hotels Ltd Limited Price Charts

Samhi Hotels Ltd. was listed in late Sep, 2023, so we only have 1 year’s worth of price action to analyse on the charts. The story of Samhi Hotels Ltd stock price since listing seems to be that of two parallel inclined channels so far – the first one an upward incline from the listing date to Feb, 2024 and the second a downward channel from the top in March, 2024 to the bottom in Aug, 2024.

In the first phase since listing, Samhi Hotels Ltd stock went steadily up all the way from 130 levels at listing to 230 levels in late Feb, 2024 in a span of about 5 months. Then Samhi Hotels Ltd stock started correcting due to institutional selling pressure and went down in a channel from 230 levels all the way down to 165-170 levels from March, 2024 to Aug, 2024 in a span of another 5 months. During Q4, FII holdings reduced by 6% as Goldman Sachs exited their long held position to book profits. This stake sale was mostly absorbed by retail and the price was unable to withstand the selling pressure.

Samhi Hotels Ltd Q1 FY25 results were quite strong and set the stage for an ₹400 Cr+ EBITDA for the full year. Given the lack of a long term technical trend to rely on, we believe that the decision should be driven off fundamental numbers from here. We would watch whether the 50 DMA of ~198 holds on days of small cap correction.

Samhi Hotels Ltd Latest Latest Result, News and Updates

Samhi Hotels Ltd Quarterly Results

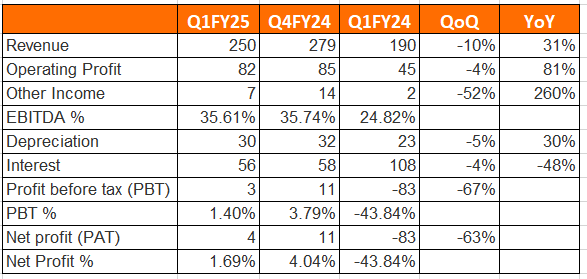

Samhi Hotels Ltd. reported robust Q1 FY25 numbers, with sales growing 31% YoY and EBITDA growing 81% YoY. Of course, a large part of the strong growth came because the year-ago quarter did not have the ACIC portfolio numbers, as ACIC was not consolidated with the company in Q1 FY24. However, even on a same-store basis, Samhi Hotels Ltd. reported industry-leading RevPar growth in Q1 FY25 at 13%. In general, Q1 FY25 was a weakish quarter for the hotel industry due to the general elections happening across the country and the heat wave in the Northern part of the country.

Final thoughts on Samhi Hotels Ltd

Investors need to be very careful when investing in asset heavy plays like hospitals and hotels. These sectors are driven by long term cycles where a bull run sets the stage for the upcoming bear run. At the bottom of the cycle, the industry sees low capacity addition as existing players are saddled by debt and need 3-4 years of operating cash flows to make the unit economics look better. Once a demand uptake materialises, one sees operating leverage and financial leverage play out in unison as the accounting numbers get far better. In the hotels industry one will notice that as demand improves, utilisation increases that spikes RevPAR and ARR and results in operating cash flows improving drastically. As the better operating cash flows are used to pare down debt that improves balance sheet quality and capital efficiency metrics. Closer to the peak of the cycle as utilisation starts crossing 75%, many new projects are announced at the same time that upsets the demand-supply equation for the next few years.

Given where we are on the hotel cycle (5-6 quarters of good results have already been announced by leading players), it would not be prudent to assume that the good times will continue for a long period of time. At the same time, we believe that Samhi Hotels Ltd has presence in the best cities of India in terms of the balance across commercial real estate space absorption and air traffic. Hence we aren’t worried about the possibility of a cycle peak coming in the near future, especially for a more durable segment like business travel which is not as cyclical as luxury tourist travel. At the same time, we believe that the attractive numbers and stock price returns of the leading listed hotel players means that investors are forced to look lower in the hierarchy to find mispriced bets. In our assessment Samhi Hotels Ltd presents an interesting prospect in this context – if operating cash flows can improve as expected and help shore up the balance sheet as expected, one can expect a significant rerating in this story.

On the risk front there is always the possibility that we are investing into a small cap, asset heavy player after a 12 months+ bull run in the Indian market. When bull markets take a breather or end, what looks cheap can get much cheaper even if the operating numbers get better. Good fundamentals cannot withstand the deluge of liquidity leaving the small cap segment in India, as many of us have experienced in 2018-19. Companies would print 20% higher PAT only for the rally to fizzle out in weeks and a fresh round of downrating to take place.

If one is looking to add exposure to the hotel sector where most of the well known stories are already priced in, looking at Samhi Hotels Ltd would offer a decent risk reward ratio in the current context. Investors should take a deep look at their overall asset allocation, equity portfolio mix and then decide if investing into an asset heavy small cap hotel play is the right move in the current context where large caps are finally showing the first signs of outperformance over small caps in more than a year.

Please research well and choose wisely.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.

Disclosure (Updated as of Sep 30, 2024) – No position in the stock in personal portfolio