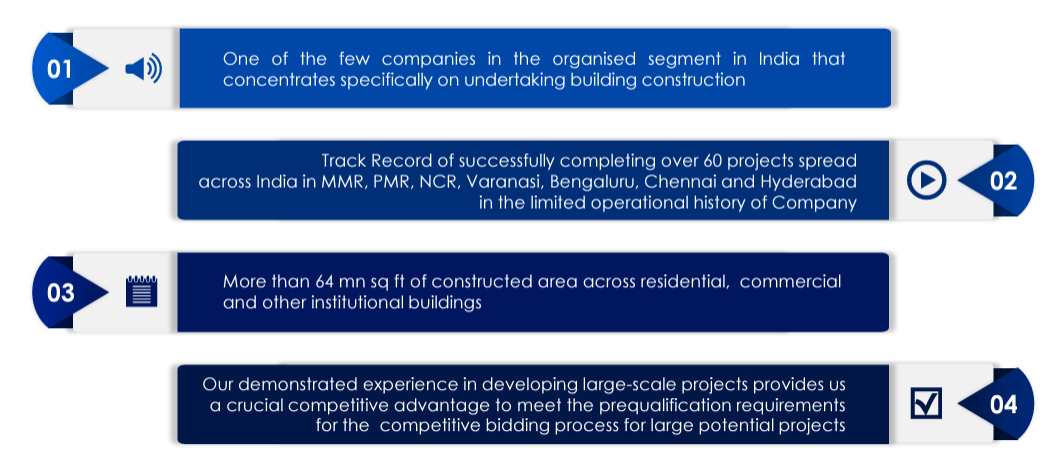

Capacite Infraprojects Ltd. headquartered in Mumbai operates as a prominent player in the construction industry. It is a focused EPC company that provides an end-to-end construction service for building and factories across residential buildings, commercial buildings, data centres and buildings for educational, hospitality and healthcare. Capacite Infraprojects Ltd has successfully delivered 60+ projects across segments within the limited operational history of 12 years and holds Limca Book of Record for fastest hospital construction.

Capacite Infraprojects Ltd. offers an attractive investment opportunity due to its large order book (order book to sales > 4x), relatively large avg order size, strong management guidance of 25% growth for FY25 and FY26. This is supported by recent capital raises and favourable industry tailwinds in real estate cycle and government focus towards infrastructure including affordable housing. However, one should be mindful of risks related to geographical concentration and increasing working capital needs.

Capacite Infraprojects Ltd Company Overview

Capacite Infraprojects Ltd. is a micro-cap EPC construction company based out of Mumbai. Capacite Infraprojects Ltd. was listed on the Indian markets in Sep 2017. Capacite Infraprojects Ltd. is an EPC (Engineering, Procurement, Construction) contractor that provides end-to-end construction services for residential, commercial, and institutional buildings. It specialises in employing modern construction techniques and equipment to construct high-rise and super-high-rise buildings.

Capacite Infraprojects Ltd. was incorporated in Feb 2012 as a private limited company. As construction companies go, Capacite Infraprojects Ltd. is quite a young company. It was subsequently converted to a public limited company in March 2014 and was listed in the Indian markets in Sep 2017. The company was founded by Mr. Rahul Katyal and Mr. Subir Malhotra. Mr. Rahul Katyal’s brother, Mr. Rohit Katyal, joined the business in 2014.

Prior to starting Capacite Infraprojects Ltd., the promoters (Mr Rohit Katyal and Mr Rahul Katyal) were employed with Pratibha Industries Ltd in senior management positions. The Katyal brothers are relatives of the erstwhile promoter and Chairperson of Pratibha Industries Ltd., Ms Usha Kulkarni (as per Pratibha Industries Annual Report of 2007-08). ) Pratibha Industries Ltd. was once a prominent player in India’s construction and infrastructure sector. However, in an attempt to grow aggressively, Pratibha Industries Ltd. became excessively debt-laden and had to be liquidated in 2019 following insolvency proceedings initiated in 2017. The promoters of Capacite Infraprojects Ltd. quit Pratibha Industries Ltd. a few years before the liquidation in 2012 to start Capacite Infraprojects Ltd.

PE funds such as Paragon Partners (promoted by Mr Siddharth Parekh, son of erstwhile Chairman of HDFC Bank Ltd., Mr Deepak Parekh) and Hong Kong-based NewQuest Asia invested in excess of ₹ 60 Cr in the company in 2015 (CCPS issued in 2015 and converted to equity in 2017 before the IPO).

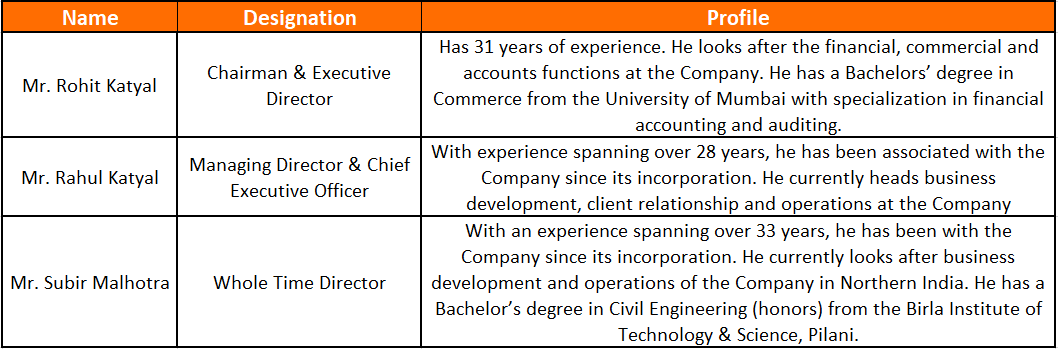

Capacite Infraprojects Ltd Management Details

Capacite Infraprojects Ltd. is actively managed and driven by the 3 promoters – Mr. Rohit Katyal, Mr. Rahul Katyal and Mr. Subir Malhotra. Mr. Rohit Katyal is the chairman and executive director of the company, Mr. Rahul Katyal is the managing director and CEO, and Mr. Subir Malhotra is the Whole-time director of the company. Capacite Infraprojects Ltd also has a team of professionals and skilled workers who are dedicated to execute high-rise and super-high-rise projects.

Capacite Infraprojects Ltd – Industry Overview

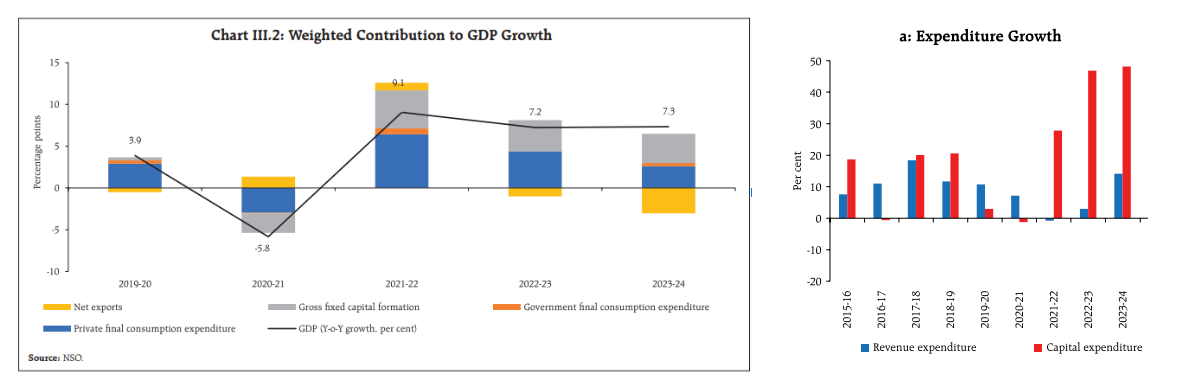

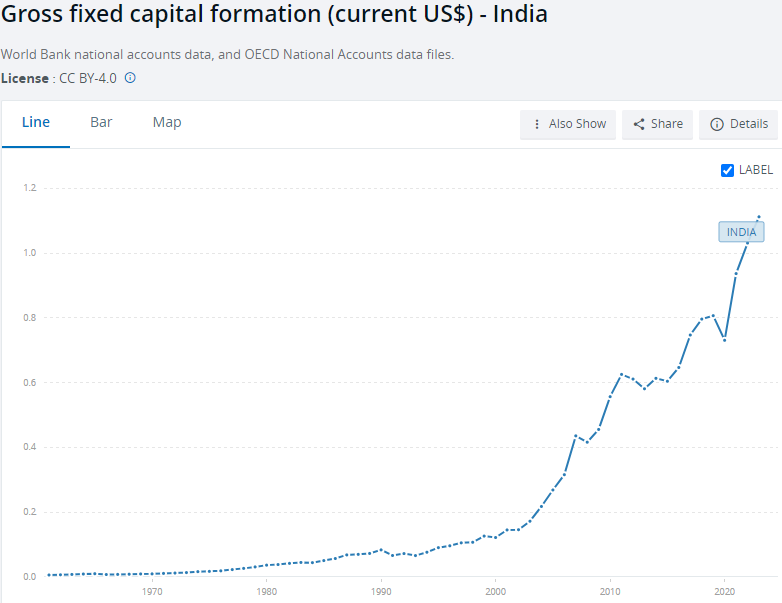

The Indian economy has been in a gross fixed capital formation (GFCF) addition mode since 2020. Total GFCF has been on an increasing trend for the last 4 years since bottoming out in 2020 at 29%. It reached 34% in FY23 and is expected to keep trending at similar or higher levels for some years to come. Gross Fixed Capital Formation (GFCF) represents the net increase in physical assets within an economy during a given period. It includes investments in fixed assets like buildings, machinery, infrastructure and equipment. GFCF as a % of GDP reflects the amount of physical investment in an economy. GFCF is considered to be a critical determinant of the future economic growth of a country as it creates more capacity for GDP growth and increases productivity. Most of this increase in GFCF has been driven by Government investment in capex. The Indian Central Govt’s capex has increased from ₹ 1.97 trillion in 2014 (1.6% of GDP) to a whopping ₹ 11.1 trillion in 2024 (3.4% of GDP).

Source: RBI Monthly Bulletin

Source: World Bank data

This emphasis on capex and infrastructure creation by the Government has given confidence to private enterprises, which have started to show the first signs of following through via their own capital investments. From Capacite Infraprojects Ltd.’s perspective, the following sectors are relevant – residential real estate, commercial real estate, the hospitality industry, data centres and healthcare. Let’s take a brief look at what’s happening across these sectors in terms of demand and capital expenditure

Residential real estate sector

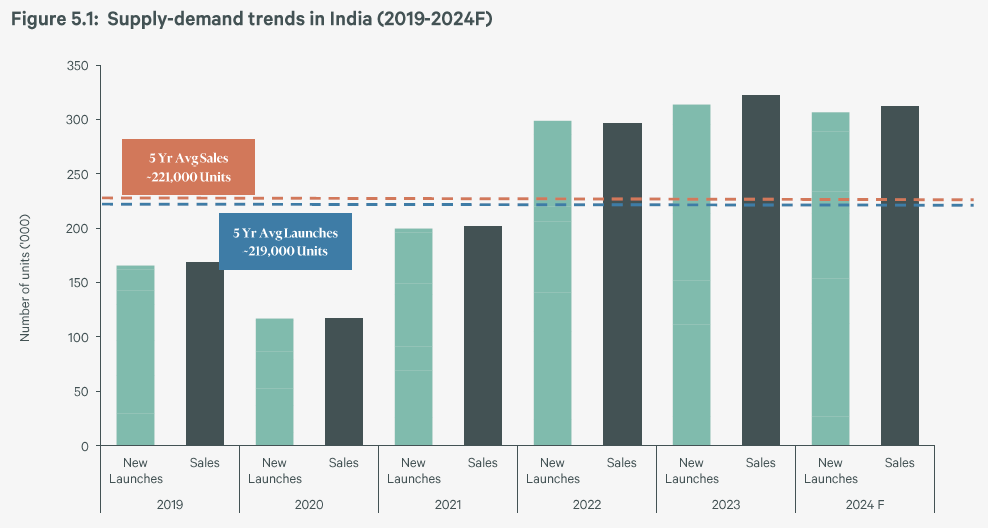

The residential real estate sector has seen a very strong demand bounceback since COVID-19. 2023 was a milestone year for the industry, with residential real estate unit sales exceeding the 3 Lakh mark for the first time in a decade. Major bank credit disbursal towards housing loans showed an annual growth of 37% in 2023. Development momentum also picked up to keep pace with the demand, with developers launching 3 Lakh + units in 2023. Growth in the premium and luxury real estate segment has been especially astounding, with a 75% YoY growth in sales of such units. Increased investment activity by NRIs and HNIs drove the outstanding demand in this segment of the market as these investors sought to diversify their portfolios out of equity.

The market is expected to maintain the growth momentum in 2024 led by increasing household incomes, a strong economy and higher propensity for home ownership. However, due to increased land price appreciation, it will become increasingly challenging for developers to buy fresh land parcels at reasonable rates for future development.

[Source: CBRE 2024 India Market Outlook]

Complimenting the growth in the private residential real estate sector, the Government has also placed increasing importance on promoting homeownership for the poor. In the 2024 budget, the Govt announced its commitment to address the housing needs of 1 Cr urban poor and middle-class families. A total outlay of ₹ 30100 Cr has been made in the 2024 budget towards the Pradhan Mantri Awas Yojana – Urban (PMAY-U). This amounts to 36.5% of the total budget allocated to the Ministry of Housing and Urban Affairs. Since its inception, the PMAY scheme has enabled the construction of 4.2 Cr houses across rural and urban India.

Commercial real estate sector

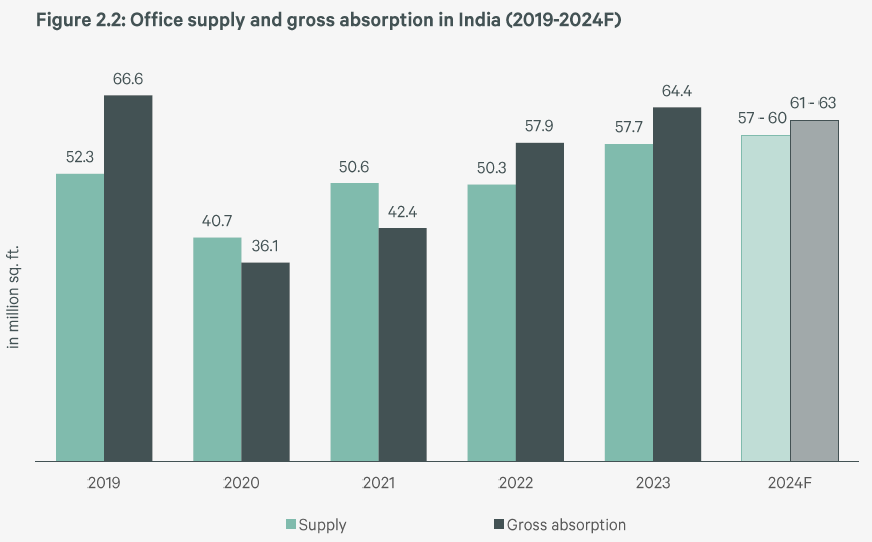

Total gross absorption of office space in 2023 was 64.4 million sq ft and 11% growth YoY. This marked the 2nd highest leasing activity ever, following the 66.6 million sq ft released in 2019. Bangalore, Delhi-NCR, Hyderabad and Chennai accounted for 75% of this absorption. Development completions increased by 15% YoY to reach 57.7 million sq ft. Most markets experienced rental growth in the range of 1%-13% YoY, led by higher demand. Return-to-office was a key driver of increased commercial space occupancy and absorption. Demand is likely to remain strong in 2024.

[Source: CBRE 2024 India Market Outlook]

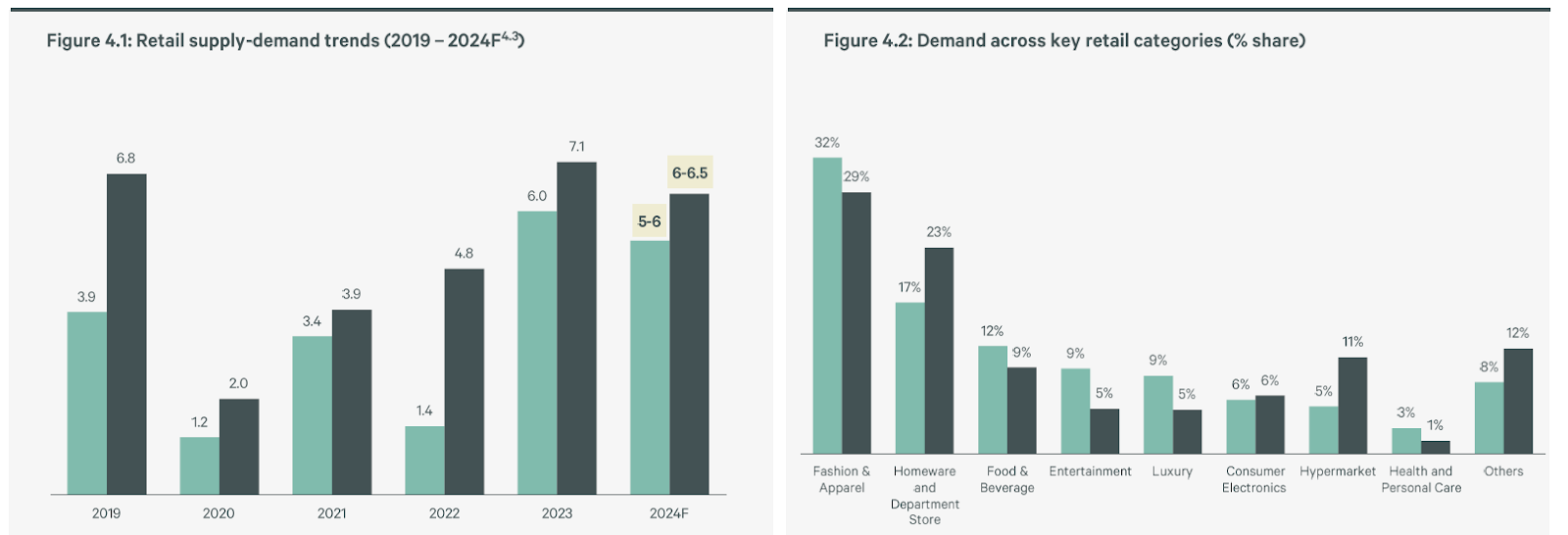

Retail sector

2023 was a very good year for the retail real estate segment. 2023 reported a space absorption of 7.1 million sq ft and a growth of 47% YoY in Tier 1 cities. Bangalore, Delhi-NCR, and Mumbai accounted for 61% of this retail space absorption. Supply also increased 3X YoY, with 13 malls totalling around 6 million sq ft becoming operational. Tier 2 markets also saw a total retail space absorption of 1.2 million sq ft, led by cities like Kochi and Indore.

[Source: CBRE 2024 India Market Outlook]

The demand outlook for 2024 remains slightly cautious as pent-up COVID demand subsidies and inflation start to bite consumers’ savings.

Other sectors

Data centres, hospitality and healthcare are other key sectors in the real estate landscape.

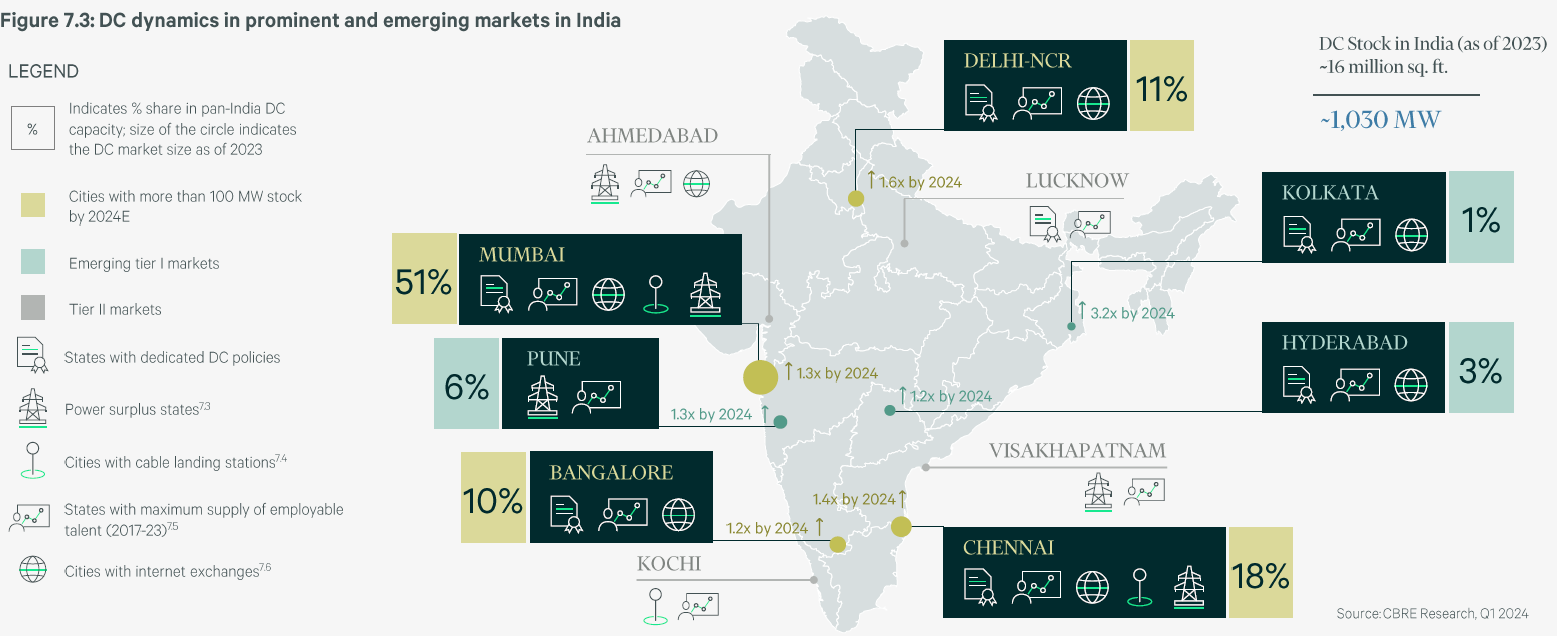

Data centre capacity addition in 2023 was around 255 MW, a growth of 28% YoY. Capacity addition in 2024 is expected to be 330 MW, taking the total supply stock to 1370 MW by the end of 2024. Mumbai leads the data centre market with a 50% share of stock, followed by Chennai with 18%.

[Source: CBRE 2024 India Market Outlook]

Following a severe slump during COVID-19, the hospitality sector has seen a strong revival starting in 2022. This is evident from increasing occupancy levels and average daily rates.

[Source: CBRE 2024 India Market Outlook]

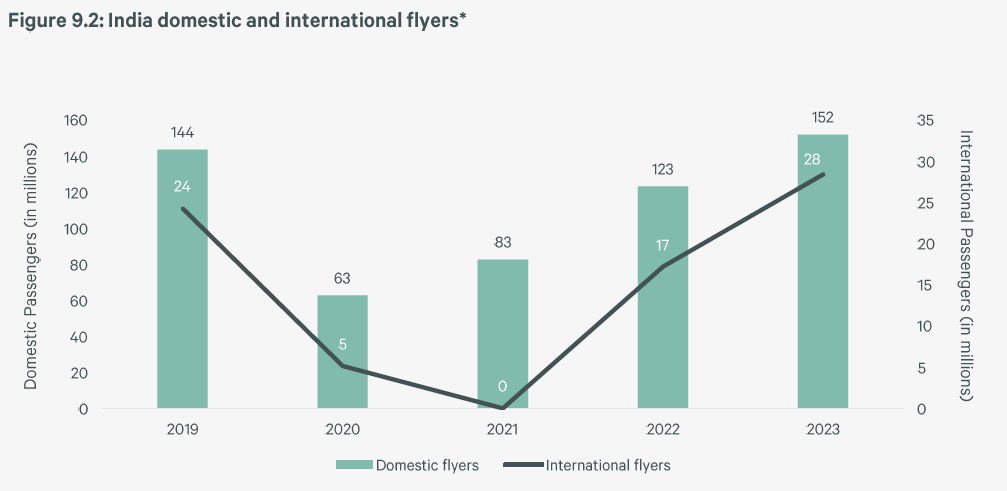

Domestic and international flyers also inched above pre-COVID levels in 2023, signalling a revival in office travel and leisure travel demand.

[Source: CBRE 2024 India Market Outlook]

India’s hospital beds per 1000 population are at 1.4 against a global average of 3.2, resulting in a gap of 2.9 million hospital beds to be bridged by 2030. This gap should create enough incentives for the Government and the private sector to speed up investments in hospitality.

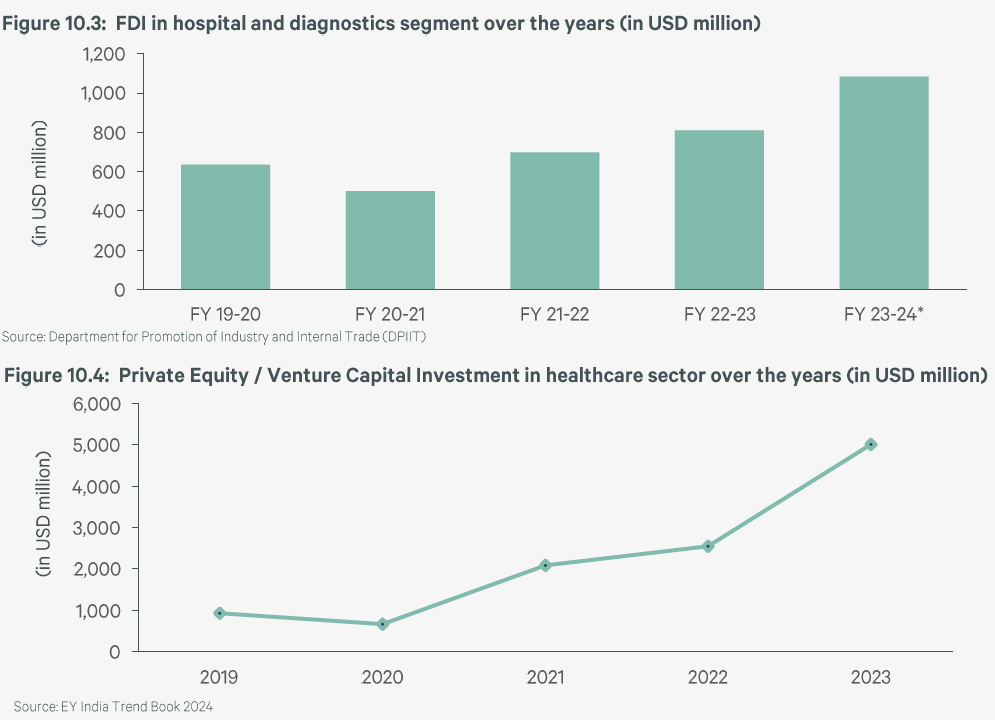

FDI and PE/VC investments in healthcare have picked up significantly in 2023

[Source: CBRE 2024 India Market Outlook]

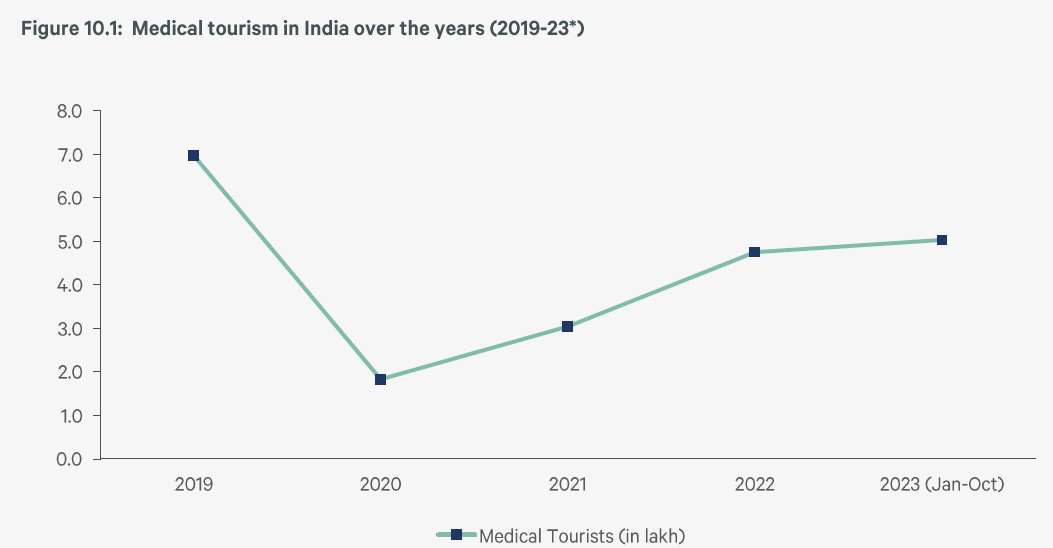

India is a leading centre for global medical tourism. After a blip during COVID-19, India’s international medical tourist numbers are expected to surpass pre-pandemic levels in 2024.

[Source: CBRE 2024 India Market Outlook]

Capacite Infraprojects Ltd – Business Details

Capacite Infraprojects Ltd. is one of the leading EPC contractors in India, and it constructs residential, commercial, and institutional buildings. In addition to constructing the building shell, Capacite Infraprojects Ltd also provides mechanical, electrical, and plumbing services (MEP) and finishing work. Capacite Infraprojects Ltd. is headquartered in Mumbai and has most of its projects concentrated in Mumbai and the Maharashtra region. Capacite Infraprojects Ltd specialises in high-rise residential buildings (buildings with 7+ floors) and super high-rise residential buildings (buildings with 40+ floors). In addition to residential buildings, Capacite Infraprojects Ltd. also constructs commercial buildings such as data centres, hospitals, hospitality buildings and educational buildings.

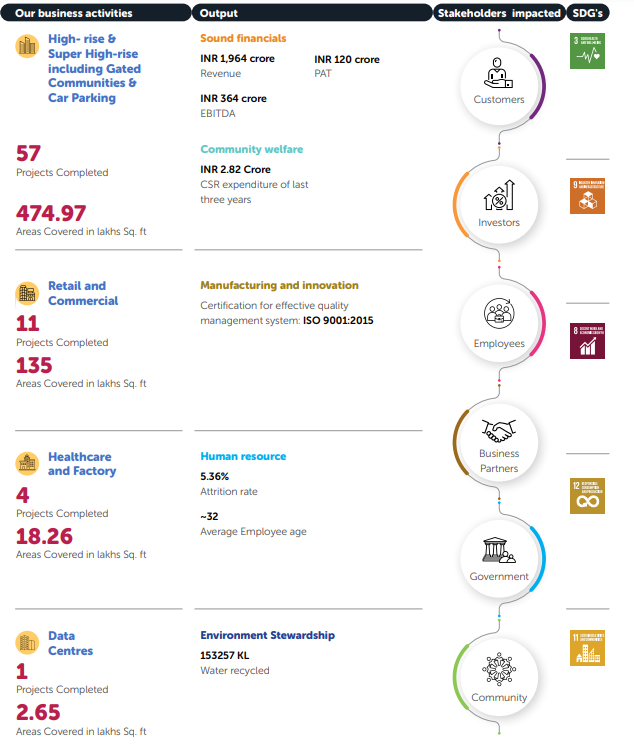

Capacite Infraprojects Ltd Investor Presentation

Capacite Infraprojects Ltd Investor Presentation

Capacite Infraprojects Ltd counts major organisations in the public and private sectors as its clients, as shown in the image below.

Till date, Capacite Infraprojects Ltd has completed over 70+ major projects across the Mumbai Metropolitan region, the Delhi NCR region, Pune Metropolitan region, Bangalore, Chennai and Hyderabad. Capacite Infraprojects Ltd has completed the construction of more than 64 million sqft of residential, commercial, and institutional buildings. The bulk of Capacite Infraprojects Ltd.’s projects have been high-rise and super high-rise residential projects, followed by retail and commercial projects. Healthcare and data centres are relatively new sectors for Capacite Infraprojects Ltd.

Status of the business as of FY24

As of FY24 Capacite Infraprojects Ltd has revenues of ₹ 1964 Cr, EBITDA of ₹ 364 Cr and a PAT of ₹ 124 Cr with a PAT margin of 6.1%.

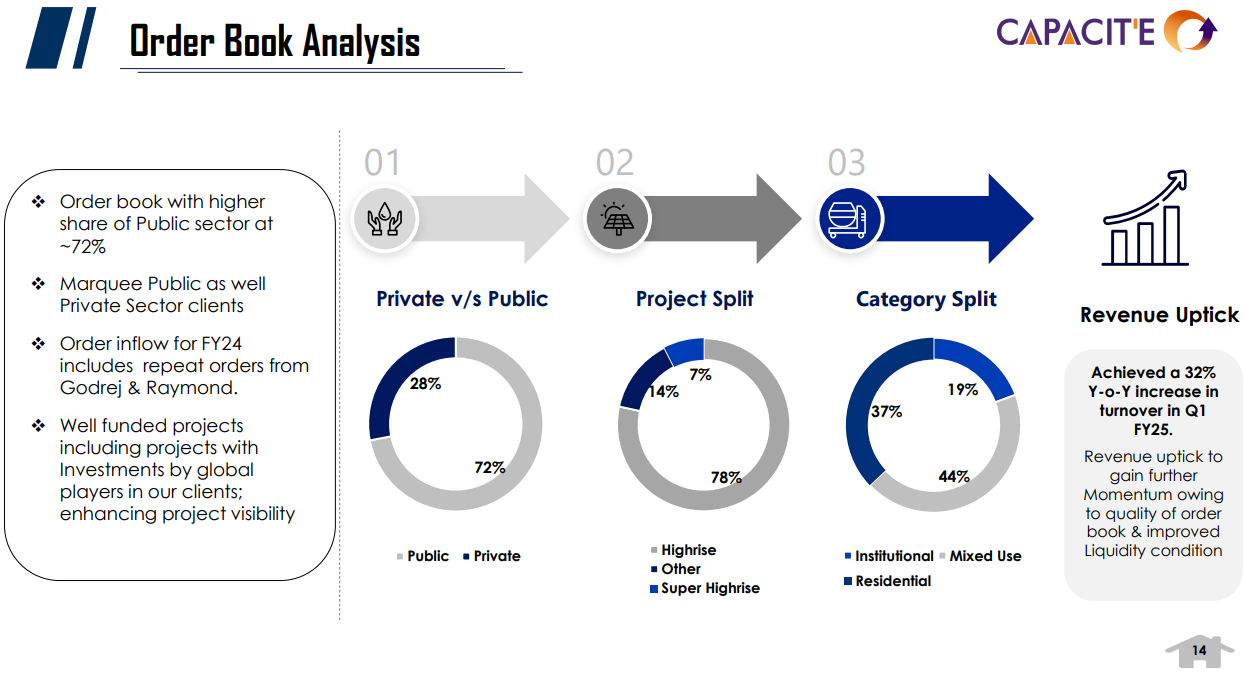

As of Q1 FY25, Capacite Infraprojects Ltd has an order book of ₹ 9011 Cr with an order book-to-sales ratio of 4.7x. The order book is spread across 24 projects. Over the last few years, the number of projects under execution has reduced as larger orders have flown into the order book. Less number of larger orders is always good for an EPC company as it helps reduce fixed costs, and management is able to monitor each project better, ensuring faster and more optimised execution. The order intake in FY24 was worth ₹ 2009 Cr. Capacite Infraprojects Ltd had intentionally slowed down new order booking in FY24 as it already had its hands full with existing orders.

The current order book consists of 72% public sector orders and 28% private sector orders. 78% of the order book consists of high-rise buildings, 7% super-high-rise buildings, and 14% others. 37% of the order book is residential, 44% is mixed-use, and 19% is institutional.

This is in stark contrast to pre-COVID when 80%+ of the order book consisted of private sector orders and less than 20% of the order book consisted of public sector orders. Things changed significantly in FY19 and FY20 when various arms of the Maharashtra State Government awarded two large public sector orders to Capacite Infraprojects Ltd.

MHADA BDD Chawls Project and CIDCO Navi Mumbai Project

In June 2018, Capacite Infraprojects Ltd., as part of a consortium with Tata Projects Ltd. and CITIC Construction, emerged as the winner of the bid to redevelop the BDD Chawls in Worli. The project was awarded by MHADA (Maharashtra Housing and Area Development Authority) to construct 33 high-rise buildings, each consisting of 40 floors, to house 9000+ underprivileged tenants in the Worli area. The total project award value was ₹ 11744 Cr, of which Capacite Infraprojects Ltd.’s share was 37% (₹ 4357 Cr). While the project was awarded in FY19, construction did not start before Q4FY22 due to a major design change in the project. As of Q1 FY25, Capacite Infraprojects Ltd has executed about ₹500 Cr out of its share of ₹4357 Cr. The project is expected to pick up pace in FY25, with Capacite Infraprojects Ltd expecting to clock ₹350 Cr revenues from the project in FY25 and ₹550 Cr+ revenues in FY26.

Proposed podium view after BDD Chawl, Worli redevelopment is completed

In Sep 2019, Capacite Infraprojects Ltd. received an order from the City and Industrial Development Corporation (CIDCO) worth ₹ 4502 Cr for the development of 21000+ dwelling units along with the development of commercial areas and onsite infrastructure works in Navi Mumbai. The project is spread across 7 locations in Navi Mumbai, and execution is happening in phases. While the original intention was to execute the project in 3 years, there have been significant delays due to Covid. As of FY24 end, about ₹ 1300 Cr worth of execution had been done, with ₹ 3200 Cr still pending. Capacite Infraprojects Ltd. hopes to execute ₹ 600-700 Cr revenues in this project in FY25.

Impact of public sector projects on P&L and balance sheet

The pivot of Capacite Infraprojects Ltd. from having < 20% public sector orders pre-COVID to 70%+ public sector orders post-COVID has had a significant impact on the company’s P&L, balance sheet and return ratios. There are two key differences between public-sector projects and private-sector projects from the point of view of a building contractor.

Higher margins in public sector orders – Private sector orders usually require the design and engineering plan to be formulated by the client, and the contractor is only required to execute the shell and core of the building as per the formulated designs. MEP (Mechanical, Electrical, Plumbing) works are often out of scope in private projects for a contractor like Capacite Infraprojects Ltd. In contrast, public sector projects have a complete EPC scope, and Capacite Infraprojects Ltd is in charge of formulating the design and engineering plan for the building. This enables Capacite Infraprojects Ltd to optimise the design and, hence, the construction plan to enable the highest construction efficiency while delivering as per the requirements of the client. This flexibility enables Capacite Infraprojects Ltd. to earn up to 200 bps higher EBITDA in public sector projects. In addition, public sector projects include MEP works also in the scope, which have higher margins for a contractor.

Higher working capital requirement in public sector orders – While public sector orders offer a higher margin, they also place higher demands on EPC contractors like Capacite Infraprojects Ltd. with respect to working capital requirements, especially in terms of receivables, retention money and performance bank guarantees. Public sector projects usually have payment terms of 45-60 days after bill submission and certification. Bill submission and certification itself takes 45-60 days from construction, as bills are raised at certain intervals or as per agreed milestones. This results in a total receivables cycle of > 100 days in public sector projects. This cycle is shorter in the case of private-sector projects. In addition, public sector projects have onerous requirements of furnishing retention money or performance bank guarantees until project completion as well as completion of the defect liability period. The retention amount usually varies between 5-10% of the project value. The defect liability period can vary between 12 months to even 72 months post-project completion. Retention money or bank guarantee margins provided by the EPC contractor are stuck for this duration post-project completion, increasing the working capital burden.

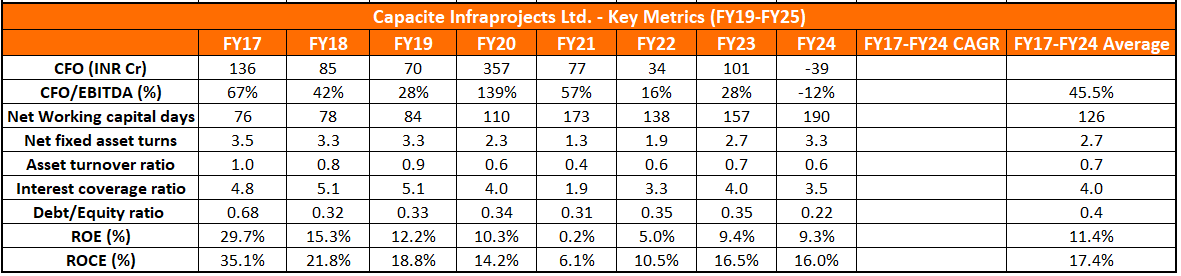

This is starkly visible in the net working capital cycle of Capacite Infraprojects Ltd. over the years. The net working capital cycle of Capacite Infraprojects Ltd has deteriorated significantly since the uptick in public sector project execution post-COVID. Net working capital as a % of revenue used to be < 25% pre-Covid. It has now more than doubled to 52% in FY24.

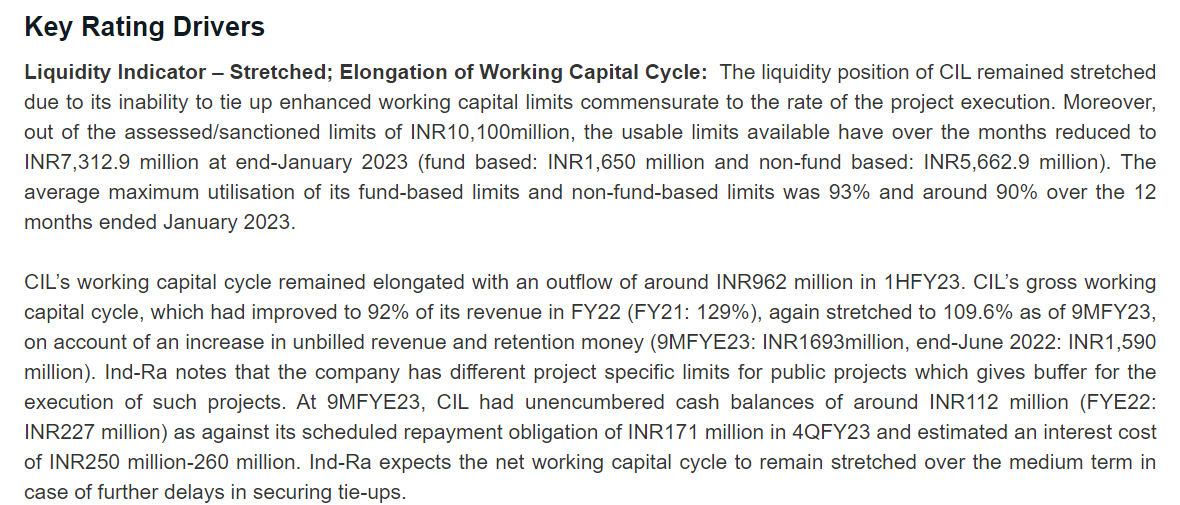

This sharp rise in working capital requirements has placed significant stress on Capacite Infraprojects Ltd.’s credit ratings, which got downgraded from BBB+ to BB+ in Feb 2023 due to Capacite Infraprojects Ltd’s inability to tie up enough banking limits to serve the increased working capital. Since FY23, Capacite Infraprojects Ltd has taken steps to shore up its capital base by raising ₹ 330 Cr+ equity from secondary markets and promoters via QIPs and warrant issuances. It has also tied up banking limits worth ₹ 350 Cr in FY24. In addition, it is making efforts to bring down debtor days in the current projects and to expedite the recovery of stuck receivables from older projects. These steps should be adequate to meet the Capacite Infraprojects Ltd working capital needs for the next 2 years.

Accounting quirk

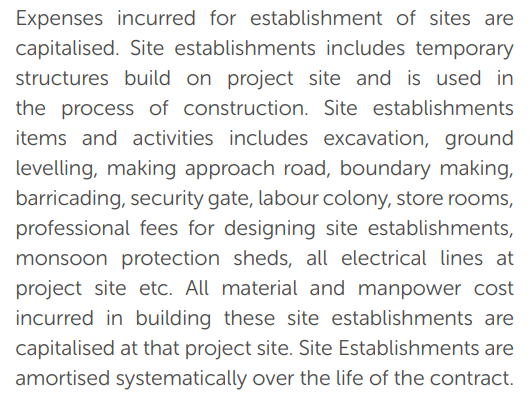

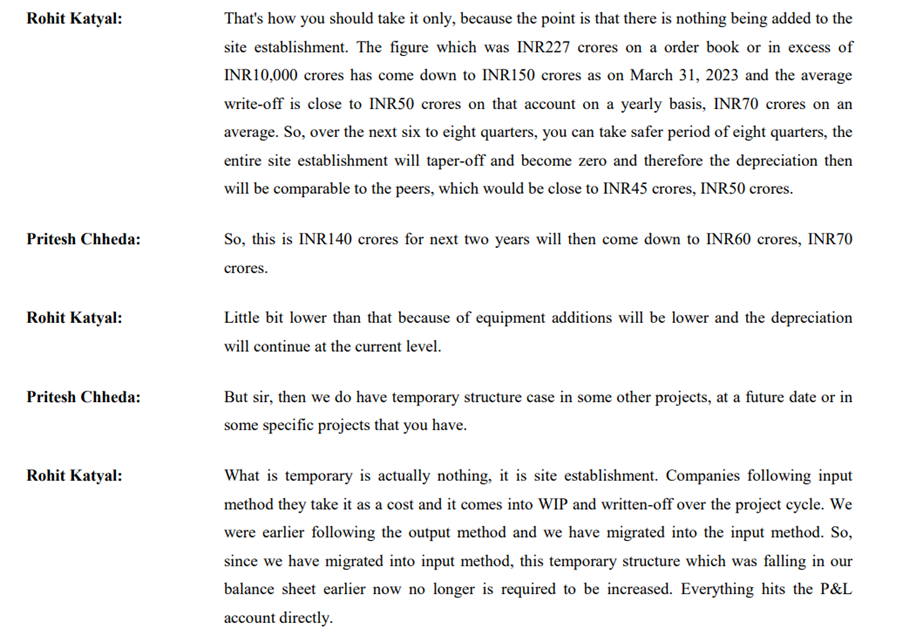

Capacite Infraprojects Ltd. used to have an accounting quirk till FY23, which was non-standard in comparison to the accounting standards adopted by other peers in the construction industry. Capacite Infraprojects Ltd. used to capitalise certain project site establishment-related expenses under the head “Site establishment”. Site establishment expenses such as excavation, ground levelling, making approach roads, boundary construction, labour hutment construction, professional fees for site establishment design and electrical installations on-site, etc., were all capitalised and amortised over the life of the respective projects. Other EPC companies, such as Ahluwalia Contracts India Ltd. or ITD Cementation Ltd., did not capitalise on such expenses but booked them directly in the P&L as costs.

This variation in accounting treatment increased Capacite Infrastructure Ltd.’s EBITDA margins to the extent of the site establishment costs and caused fixed assets in the balance sheet to balloon up. This accounting treatment helps partially explain why Capacite Infraprojects Ltd has higher EBITDA margins and lower asset turnover ratios than its peers.

However, this policy has been modified as of FY23, with Capacite Infraprojects Ltd no longer capitalising on site establishment expenses. As a result, the balance sheet item titled “Site Establishment” under Fixed Assets has come down from ₹ 214 Cr in FY22 to ₹ 116 Cr in FY24 and is expected to taper off to zero in the next 2 Financial years.

Capacite Infraprojects Ltd Concall

Capacite Infraprojects Ltd Corporate governance

Board Composition – The Capacite Infraprojects Ltd. board comprises 8 Directors, with 5 Independent Directors, meeting the requirement of at least 50% of Directors being independent. The Independent Directors bring relevant experience across the areas of construction and infrastructure management, banking and finance and law.

Promoter Remuneration – The total remuneration drawn by promoters and their related parties (relatives and enterprises over which promoters exercise control) in the form of salaries, rent and interest against loans provided, amounted to ₹ 6.3 Cr in FY24. This amounted to ~5% of the PAT of the company for FY24.

Related Party Transactions – About ₹ 21 Cr worth of sub-contracting and hire charges were paid to Capacite Engineering Pvt. Ltd., an entity over which the promoters exercise direct control. An advance of ₹ 19 Cr was also extended to Capacite Engineering Pvt. Ltd. Capacite Infraprojects Ltd. holds about ₹ 4.7 Cr of retention money from Capacite Engineering Pvt. Ltd. Loans provided to Directors have reduced from ₹ 22 Cr in FY23 to ₹ 3 Cr in FY24. The interest charged on Directors’ loans was at fair rates.

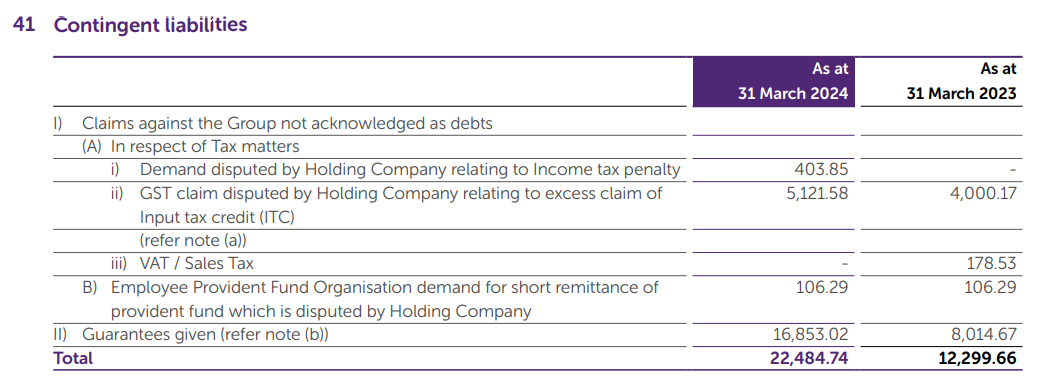

Contingent Liabilities – The total contingent liabilities for Capacite Infraprojects Ltd on account of disputes or claims not acknowledged as debts amounted to ₹ 55 Cr, which is ~3.5% of the net worth of Capacite Infraprojects Ltd

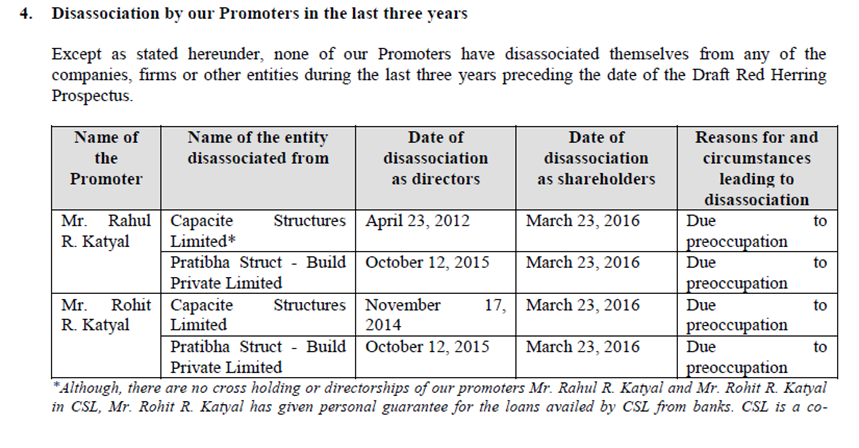

Graft allegations against the erstwhile related party – In Dec 2017, Mr Sanjay Kulkarni, the Managing Director of Capacite Structures Ltd was booked by the CBI on graft allegations. This is relevant for Capacite Infraprojects Ltd. because Mr Sanjay Kulkarni is most likely a relative of the Katyal brothers and the office premises of Capacite Structures Ltd. was located in the same building of Capacite Infraprojects Ltd. However, Capacite Infraprojects Ltd. promptly came up with an exchange disclosure in December 2017 stating that Capacite Infraprojects Ltd had no direct or indirect link with Capacite Structures Ltd.

The DRHP also shows that Mr. Rahul Katyal and Rohit Katyal were once associated with Capacite Structures Ltd. but completely disassociated from it as of November 2014.

These data points are sufficient to give investors confidence about the non-implication of Capacite Infraprojects Ltd in the said graft allegation. However, we thought this was still worth noting.

Capacite Infraprojects Ltd Financial Performance

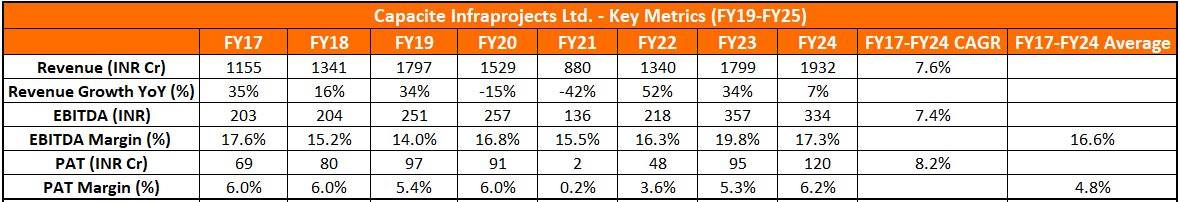

Since listing in Sep 2017, Capacite Infraprojects Ltd’s journey can be divided into 3 distinct phases. The first phase, from listing to FY19, was a phase of high growth, with revenues compounding at 25% CAGR and PAT compounding at 19% CAGR. The latter half of FY19 and FY20 saw a slowdown in the real estate and construction industry in India following the ILFS crisis and a slowing economy. This was exacerbated by COVID-19 in early 2020, which caused significant stress for the real estate and allied industries. Between FY19-FY21, revenues for Capacite Infraprojects Ltd. halved, and PAT collapsed from ₹ 97 Cr to ₹ 2 Cr. Recovery started gradually from FY22. Between FY21-FY24, revenues grew at a CAGR of 30%, and PAT increased from a low of ₹ 2 Cr to ₹ 120 Cr. Overall, in the 8-year period since listing, Capacite Infraprojects Ltd. has managed to compound revenues at a CAGR of 7.6%, EBITDA at a CAGR of 7.4% and PAT at a CAGR of 8.2%

Capacite Infraprojects Ltd Return ratios, Debt and Working Capital Analysis

The average ROE delivered by Capacite Infraprojects Ltd during this period has been 11.4%, and the average ROCE delivered by Capacite Infraprojects Ltd this period has been 17.4%. However, Capacite Infraprojects Ltd ROE since Covid has significantly lagged the average ROE for the period. This is primarily due to a collapse in profitability during the Covid years and subsequent increases in equity due to external equity fund raises. However, the profitability of Capacite Infraprojects Ltd has again reached pre-Covid levels in FY24, and one hopes that ROE can also reach the pre-Covid levels of 12-15% soon.

The most stark contrast in numbers pre-Covid and post-Covid is in the net working capital days, which has more than doubled from pre-Covid levels of mid-80 days to 190 days now. This is primarily due to the change in the nature of Capacite Infraproject Ltd.’s order book. From a mostly private projects-led order book pre-Covid, Capacite Infraprojects Ltd. has pivoted to a very heavy Government projects led order book. From a standalone order book share of only 13%, Government orders today constitute > 70% of Capacite Infraproject Ltd.’s order book. As reflected in the reduced interest coverage ratio over the years, finance costs have also gone up for Capacite Infraprojects Ltd. over the years. This is due to the need to finance the increased working capital and associated commitments such as performance bank guarantees to be given to Government clients.

Capacite Infraprojects Ltd Comparative Analysis

To understand Capacite Infraprojects Ltd investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Capacite Infraprojects Ltd to its competitors (peer comparison) on various fundamental parameters and Capacite Infraprojects Ltd share performance relative to relevant benchmark and sector indices.

Capacite Infraprojects Ltd Peer Analysis

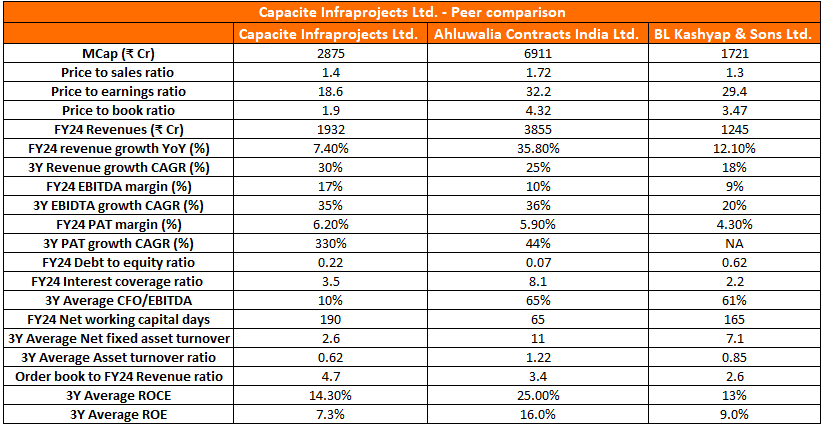

Key peers for Capacite Infraprojects Ltd. are Ahluwalia Contracts India Ltd., one of the best EPC companies listed in India. It has a very strong execution and financial track record. BL Kashyap & Sons Ltd. is another EPC contractor with a long track record in the Indian markets. Let’s compare Capacite Infraprojects Ltd.’s key metrics against these two peer companies.

It is clear from the data that Ahluwalia Contracts India Ltd. has superior financial metrics compared to the other two companies. While EBITDA margins for Ahluwalia Contracts India Ltd at 10% are much lower than Capacite Infraprojects Ltd.’s 17% EBITDA margin, Ahluwalia Contracts India Ltd has a 3Y average ROCE of 25% compared to 14% and 13%, respectively, for Capacite Infraprojects Ltd and B.L.Kashyap & Sons Ltd. This is mainly due to the small size of its balance sheet, which is reflected in its 3Y average asset turnover ratio of 1.22, far superior to Capacite Infraprojects Ltd ratio of 0.62 and B.L.Kashyap & Sons Ltd ratio of 0.85. This is driven by its very low working capital days of 65 and high net fixed asset turnover of 11x compared to the other two companies.

While Capacite Infraprojects Ltd. has the highest EBITDA margins by far, its ROCE and ROE are far lower than Ahluwalia Contracts India Ltd because of its huge balance sheet. Capacite Infraprojects Ltd.’s asset turnover ratio is half that of Ahluwalia Contracts India, primarily due to its low net fixed asset turnover ratio of 2.6x and very high working capital days of 190. In order to close the gap with Ahluwalia Contracts India Ltd in terms of financial metrics, Capacite Infraprojects Ltd. needs to work on reducing the size of its balance sheet, especially its working capital days.

Capacite Infraprojects Ltd Index Comparison

Capacite Infraprojects Ltd share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Capacite Infraprojects Ltd?

Capacite Infraprojects Ltd offers some compelling reasons to track the business closely and to consider investing if one is looking to build position on India infrastructure sector

Large order book with all projects active – Capacite Infraprojects Ltd has a standalone order book of ₹ 9000 Cr as of FY24. This is almost 4.7x of Capacite Infraprojects Ltd FY24 revenues. In addition to the ₹ 9000 Cr order book, there is an additional ₹ 3000 Cr+ order from MHADA for the redevelopment of BDD Chawls. That order gets released in phases, and the Capacite Infraprojects Ltd. management includes it in the order book once a new phase is released for execution by MHADA. The large order book provides strong growth visibility for years to come.

Strong growth guidance by management – Capacite Infraprojects Ltd management has indicated that they are confident of growing at least 25% each year in FY25 and FY26. Capacite Infraprojects Ltd management has indicated that available machinery, management bandwidth, and working capital limits are sufficient for Capacite Infraprojects Ltd to reach execution levels of ₹ 800 Cr per quarter, i.e. ₹ 3200 Cr per year.

Recent capital raise and bank funding tie-ups give execution comfort – After struggling with working capital limits post Covid and receiving a credit rating downgrade from IND A straight to IND D in Aug 2021 due to defaults on loan obligations, Capacite Infraprojects Ltd has shored up its capital base and banking limits significantly in FY23 and FY24. In FY24, Capacite Infraprojects Ltd raised equity via QIP and warrants to the tune of ₹ 330 Cr+. It also tied up around ₹ 350 Cr worth of non-fund-based limits with various banks as of Q1 FY25. This should arm the management with enough working capital firepower to deliver on its growth commitments for FY25 and possibly even FY26.

Affordable housing is a focus segment of the government – The provision of affordable housing is a big agenda for the Indian government. In the 2024 financial budget, an amount of ₹ 30000 Cr was allocated to the PM Awas Yojana – Urban (PMAY-U) for the current financial year, an increase of 36% over last year. Similarly, state Govt arms are also focusing on affordable housing in urban areas. For example, Capacite Infraproject Ltd. is currently executing the MHADA BDD Chawls redevelopment project in Worli, which aims to provide affordable housing for the poor and is funded by the Maharashtra state government. Large-scale affordable housing projects usually consist of high-rise buildings, which is a forte of Capacite Infraprojects Ltd.

Real estate sector in an upcycle – After a prolonged lean period in the 2010s, the real estate sector is in an upcycle post-COVID. Real estate cycles are usually long, so this cycle may continue for a few more years. Capacite Infraprojects Ltd. is a reputed EPC company in the residential construction space with several marquee real estate developers on its client list. Capacite Infraprojects Ltd. should be able to get more orders from the private residential sector in this upcycle.

What are the Risks of Investing in Capacite Infraprojects Ltd?

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

Geographical Concentration Risk – A large part of Capacite Infraprojects Ltd.’s order book is concentrated in their home city of Mumbai and in the state of Maharashtra. This makes them more susceptible to natural disasters or political risks compared to a more well-diversified EPC contractor

Client concentration risk – Over the last few years, Capacite Infraprojects Ltd.’s client concentration has significantly increased as it has received two large Govt. projects from CIDCO and MHADA. CIDCO and MHADA projects comprise about 45% of its total order book as of Q1 FY25. This exposes Capacite Infraprojects Ltd to any adverse events or slowdowns related to these particular projects. However, finances for both projects are tied up separately with adequate bank limits. Hence, execution should not suffer in normal circumstances.

WC intensive operations – As discussed above, Capacite Infraproject Ltd.’s operations have become quite working capital intensive since Covid, with an increase in the execution of Govt funded projects and a few old receivables pending for collection. The net working capital days for the capacite Infraproject Ltd spiked to 190 days as of FY24. In FY23, India Ratings downgraded the capacite Infraproject Ltd credit rating from BBB+ to BB+, citing its inability to tie up additional bank limits. Since then, Capacite Infraproject Ltd has tied up around ₹ 350 Cr of banking limits, and the credit rating has gone back up to BBB- (Infomerics) in Sep 2024. However, working capital becoming unmanageable remains the biggest risk for Capacite Infraproject Ltd and hence needs to be closely monitored.

Source: India Ratings report, Feb 2023

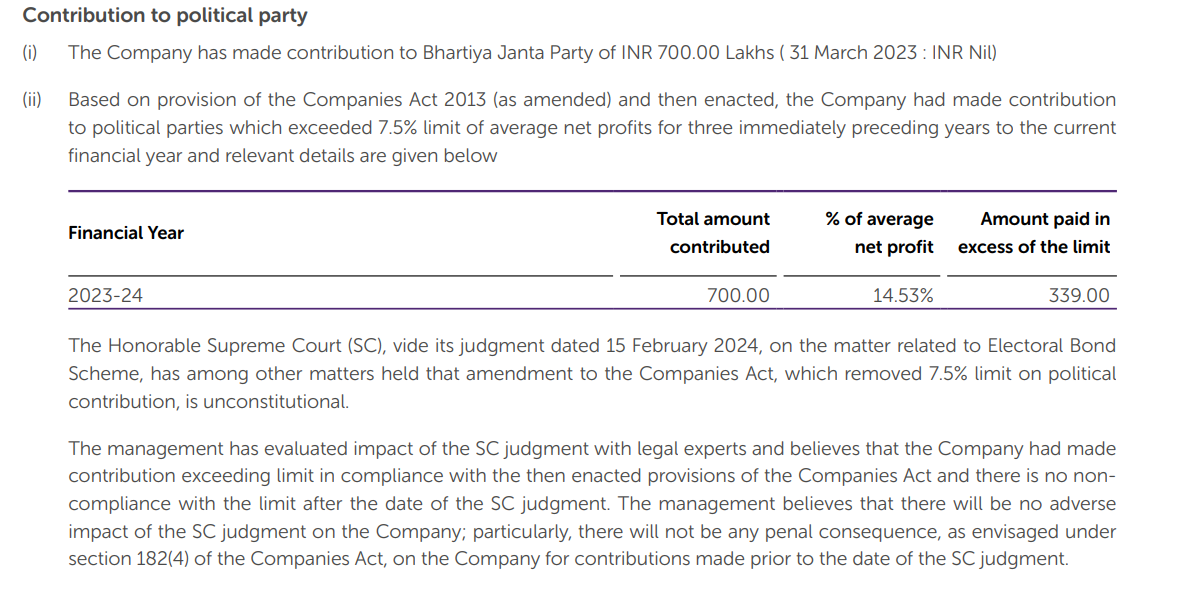

Political exposure and risk – Capacite Infraprojects Ltd. donated an amount of ₹ 7Cr to the Bharatiya Janata Party in FY24 through electoral bonds. This exposes them to political risks to an extent. Infrastructure, as a segment, is relatively politically sensitive as government budget changes can significantly speed up or slow down project award and execution momentum. Hence, the upcoming Maharashtra Assembly elections of Nov 2024 may also be a relevant event in this context. Election results may impact future project award momentum, although the execution of Capacite Infraprojects Ltd.’s current order book should not be impacted, irrespective of the election results.

Lack of sufficient cash flow generation since COVID-19 – Between FY22 and FY24, Capacite Infraprojects Ltd. has, on average, only converted 11% of its EBITDA into cash flows. This is in contrast to a pre-COVID average of 66% between FY17 and FY21. This is primarily due to the share of Government projects increasing in execution compared to private projects earlier. Also, receivables stuck during COVID-19 have also contributed to this lack of cash flow generation.

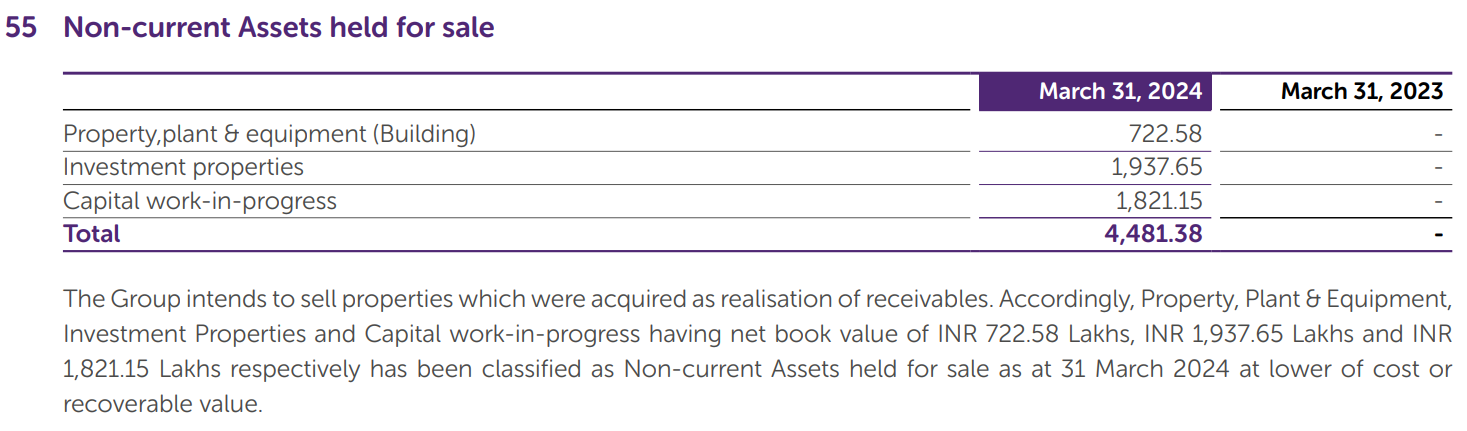

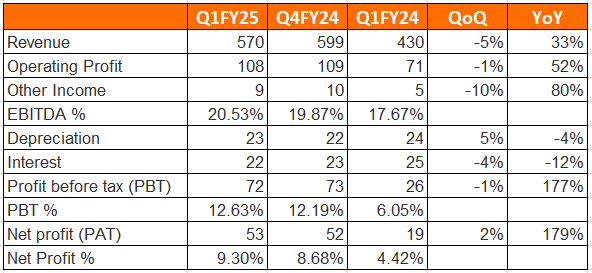

Old receivables – Like most other EPC contractors, Capacite Infraprojects Ltd went through a period of stress from FY19-FY21 due to the ILFS crisis and COVID-19. During this period, some of its clients faced cash flow issues, and some even went bankrupt. While Capacite Infraprojects Ltd. has recovered a lot of receivables in such cases, some issues still remain. Capacite Infraprojects Ltd has taken possession of client assets to the tune of ₹ 44 Cr, which it intends to sell to recover its dues. In addition, there are ₹ 68 Cr worth of receivables outstanding, which Capacite Infraprojects Ltd has assessed that the client won’t be able to pay and hence has moved to take possession of client assets with the intention to sell them in the future. Any haircuts in the process of these resolutions can hit Capacite Infraprojects Ltd P&L in the coming years. Capacite Infraprojects Ltd holds no provisions against these two items.

Capacite Infraprojects Ltd Future Outlook

The growth outlook for Capacite Infraprojects Ltd. is quite good, with management guiding 25% growth for FY25 and FY26. An order book to revenue ratio > 4x, a relatively low no. of projects to be managed (24) and a pick up in execution in its two largest projects from CIDCO and MHADA have meant that Capacite Infraprojects Ltd. has strong revenue visibility in the coming few years. As per management, Capacite Infraprojects Ltd. now has enough management, machinery and banking-limit capacity to grow revenues to ₹ 3200 Cr without significant investments.

While growth prospects for Capacite Infraprojects Ltd. look quite robust, it’s clear that over the last few years, Capacite Infraprojects Ltd. has prioritised its P&L at the cost of the balance sheet. By grossly increasing its share of public sector projects, Capacite Infraprojects Ltd. has lost the tight control of working capital that it used to have pre-Covid. This has resulted in the balance sheet ballooning up to the extent that gross asset turnover (Revenue divided by Total balance sheet assets) has dipped to 0.6x, significantly below the levels of its peers (B.L.Kashyap & Sons Ltd 0.8x, Ahluwalia Contracts India Ltd 1.2x). The significant ballooning of the balance sheet is the reason that despite earning industry-leading EBITDA margins of 15-20%, Capacite Infraprojects Ltd. has a single-digit return on equity.

In the next couple of years, Capacite Infraprojects Ltd. needs to increase its return ratios by reducing the size of its balance sheet. This will require a sharp reduction in working capital days from the current 190 days to below 150 days. An increase in the private sector contribution to the order book should help this process, as private sector orders are much less working capital intensive. Balance sheet size reduction and improvement in return ratios are key monitorable for investors going forward.

Capacite Infraprojects Ltd Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Capacite Infraprojects Ltd Price Charts

On weekly charts, over the last 3 years, Capacite Infraprojects Ltd Stock has gone through two distinct phases. Between Oct 2021 and May 2023, Capacite Infraprojects Ltd stock consolidated between the levels of 100-185. Capacite Infraprojects Ltd stock bounced from lows of 100 in June 2022, as earnings started showing strong recovery in FY23. However, from Sep 2022 to March 2023, Capacite Infraprojects Ltd stock again grinded down to 120 levels in line with weak Indian markets. Starting May 2023 Capacite Infraprojects Ltd stock started rising again with improving sentiments in the Indian market and eventually broke through the resistance level of 185 with high volumes in early June 2023. Since then Capacite Infraprojects Ltd stock has broadly moved in an upward sloping parallel channel with improving earnings trajectory and a bull run in the Indian equity market.

Taking a longer view of the history, we can observe that the price is now hovering near the all time highs seen during the 2018 listing. Good earnings momentum without balance sheet deterioration can push the price trend into blue sky territory beyond the previous high of 430 in 2018.

On daily charts, we can observe the price is now awaiting earnings confirmation to get past the upper resistance line of 400+. The dotted line has acted as support in the recent bout of market volatility where the indices fell ~8% from the peak within 10 days in October 2024. All interim lows have been respecting the upward sloping trend line starting from March 2024. If Q2 earnings sustain the momentum of the previous two quarters, there appears to be a strong possibility that the price will retest the September 2024 high of 400+

Capacite Infraprojects Ltd Latest Latest Result, News and Updates

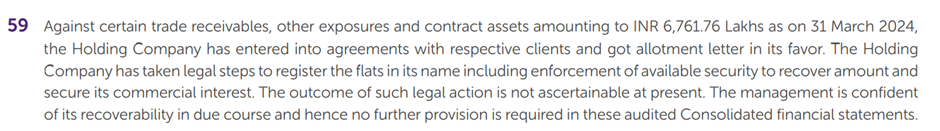

Capacite Infraprojects Ltd Quarterly results

Capacite Infraprojects Ltd. posted very strong Q1 FY25 numbers, with a 33% YoY sales growth, 52% YoY EBITDA growth and 179% YoY PAT growth. While the performance was Flat or slightly low on QoQ basis due to election related slowdown (similar for the entire industry). Quarterly revenues almost touched the guided number of ₹ 600 Cr. Q1FY25 was the second consecutive quarter of ₹ 50 Cr+ PAT. The management also highlighted that there was a reduction of 17 days in net working capital in Q1 FY25 over Q4 FY25. The management is pursuing various efforts to reduce working capital, such as getting retention monies released, bringing down debtor days and recovering old receivables. Management sounded confident of delivering 25%+ YoY revenue growth in FY25 at ongoing levels of profitability.

In October 2024, Capacite Infraprojects Ltd. won a large order worth ₹ 1200 Cr from Signature Global India Ltd, a listed real estate company. The order is for the construction of “Civil structure and Part MEP work for all towers & basements and all other ancillary buildings” in their Group Housing Project, namely, “Titanium SPR (Phase-1 and 2)” at Sector 71, Gurugram, Haryana. This order should increase the private sector contribution to the order book and help reduce working capital pressure on Capacite Infraprojects Ltd going forward.

Final thoughts on Capacite Infraprojects Ltd

It is quite clear that the business offers the prospects of strong earnings growth through FY25. Management indicated towards the end of FY24 that quarterly revenue will be > 500 Cr through FY24 and that PAT is likely to continue to print 50+ Cr. From a short term earnings momentum point of view, things appear to be falling into place. Seen purely in P&L terms, the stock is much cheaper than peers, but for good reasons.

The challenges plaguing this business are on the balance sheet and cash flow fronts. With the working capital cycle stretching to more than 180 days and some projects that are politically sensitive in nature, there are obvious risks to note. In terms of corporate governance & accounting too, there are a few grey areas one will need to take a deeper look at.

This is one of those businesses where investors will need to be clear about the risk return tradeoff and take a decision on whether to invest (leaving valuation aside). Such stocks usually make for good tactical calls, rather than long term investing where one intends to buy and hold for 3-5 years. This view about this microcap would change if the management addresses concerns on cash flow & balance sheet, in which case the investment thesis can be relooked at as a long term play.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.

Disclosure(Updated as of Oct 31, 2024) – No position in the stock in personal portfolio