Vaibhav Global Limited is into retailing of fashion jewellery, fashion accessories and lifestyle products through television and the Internet in developed markets.

We find Vaibhav Global Limited interesting at this juncture because we believe that the investment cycle vaibhav global limited had embarked on for 2-3 years is now behind it and the new investments coupled with a steady economic environment in its key markets should result in early to mid double digit revenue growth with significantly strong operating leverage, leading to robust PAT growth over the medium term

Vaibhav Global Limited Company Summary

Vaibhav Global Limited is a small-cap company headquartered in Jaipur, India. Vaibhav Global Limited is a value-focused multinational retail company that specializes in selling low-cost jewelry and lifestyle products to customers over television and the Internet.

Vaibhav Global Ltd. was founded as Vaibhav Enterprises in 1980 by Mr. Sunil Agarwal, who is currently the Managing Director of the company. Vaibhav Global Ltd. started as a B2B business, exporting gems and jewellery to departmental stores and TV shopping networks in the UK and the USA, such as Walmart, JCPenney, Macy’s, etc. In the mid-2000s, the company started getting into the B2C side of things by opening physical retail stores and proprietary TV channels to sell premium gems and jewellery. Following the global financial crisis in 2007-08, Vaibhav Global Limited pivoted from a premium jewellery seller to a discount jewellery and lifestyle seller. It also got rid of the asset-heavy physical retail part of the business and focused exclusively on selling to consumers directly via television and the Internet.

Since emerging from the 2007-08 financial crisis, Vaibhav Global Limited has gone from strength to strength, refining its business models along the way to broadly keep pace with the rapidly changing retail landscape in Western economies.

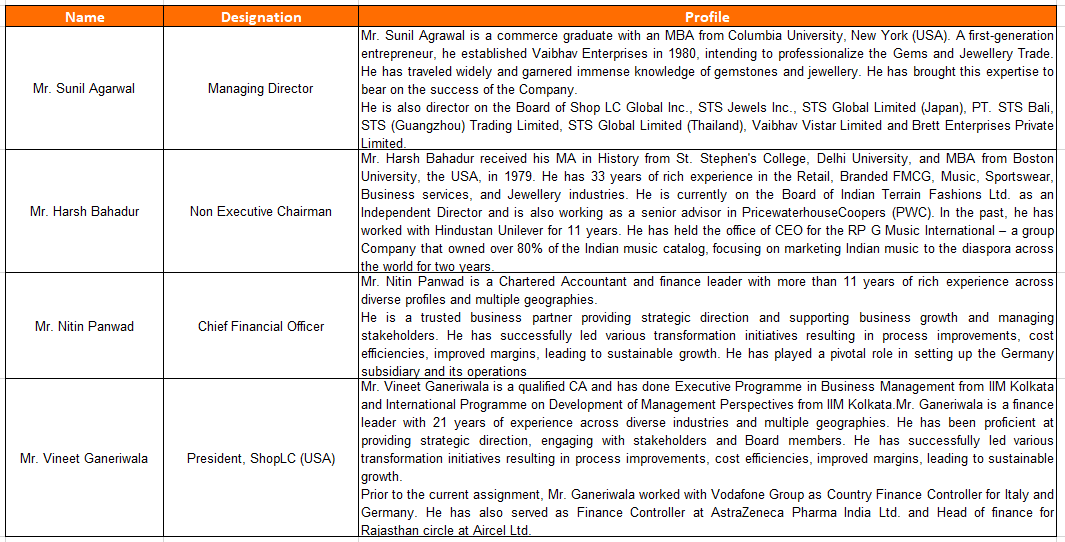

Vaibhav Global Limited Management Details

Vaibhav Global Limited Company Structure

Vaibhav Global Limited, by virtue of its global operations, has a complicated subsidiary structure. The subsidiaries highlighted in green are the revenue-generating units – Shop TJC UK, Shop LC USA, Shop LC Gmbh Germany, and Mindful Souls BV. The acquired assets of Ideal World sit in the Shop TJC UK subsidiary.

Vaibhav Lifestyle Ltd. manufactures women’s garments in-house. All the other STS subsidiaries are focused on sourcing jewellery and lifestyle products from various geographies.

Vaibhav Global Limited – Industry Overview

The teleshopping industry

Let us understand how the teleshopping industry works.

1. The teleshopping company (QVC/HSN/ShopLC/Asian Sky Shop/Naaptol.com) produces television content in a studio where presenters demonstrate various products in the lifestyle/home/jewellery/apparel/electronics categories (Refer to TJC and SHop LC screenshots above)

2. The teleshopping companies usually run proprietary 24*7 television channels that run their produced content. Examples of such 24*7 teleshopping channels are QVC, HSN, ShopLC (VGL group), TJC (VGL Group), etc. In some cases, teleshopping companies may also choose to run their programs in certain slots on other TV channels, such as Asian Sky Shop, running their programming late at night on Indian entertainment channels such as Sony TV or Zee TV.

3. The television screen shows the price of the item. Usually there is a significant discount shown to attract customers. The number of items sold or the number of items left in inventory is also usually flashed on the screen to create an urgency in potential buyers.

4. A call center number is flashed on the screen. Interested customers dial the number and are able to place an order and pay for the product with the help of telecallers. The telecaller, at this point, may also attempt to sell additional items to the customer. Once the payment is made, the purchased product(s) gets shipped directly to the customer within a few days.

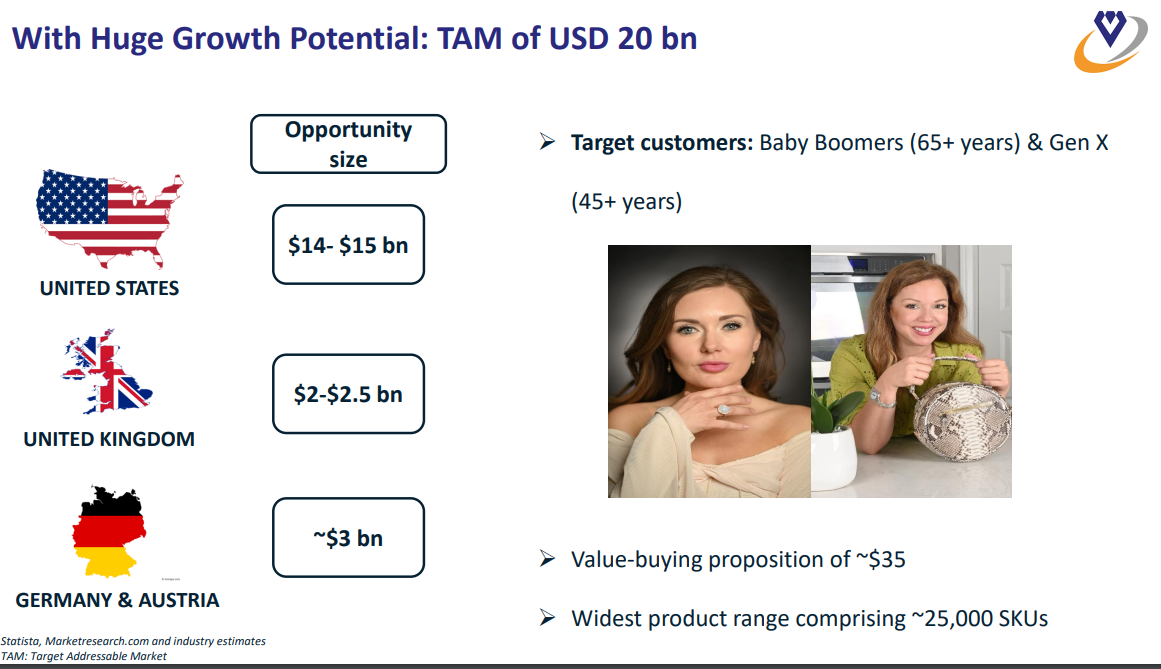

The global teleshopping industry is estimated to be ~50bn USD in size and is growing at a sedate CAGR of ~2% per annum. This is dwarfed by the size of the global ecommerce industry, which is 100s of times larger than the teleshopping industry, with its size running into trillions of USD and still growing at 8-10% per annum.

The teleshopping industry was in its heyday in the 1990s and 2000s when ecommerce did not exist, television penetration was still increasing in major markets, and the shop-sitting-at-home concept was a new one. In the 1990s, the teleshopping industry was growing at a CAGR of 8-12% per annum. The competition began to intensify with the rise of ecommerce in the 2000s, and by the mid to late 2010s, ecommerce, and mobile commerce had firmly established themselves as the primary home shopping media, eating significantly into the growth of teleshopping.

The major reasons behind the slowdown of teleshopping are as follows:

- The emergence of ecommerce in the 2000s and 2010s – Ecommerce platforms are able to carry a larger variety of inventory and are often able to service clients faster.

- .The emergence of alternative sources of media consumption – The emergence of alternate video consumption and marketing platforms such as OTT platforms like Netflix, streaming platforms like YouTube, and social media platforms like Facebook and Instamart have reduced the prominence of television in the lives of consumers, especially the younger generation. This has impacted teleshopping’s reach since the 2010s

- The emergence of smartphones – The emergence of smartphones in the late 2000s and early 2010s has further reduced the monopoly of traditional television in terms of media and entertainment.

All these factors have meant that traditional teleshopping companies have had to evolve to stay competitive. Most of the erstwhile leaders, such as QVC, HSN, and Shop LC, have invested heavily in building their digital presence, and a significant proportion of sales for these companies now come from digital channels. However, in the digital space, they face steep competition from digital native platforms and marketplaces such as ecommerce websites like Amazon.com, Alibaba.com, online discount marketplaces such as Temu and Shein, etc.

Demographics in Western economies

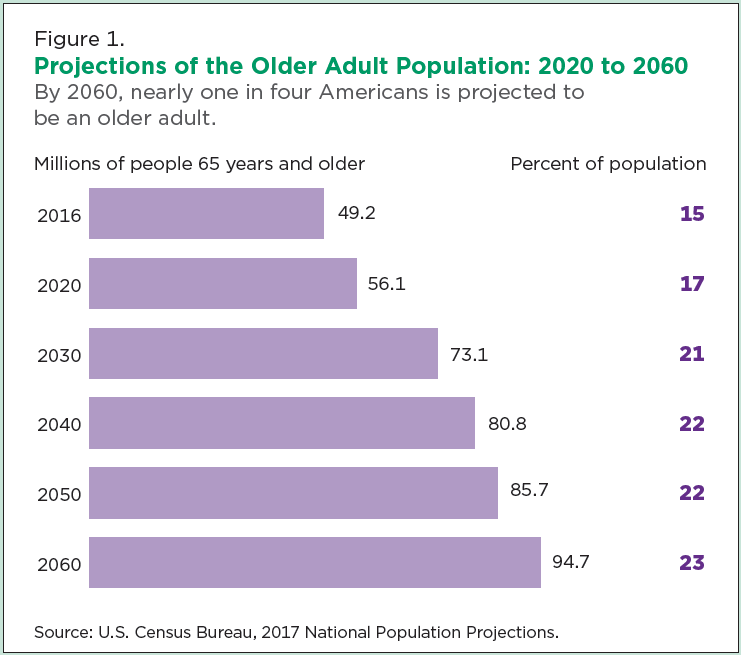

However, the older demographic (GenX and Baby Boomers) in countries such as the USA, UK, and Europe still continue to watch traditional broadcast television in significant numbers.

Source: Roland Berger and Potbloc study on Decoding Consumer Behaviour in 2023-24

These geographies also have aging populations, which should mean that the pace of dropoff in television viewership in these countries should be slower than in other parts of the world. For example, in the USA, by 2030, it is expected that the number of people over the age of 65 will be 73.1mn, up from 56.1mn in 2020, and will comprise 21% of the total population of the country. People aged 65+ in 2030 belong firmly to the Baby Boomer generation (born before 1965), who are still avid television watchers.

The Baby Boomer (Born between 1946 and 1964) and GenX (Born between 1965 and 1980) generations also own most of the wealth in the USA. According to Statista, ~50% of the USA’s total wealth is owned by baby boomers, and ~25% is owned by GenX. Thus, most of the spending power still rests with these generations.

Source: Statista

Competitive dynamics in the teleshopping industry

The teleshopping industry is quite consolidated in nature. Due to the slow growth rates of the industry and the high fixed costs involved in television broadcasting, inefficient or subscale players are unable to survive in this industry.

By far, the largest company in teleshopping globally is the Qurate Retail Group, which owns the teleshopping networks QVC and HSN. The Qurate Retail Group has a presence across most Western geographies, such as the USA, UK, Germany, and Europe. In CY23, the Group reported revenues of ~12bn USD. Qurate has been struggling for growth since the pandemic highs. Revenues for the group have dropped by 23% between CY20 and CY23. It is presumably losing market share not only to ecommerce and digital rivals but also to smaller and more cost-efficient teleshopping companies.

Other prominent teleshopping companies in the USA are ShopHQ (formerly Evine), The Shopping Channel, and Shop LC (VGL Group).

The largest teleshopping channels in the UK are QVC UK (Qurate), Ideal World (VGL Group), JML Direct, and TJC (VGL Group).

The largest teleshopping channels in Germany are QVC Germany (Qurate), HSN Germany (Qurate), HSE24, and Shopping24.

As mentioned earlier, as much as competition in the teleshopping industry comes from within the industry, a large part of the competition comes from e-commerce websites and digital platforms such as amazon.com, walmart.com, alibaba.com, temu.com, m.shein.com, etc.

Vaibhav Global Limited Business Segments

History of Vaibhav Global Limited

Let’s take a deeper look into the history and evolution of Vaibhav Global Limited first. This will provide a perspective on how Vaibhav Global Limited has successfully evolved with the changing retail landscape over the years. It will also help one understand that Vaibhav Global Limited goes through cycles of investment and infrastructure upgrade from time to time, where growth slows down and then subsequently reaps the benefits of the growth initiatives in the next few years.

Vaibhav Global Limited was founded as Vaibhav Enterprises in 1980 by Mr. Sunil Agarwal as a gem and jewellery exporting company. The company was listed on the stock exchanges in 1994 under the name Vaibhav Gems Limited. The company was a completely B2B operation, exporting its gems and jewelleries to organized retail stores in the US and UK, such as Walmart, JCPenney, and Macy’s, and to specialty jewellery stores. The company set up an export oriented manufacturing facility in Jaipur to manufacture gems and jewelleries.

After about a decade of listing, in 2004-05, Vaibhav Global Limited decided to venture into B2C operations as it wanted to capture value in the retail supply chain.

- It started off by setting up physical retail stores in tourist locations in Alaska, Mexico, and the Caribbean. The idea was to sell premium jewellery to holidaygoers and cruise ship tourists in these locations.

- In FY06, Warburg Pincus invested USD 47mn into Vaibhav Global Limited to help grow its B2C business.

- Soon after, it acquired the STS Group in 2005-06. The STS Group was a global jewellery manufacturing and marketing company with a presence in Thailand and Hong Kong on the manufacturing side and the USA and Japan on the marketing side. This acquisition gave Vaibhav Global Limited a retail and manufacturing foothold in various geographies around the world.

- Across 2006 and 2007, Vaibhav Global Limited established 24*7 TV channels in Germany, the UK, and the USA for selling gems and jewelleries direct to consumers.

As Vaibhav Global Limited was making confident strides in its B2C journey in the mid-2000s, disaster struck in the form of the Global Financial crisis in late 2007 and the subsequent deep recession in their target markets. Revenues collapsed by 25% and 42% YoY in FY09 and FY10, respectively. Vaibhav Global Limited applied for corporate debt restructuring in FY09 (The precursor to the present-day Insolvency and Bankruptcy Code), and the promoter infused INR 44Cr capital via preference shares issued at 1% yield.

Mr. Sunil Agarwal had to take a number of hard calls at this point in time to keep losses under control, preserve cash, and save the company from bankruptcy.

- He decided to exit the German TV retail market and the Japanese wholesale market to stop bleeding cash.

- He decided to shut down all physical retail stores and focus on the asset-light TV business.

- He decided to shut down manufacturing operations in Thailand and consolidate the separate gems and jewellery manufacturing facilities in Jaipur into one facility to consolidate costs.

- He decided to consolidate the US wholesale operations with the US TV retail operations to save costs.

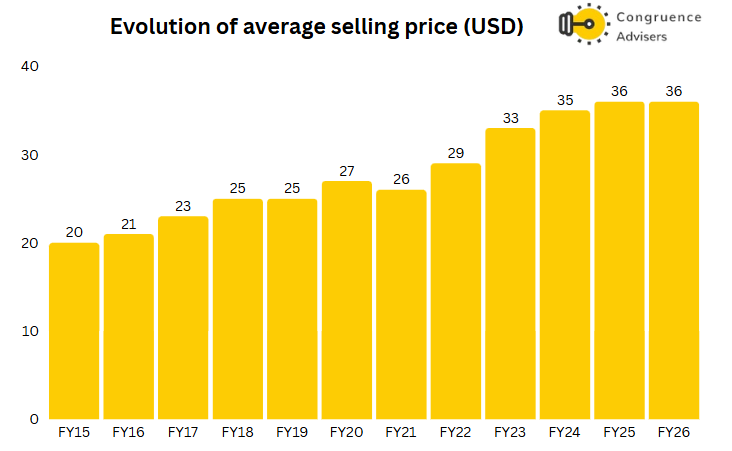

- Vaibhav Global Limited started introducing many lower price point jewellery items in the recessionary environment prevalent in their target markets. Over the next couple of years, Vaibhav Global Limited completely pivoted from a premium jewellery seller to an affordable jewellery seller, bringing down the average sales price of its items to 41$ in 2010 from 132$ in 2008.

These bold steps around cutting costs in businesses that did not have cash flow generation visibility and completely pivoting its business model from a physical retail heavy premium jewellery model to a completely TV based affordable jewellery model paid rich dividends. From reporting a loss of INR 240Cr in FY09, Vaibhav Global Limited managed to post a profit of INR 43Cr in FY11.

In FY12, the company rebranded itself from Vaibhav Gems Limited to Vaibhav Global Limited and launched lifestyle products as an additional category. In FY14, Vaibhav Global Limited paid back all external dues and exited CDR and also paid back the promoter’s preference shares. Between FY10-FY14, revenues became 4x from INR 338Cr to INR 1298 Cr.

After 4 years of strong growth after the Great Financial Crisis, the years FY15 and FY16 again proved to be years of consolidation for Vaibhav Global Limited, this time due to heightened competitive pressures and infrastructure upgrades.

- In response to competitive pressures, Vaibhav Global Limited launched a Budget Pay option for its customers wherein customers could purchase items priced higher than $20 on EMIs at no extra cost to them. Vaibhav Global Limited also launched an easy return policy for its customers. These steps were necessitated to maintain parity with larger competitors in the USA who were offering these services to their customers.

- Vaibhav Global Limited transitioned its USA and UK websites from proprietary platforms to the advanced SAP-hybris platform which would ensure a seamless customer experience across multiple device formats. The company also launched apps for its Shop LC and TJC websites.

- The manufacturing capacity at the Jaipur facility was increased to 2x the earlier capacity.

These strategic changes set the tone for sustained growth between FY17-FY21. During this period, revenues almost doubled, and PAT more than quadrupled.

In FY22, Vaibhav Global Limited decided to re-enter the German TV and digital retail market, which it had vacated post the Great Financial Crisis. In H2 FY24,Vaibhav Global Limited decided to utilize its excess cash flows to pursue value-added inorganic growth by acquiring two companies.

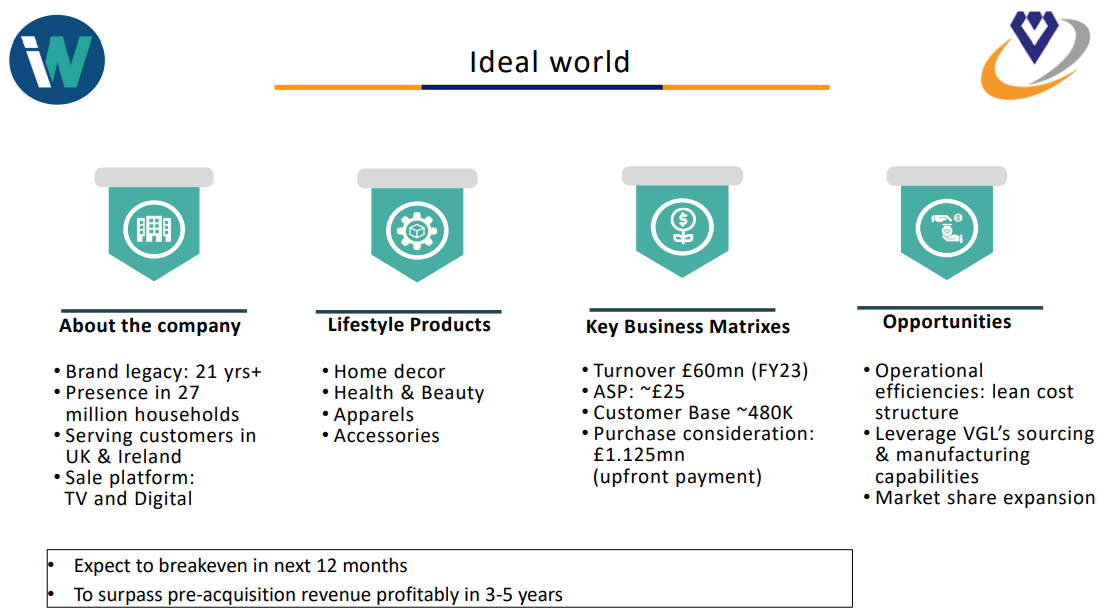

- First, it acquired the assets of Ideal World (studio, brand name, customer contact details, and other assets) in the UK for a sum less than GBP 1mn. Ideal World used to be one of the leading teleshopping networks in the UK before it underwent financial troubles. However, the brand still commanded significant loyalty and brand recognition in the UK, and the acquisition was done at a very lucrative price.

- Second, it acquired a digitally native e-commerce company called Mindful Souls BV for ~12mn Euros. Mindful Souls BV sells subscription boxes of lifestyle products to customers in several geographies, with the majority of sales coming from the USA. This would be the first purely digital segment of business added to the portfolio of the VGL Group

Business model

Now that we have understood the history and DNA of the company and the promoter in some detail, let’s understand the company’s business model in depth.

- Target segment – Vaibhav Global Limited has a very clear target segment of customers in mind – 45+ year-old (GenX and Baby Boomers) women in the USA, UK, and Germany who are in general, wealthy with high disposable income and, in most cases, empty-nesters, i.e., whose children have moved out of their homes to pursue their own lives.

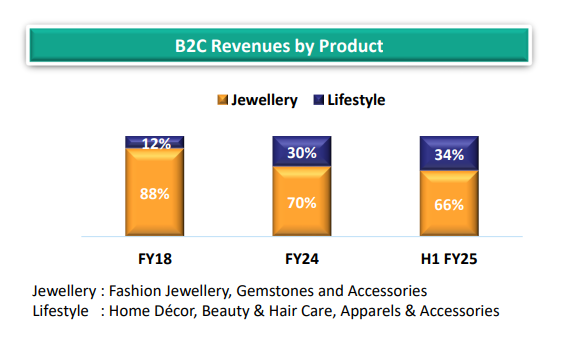

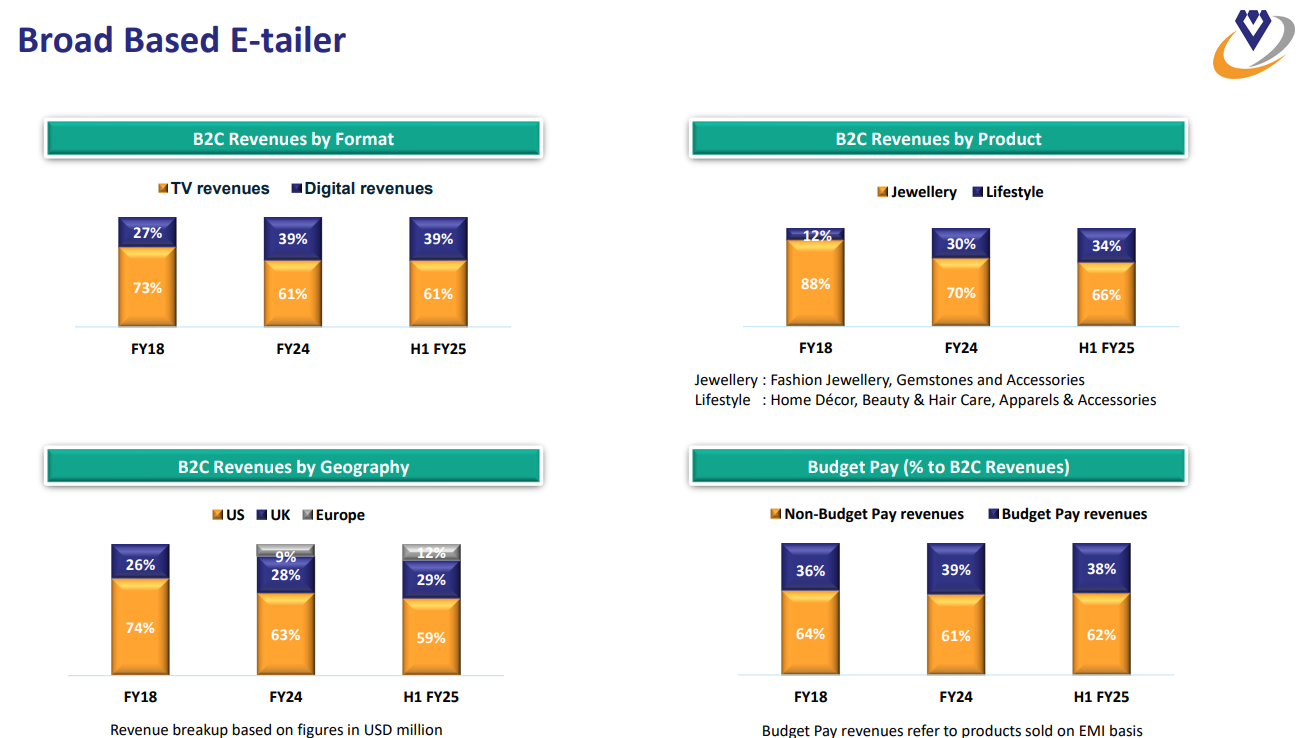

- Product segments and supply chain – Vaibhav Global Limited sells products across two categories – gems & jewelleries and lifestyle products. In the lifestyle segment, it sells home decor, beauty, and apparel products, amongst others. The lifestyle segment was launched in 2013. Since its inception, the segment has consistently grown to occupy 34% of revenues in H1FY25.

One of the biggest advantages of Vaibhav Global Limited vis-a-vis its competitors is the fact it is vertically integrated into the gems and jewellery segment by virtue of having a 170000 sq ft manufacturing facility in Jaipur, India. This is complemented by a global sourcing base that facilitates sourcing from > 30 countries across the world. While > 80% of the products in its Gems and Jewellery segment are manufactured in-house, almost the entirety of the lifestyle segment manufacturing is outsourced.

Vaibhav Global Limited has consistently maintained industry-leading gross margins of >60% across both segments.

The average selling price (ASP) of items on Vaibhav Global Limited’s platforms is a mere $36, highlighting its positioning as a discounted, value seller of jewellery and lifestyle products. The ASP has increased significantly since Covid due to customers’ proclivity for precious metal jewellery as a hedge against inflation. Management has said that in the medium term they do not expect further increase in ASP. Revenue growth will primarily be driven by volume growth.

- Go-to-market approach – While Vaibhav Global Limited is today an omnichannel retailer, its origins as a retail company lie primarily in the teleshopping space. Today, it sells products across both television and online.

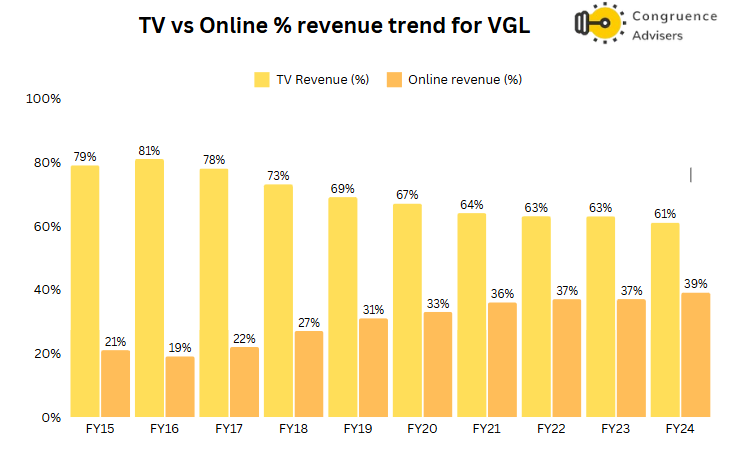

Television – Vaibhav Global Limited reaches its customers via proprietary television channels that it owns in the USA, UK, and Germany. Their TV channel in the USA is called Shop LC USA, their channels in the UK are called TJC and Ideal World, and their channel in Germany is called Shop LC Germany. Together, through these 3 channels, the company reaches 130 mn households globally. As of H1 FY25, about 61% of Vaibhav Global Limited’s B2C revenues happen through TV.

- Digital – Vaibhav Global Limited reaches its customers digitally via several mediums

- Proprietary websites – VGL has four websites operating in its three major geographies – Shop LC USA, TJC UK, Ideal World TV, and Shop LC Germany. The content of the corresponding TV channels is live-streamed on the websites, so customers can choose to watch the programming on TV or stream it live from the website. In addition to live stream-based customers, the websites also offer normal catalogue-based e-commerce shopping. Traffic to the websites is driven using various media such as search engine optimization, email marketing campaigns, and social media campaigns across platforms such as Instagram, Facebook, and TikTok.

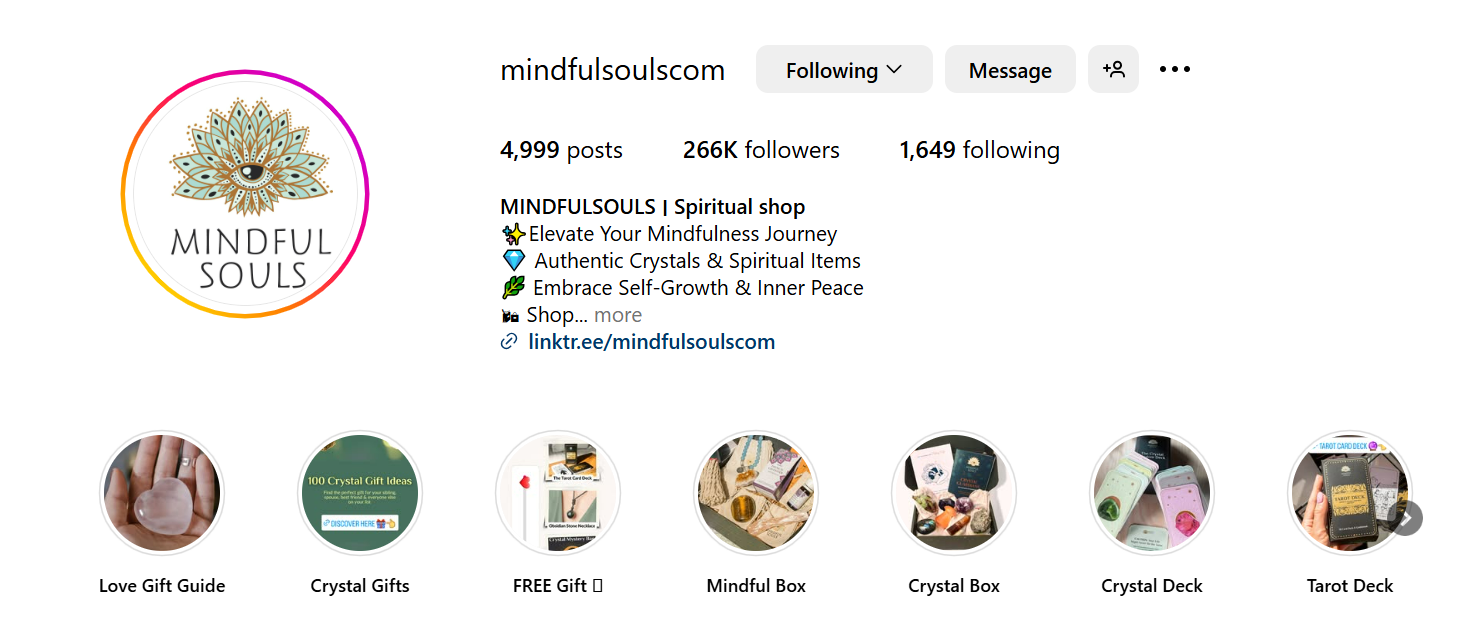

- Mindful Souls – The recently acquired Mindful Souls business is the only digital native business in Vaibhav Global Limited’s portfolio. Mindful Souls sells digital subscription boxes of spiritual and wellness products to customers. While sales happen via the mindfulsouls.com website, the brand has a very strong organic presence on Facebook and Instagram, with over 700k cumulative followers.

- Third party marketplaces – Vaibhav Global Limited also lists its products on third party marketplaces such as Amazon.com and Walmart.com

- OTT streaming platforms – Vaibhav Global Limited is also present on OTT streaming platforms such as ROKU TV, Google TV, and DirectTV Stream. Customers can download Vaibhav Global Limited channels, such as ShopLC or TJC, on these platforms and stream their content. Revenues from OTT streaming are still < 5% for Vaibhav Global Limited as a whole, but it’s a segment that is growing rapidly.

Over the years, digital revenue as % of total B2C revenues has consistently increased. At present, it stands at 39%, and management has guided it to increase to 50% in the next few years.

The primary competitive advantages of Vaibhav Global Limited’s business model can be summarized as follows.

- A sales proposition offering “value” to customers by selling products with an ASP < $40. The low price point makes its products less vulnerable to cyclical economic downturns or inflation and also promotes impulse buying amongst its target segment

- Integrated supply chain with in-house manufacturing of gems and jewelleries and extensive global sourcing capabilities. This enables seamless supply without disruptions and also helps keep costs much lower than the competition, most of whom outsource 100% of their sales.

- Obsessive control of gross margins at > 60% levels through in-house manufacturing and strategic sourcing

- Significant entry barriers in terms of the recognition and loyalty commanded by the Vaibhav Global Limited’s brands and the high fixed costs involved in TV broadcasting

What happened between FY21-FY24

With a fairly detailed understanding of Vaibhav Global Limited’s history and business model, it is important to understand what has transpired in the last few years, where Vaibhav Global Limited has struggled to grow revenues while experiencing a sharp fall in profits. During FY21-FY24, revenues grew at 62% CAGR, EBITDA at -10% CAGR, and PAT at -27% CAGR.

- A high base of one-time revenues during COVID-19 – In FY21, revenues grew by 28% YoY, and EBITDA grew by 29% YoY. EBITDA and PAT margins touched historical highs of ~14.6% and 10.7% respectively. This was thanks to the surge in demand experienced by e-commerce and teleshopping businesses as physical retail stores remained largely closed due to Covid 19. In addition to this, Vaibhav Global Limited also benefited from the sale of essential items such as hand sanitizers, masks, home cleaning products, health supplements, etc. However, most of these revenues were one-off items that were not to be repeated. Thus, FY21 set a very high base for future years in terms of revenue and profitability.

- High inflation in end markets and negative consumer sentiments – The impact of Covid related disturbances on global supply chains, the huge fiscal spending across Western countries to counter the impact of Covid 19 on the economy, and the outbreak of the Russia-Ukraine war in early 2022 caused inflation to surge to levels not seen since the 1980s. At its peak, US inflation reached 9.1%. This spike in inflation hurt the pockets of consumers very badly, and in response, they curtailed discretionary retail spending. This impacted volumes of jewellery and lifestyle retailers like Vaibhav Global Limited. Between FY21 and FY24, volumes de-grew at a CAGR of 8.5%, putting pressure on revenues and margins.

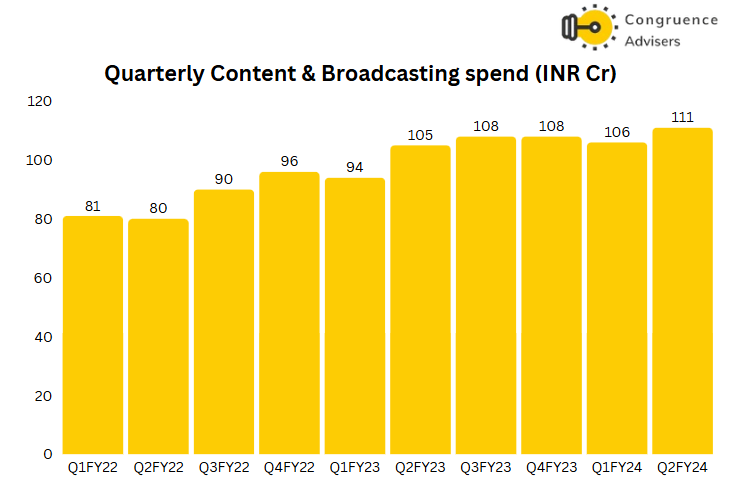

- Strategic investments made by the company in content and broadcasting, which created a drag on earnings – At the time that the demand scenario in its end markets was weak, Vaibhav Global Limited had chosen to enter a high investment cycle by significantly ramping up its spending on content and broadcasting. This was necessitated by the company’s entry into Germany in H2 FY22, its intent to improve its channel positioning across TV networks in the USA, and its acquisition of Ideal World and Mindful Souls. Mindful Souls, by virtue of being a pure play ecommerce business, had a higher intensity of content spend as % revenue compared to the base business of Vaibhav Global Limited.

As a result of this surge in content and broadcasting investment, the line item increased from 9.7% of revenue in FY21 to 16.5% in FY24. This increase in content and broadcasting costs as % revenue has been the major cause behind EBITDA margins dropping from the peak of 14.5% in FY21 to 8.8% in FY24.

Vaibhav Global Corporate governance

Board Composition – The Vaibhav Global Limited Board of Directors has eight members in total, with only 3 independent Directors. This is less than the recommended 50% independent directors on the Board. The directors have relevant experience across domains such as e-commerce, retail, strategy, law, and finance. The Managing Director and Chairman of the Board roles are separated, with Mr. Sunil Agarwal (promoter) occupying the MD role and Mr. Harsh Bahadur (non-executive director) occupying the Chairman of the Board role.

Promoter Remuneration – The promoter group draws benefits from Vaibhav Global Limited in the form of remuneration and dividends paid. The total remuneration paid during FY24 amounted to INR 5.8Cr, which was ~4.6% of the year’s PAT. Total dividends paid to promoter entities amounted to INR 56.5Cr, which was ~44% of the year’s PAT. Since dividends are distributed equally to all shareholders, including minority shareholders, this can be considered to be a fair form of remuneration for the promoters. Dividends appear to be distributed only after safeguarding enough reserves needed to drive growth for the business, so we do not see a conflict of interest here.

Related Party Transactions – There are no significant related party transactions for FY24.

Contingent Liabilities – The total contingent liabilities outstanding as of FY24 was ~INR 4.8Cr in the nature of tax demands, which amounted to ~0.4% of Vaibhav Global Limited’s total net worth and hence is worth ignoring.

Complicated subsidiary structure – As mentioned earlier in the article, Vaibhav Global Limited has a number of subsidiaries and step-down subsidiaries, which makes it complicated for investors to analyze the performances of various segments of the business independently. We understand the subsidiary structure may be necessitated due to the complex global nature of operations of the company. Even though this may not be a corporate governance concern per se, we would still like to flag this.

Vaibhav Global Limited Financial Performance

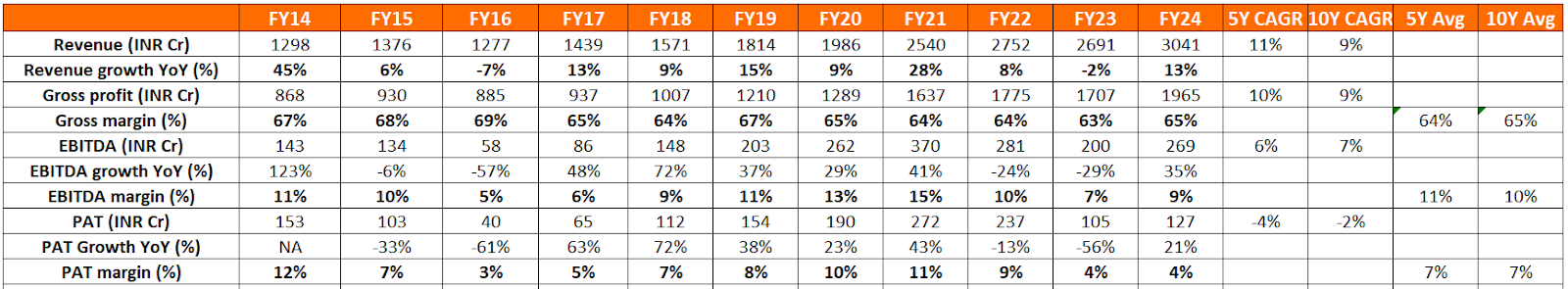

Over the last 10 years, Vaibhav Global Limited has grown revenues at ~9% CAGR, EBITDA at 7% CAGR, and operating cash flows at 5% CAGR, while PAT has de-grown at 2% CAGR. Looking at these figures only, it would seem that Vaibhav Global Limited’s business is struggling. However, that is not the case.

The base year of FY14 was a very strong growth year for Vaibhav Global Limited, where revenues grew by 45% YoY and EBITDA grew by 123% YoY. On the other hand, FY24 was a muted year for Vaibhav Global Limited, where the company was still continuing its gradual recovery from the post-Covid slump, which was brought on by very high inflation and negative retail sentiments in its core markets of the USA and UK. Hence a comparison between FY14 and FY24 skews the underlying growth figures as we are comparing a cycle peak year with a cycle trough year.

If one were to look at Vaibhav Global Limited’s strongest year in these 10 years, FY21, and compare it with the base year of FY14, then between FY14-FY21, revenues, EBITDA, CFO, and PAT for Vaibhav Global Limited grew by a CAGR of 10%, 15%, 9%, and 9% respectively.

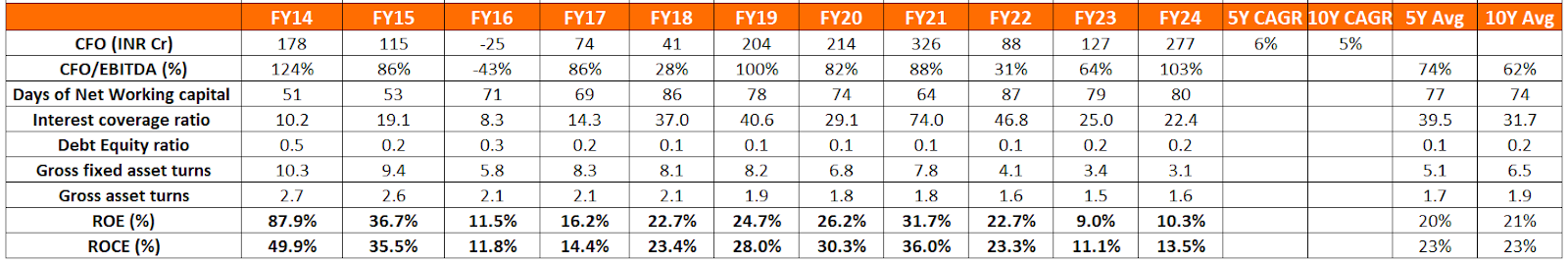

Vaibhav Global Limited Debt, Working Capital, Cash Flow and Return Ratios Analysis

Over the last 10 years, Vaibhav Global Limited has consistently maintained a very strong gross margin level of ~65% and has converted 62% of its EBITDA into operating cash flows. This has resulted in Vaibhav Global Limited maintaining a very healthy debt-to-equity ratio of ~0.2x over the last 10 years and an interest coverage ratio of ~30x. Net working capital days have also been well under control, averaging about 75 days over 10 years, which is a very healthy figure for an export business. Vaibhav Global Limited has reported very strong return on capital metrics, with ROCE and ROE averaging ~23% and ~21%, respectively, over the last 10 years.

Vaibhav Global Limited has underperformed in FY23 and FY24, with PAT margins collapsing to 4% levels and ROEs and ROCEs dipping to ~10% and ~12% levels. This has happened due to a meeting of two factors – slowing demand in the UK and USA following the Russia-Ukraine war and the inflation crisis on the one hand and Vaibhav Global Limited entering a high investment cycle at the time, on the other hand. During FY22, Vaibhav Global Limited entered Germany as a new market; during FY23 and FY24, it increased its spending on content and broadcasting significantly, and in H2FY24, it acquired two companies. A confluence of these two factors has resulted in slow growth and a dip in profitability over the last 2-3 fiscal years.

One can observe a similar slowdown in the FY15-FY17 period, following which it embarked on a period of strong growth between FY18-FY21. During these 4 years, the topline grew at ~15% CAGR with very strong operating leverage, resulting in PAT growth at 43% CAGR.

Vaibhav Global Limited Comparative Analysis

To understand Vaibhav Global Limited investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Vaibhav Global Limited to its competitors (peer comparison) on various fundamental parameters and Vaibhav Global Limited share performance relative to relevant benchmark and sector indices.

Vaibhav Global Limited Peer Comparison

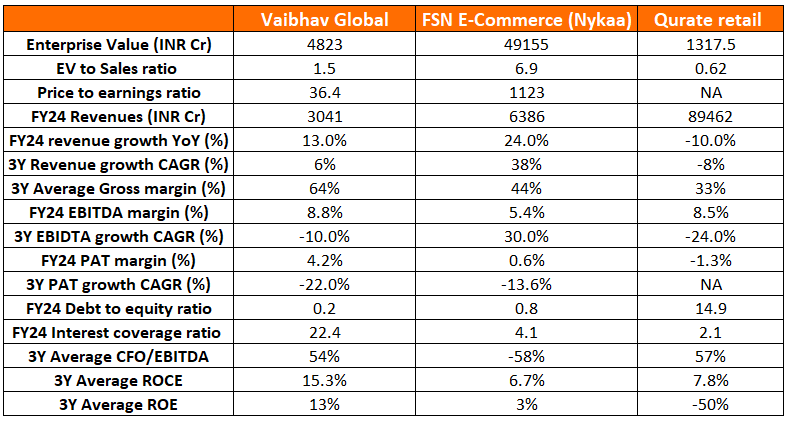

There are no direct peers of Vaibhav Global Limited listed in the Indian markets. Hence, we thought it appropriate to benchmark Vaibhav Global Limited against its US-listed direct peer, Qurate Retail. We are also benchmarking it against an Indian e-commerce player in Nykaa because Vaibhav Global Limited is also listed in India, and thus, the cost of capital and return on capital metrics should be comparable.

It is clear from the comparison table that Qurate Retail is struggling with huge debt in its balance sheet, and at the same time, it is degrowing. Qurate Retail is the largest teleshopping player in Vaibhav Global Limited’s target geographies, and hence, any further deterioration in Qurate’s financial state can benefit Vaibhav Global Limited.

Nykaa is growing at a much faster pace than Vaibhav Global Limited but in terms of margins and return on capital metrics, Vaibhav Global Limited is well ahead.

Vaibhav Global Limited’s only challenge in recent years has been growth. Its balance sheet is very healthy, and return metrics are acceptable, considering the business has been going through a downcycle in recent years.

Vaibhav Global Limited Index Comparison

Vaibhav Global Limited share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why You Should Consider Investing in Vaibhav Global Limited

Vaibhav Global Limited offers some compelling reasons to track closely and to consider investing if one is looking for direct retail play on Western economies

Extreme clarity about target customer – Through the last 1.5 decades since Vaibhav Global Limited became a B2C company, it has had extreme clarity about its target segment – women from the GenX and Baby Boomer generations located in the USA, UK, and Europe. Vaibhav Global Limited believes that this is the right customer segment for them, given that these women tend to be wealthy, are mostly empty nesters with a lot of free time on their hands, and are more loyal to brands and studio presenters compared to millennials and GenZ customers. While growth in this segment may not be as strong as younger demographics worldwide, it is nice to see that the company is very clear about its target customers and hence concentrates all its resources towards converting them, rather than spreading its resources thin chasing varied demographics.

Resilient company with evolving business models – As discussed earlier in the article in detail, Vaibhav Global Limited has managed to evolve and keep pace with the ever changing retail landscape over the last two decades. Starting as a B2B gems and jewellery exporter selling to large format retail stores such as Walmart, it evolved to become a B2C company by selling premium jewellery via physical retail stores and directly via proprietary TV channels. Following the Great Financial Crisis, which disrupted its business model, Vaibhav Global Limited successfully transitioned to an asset-light discounted jewellery and lifestyle retailer selling over television and the Internet. With the advent of e-commerce in the early to mid-2010s, Vaibhav Global Limited increased its resource allocation towards digital sales and now aims to have a 50% digital share of revenue in the near future. This demonstrates that the promoter and the company are resilient and have the ability to bounce back and adapt to changes that seriously challenge its prevailing business model.

Visibility of double-digit revenue growth in the medium term – Over the last 10 years, Vaibhav Global Limited has grown revenues at ~10% CAGR. However, between FY21-FY24, revenue growth has averaged only ~6%. This is likely to change in the medium term for various reasons, such as – inorganic acquisitions done by Vaibhav Global Limited in FY24 (Mindful Souls and Ideal World), stabilization of Germany operations where Vaibhav Global Limited entered in FY22, and stabilization of inflation and gradual return of consumer confidence in its end markets following Covid. Vaibhav Global Limited should be able to deliver early to mid-double-digit growth in revenues between FY24-FY28.

High likelihood of strong operating leverage – Between FY21-FY24, Vaibhav Global Limited was aggressively investing in building the base for its next leg of growth. Investing in setting up operations in Germany, acquiring Ideal World and Mindful Souls, increasing content and broadcasting spending to speed up volume growth, and investing in a consolidated warehouse in the USA along with robotic automation are some of the significant investments Vaibhav Global Limited has made over the last three financial years. The nature of the business is such that revenue takes a while to scale up following investments. We believe that by H1FY25, Vaibhav Global Limited has successfully completed its investment cycle for the moment, and the next few years are going to be about reaping the rewards of these investments. Hence, we expect PAT growth to be much stronger than revenue growth in the medium term as operating leverage plays out.

Strong cash generation, balance sheet, and dividends – Vaibhav Global Limited has always generated strong cash flows. Over the last 5 years, it has converted over 70% of its EBITDA into operating cash flows. About half of the operating cash flows have been used to carry out capital expenditures and acquisitions. The rest has been distributed to shareholders as dividends. There has been a minimal increase in gross debt during this period, thanks to strong working capital control. It is clear that Vaibhav Global Limited has a strong cash-generating business model which generates more than enough cash to drive future growth while also handsomely distributing dividends to shareholders.

Offers portfolio diversification via direct exposure to retail in Western economies – At an investor portfolio level, Vaibhav Global Limited provides interesting diversification to Indian investors by providing them a direct retail play on Western economies and exposure to potential INR depreciation against USD. While, over the longer term, the Indian economy is expected to grow much faster than Western economies, there can be periods of time where the Western economies outperform India, and the INR weakens significantly against the USD. Vaibhav Global Limited can help Indian investors take advantage of such situations.

What are the Risks of Investing in Vaibhav Global Limited

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

The potential threat to Vaibhav Global Limited’s TV-based retail model – An increasing number of consumers are moving away from TV viewing to other sources of audiovisual content and retail such as e-commerce websites, social commerce on platforms such as Instagram, OTT platforms, streaming platforms such as YouTube, etc. While the transition is slower amongst Vaibhav Global Limited’s target segment of older women, it is happening in that segment as well. Vaibhav Global Limited is taking the right steps to address this by increasing its digital sales – the acquisition of Mindful Souls, a pure play digital native business, is a move in the right direction – but it remains a TV-first company, and it remains to be seen how they navigate the latest shift in media consumption patterns in Western economies.

High competition in jewellery and lifestyle retail – While traditionally, Vaibhav Global Limited has competed with the likes of QVC, HSN, and other TV shopping networks, increasingly, the lines are getting blurred between TV and digital retail, and now Vaibhav Global Limited has to contend with competition not only from the likes of QVC and HSN but from e-commerce platforms such as Amazon and Etsy and China-based discount marketplaces such as Temu and Shein. While Vaibhav Global Limited is likely gaining market share from the erstwhile TV shopping giants such as QVC in its categories, it definitely faces more competition from online platforms who are increasingly starting to grab some share of the wallet of Vaibhav Global Limited’s target customers as well.

Tepid growth in the last few years – Between FY21-FY24, Vaibhav Global Limited has only grown revenues at 6% annually while profits have halved. While revenue growth seems lower than actual because the base year of FY21 had abnormal demand due to COVID-19, Vaibhav Global Limited, along with other retail companies, did face significant headwinds from surging inflation in Western economies. While management is confident of reverting to mid-double-digit revenue growth in the medium term, investors need to track this closely. Top-line growth (and, more importantly, volume growth) is the single most important metric for Vaibhav Global Limited at this point.

Significant increase in content and broadcasting spends over the years – Content and broadcasting costs as % of revenue have surged from ~11% in FY20 to ~17% in FY24, and it’s expected to sustain at 17-18% for the next couple of years. Management has said that this is due to conscious broadcast investments into the new market of Germany, investments into better channel positioning in the USA, and digital marketing investments towards Mindful Souls and Vaibhav Global Limited’s existing online business. At some point in the future, this ratio should head down to 14-15% levels. If it does not, then it may indicate that Vaibhav Global Limited is facing steeper competition overall and is now needed to spend a larger portion of its revenues than before to drive double digit growth. Whether the increased spend can be offset by higher gross margins and higher operating leverage, remains to be seen.

Significant deterioration in return on capital metrics over the last 2 years – Between FY14-FY22, Vaibhav Global Limited reported an average ROE and ROCE of 31% and 28%, respectively. However, in FY23 and FY24, the average ROE and ROCE dropped sharply to 10% and 12%, respectively, due to the reasons discussed above. While management is confident of getting back to 20% return on capital metrics in the near future, we need to keep a keen eye on this.

High fixed cost nature of business – The nature of Vaibhav Global Limited’s business is such that its fixed cost is heavy and takes time to break even. Any new entry into geography entails upfront investments in securing broadcast deals and marketing. In the initial few years, the new geography makes operating losses as the profits from customers are not enough to recover the fixed costs. As the number of customers gradually scales up, the business breaks even and starts generating healthy profits. For example, Vaibhav Global Limited entered the German retail market in H2FY22 and it is expected to break even only starting H2FY25. Thus, whenever Vaibhav Global Limited enters a new geography, we can expect a medium-term drag on profitability from that geography for 2-3 years.

Vaibhav Global Limited Future Outlook

The outlook for Vaibhav Global Limited looks quite bright in the medium term. The reasons for the muted performances between FY21-FY24 seem to be behind.

- The FY24 base of revenues and profits is quite favorable for future years. Revenues haven’t grown much since FY21, and profitability at ~4% of revenue has reached levels where it has historically tended to bottom out.

- Inflation has moderated significantly in its target markets from the peaks of CY22 and CY23, and the respective Central Banks have since eased interest rates, which has led to an increase in consumer confidence and increased discretionary retail spending on their part.

- The investment cycle in content and broadcasting seems to be behind the company for the medium term. Content and broadcasting costs as % revenue are expected to peak out in FY25 and fall marginally in subsequent years.

Management has guided for mid teens annual revenue growth for the medium term with continued operating leverage. If management is indeed able to deliver double-digit revenue growth, then operating leverage is bound to come as employee costs and certain SG&A costs are fixed in nature. There is some operating leverage also expected from the content and broadcasting line item FY27 onwards. We anticipate that an early double-digit revenue growth for Vaibhav Global Limited can drive a PAT growth of ~25%.

Early double-digit revenue growth should be driven primarily by the German retail business Ideal World and Mindful Souls. The Shop LC and TJC businesses in the USA and UK should continue a steady constant currency growth rate of 3-4%. The depreciation of INR against USD should add another layer to Vaibhav Global Limited’s revenue growth in the coming years.

The key monitorable for investors in Vaibhav Global Limited is, therefore, going to be a double-digit revenue growth trajectory. Most of the revenue growth should come from volume growth because the average selling price (ASP) has already increased significantly since Covid, and as per management, ASPs should plateau going forward.

Vaibhav Global Limited Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Vaibhav Global Limited Price charts

Let us first take a look at the 5 year weekly chart of Vaibhav Global Limited as that perfectly captures the entire story of Vaibhav Global Limited since Covid. From the Covid lows of 135 in March 2020, Vaibhav Global Limited stock zoomed almost 6x to 950 by May 2021, in a span of 14 months. On the back of a strong FY18-FY20 period, the market quickly extrapolated the one off Covid earnings of FY21 as a secular trend and took Vaibhav Global Limited stock to unreasonable valuation levels of 7x Price to Sales multiples (against a 10Y median P/S of 1.6x). From then on, the story of Vaibhav Global Limited stock has been a disappointing one.

The one way fall that started from mid 2021, stopped only around 285 levels in mid 2022 after taking away 70% of the valuations from the peak. Since then Vaibhav Global Limited stock has been consolidating for 2.5 years in a range of 260-500. Vaibhav Global Limited stock rallied from the lows of 260 odd to 500 between April 2023 and Jan 2024 along with the rest of the market as Vaibhav Global Limited reported 3 strong YoY quarters. However, starting Q4 FY24 earnings again flattened out YoY due to increased investments in content and broadcasting following the new acquisitions, taking Vaibhav Global Limited stock price back to 260-280 levels.

At present, 260 seems to be a strong support level. The longer term trend for Vaibhav Global Limited stock will change to positive only when its able to decisively cross over the downward sloping trendline before crossing the 500 resistance level.

On daily charts, over the last one year we can see that all the DMAs had been moving downwards but are starting to level off over the last few months. On a daily close basis, 267 looks like a strong support level which was not breached even in the June 4th selloff. The immediate resistance level to cross is 345 – Vaibhav Global Limited stock has tried and failed to cross this resistance level four times in the last six odd months. Once the 345 level is cleared, the next clear resistance level on the daily charts is 422.

Vaibhav Global Limited Latest Latest Result, News and Updates

Vaibhav Global Limited Quarterly Results

Vaibhav Global Limited reported a 13% YoY increase in revenues (9.3% YoY growth in volumes) but flat EBITDA and PAT YoY due to higher content and broadcasting spending in H1 FY25 vs H1 FY24. In H1 FY25, Vaibhav Global Limited spent ~20% of its topline on content and broadcasting costs against ~16% in H1 FY24.

The sharp growth in expenditure has been driven mainly by three reasons –

1. The acquisition of Mindful Souls BV in Sep 2023, which has a higher content spend intensity than the base business of Vaibhav Global Limited

2. Spends on ramping up Ideal World in the UK, which was in financial trouble when its assets were acquired by Vaibhav Global Limited in Sep 2023

3. Due to higher spending to achieve better TV channel positioning in the USA.

The German operations are expected to break even in H2 FY25. That, coupled with operating leverage in the UK and US businesses due to a seasonally stronger H2 FY25, should result in significant operating leverage playing out in H2 FY25.

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.

Disclosure (Updated as of Dec 31, 2024) – No position in the stock in personal portfolio