Welspun Enterprises Ltd. is a small-cap infrastructure company belonging to the multi-billion dollar Welspun conglomerate group. Welspun Enterprises Ltd. is an EPC (Engineering, Procurement, Construction) company that pursues projects mainly in road infrastructure and water infrastructure.

We like Welspun Enterprises Limited because of its large order book and increasing share of orders from the water sector as compared to the road sector. Water projects are larger in size, more technically complex, and have less competition as compared to road projects, which are more commoditized. Welspun Enterprises Limited Management has guided for 20-22% revenue growth CAGR between FY25-FY27 while maintaining mid-teen EBITDA margins and mid-teen return on capital metrics. We believe Welspun Enterprises Limited has demonstrated over the last decade that it’s a good capital allocator, and the management can be trusted with making bets in the right sectors. Welspun Enterprises Limited’s acquisition of Michigan Engineers Private Limited in Aug 2023 has further strengthened its technical capabilities in the water sector. With strong growth prospects highlighted by management, Govt’s continued focus on water infrastructure in the recently concluded budget for FY 25-26, and fair valuations, we believe this could be a good bet in the water sector.

Welspun Enterprises limited Company Summary

Welspun Enterprises Ltd. is a small-cap infrastructure company belonging to the multi-billion dollar Welspun conglomerate group. Welspun Enterprises Ltd. is an EPC (Engineering, Procurement, Construction) company that pursues projects mainly in road infrastructure and water infrastructure.

Welspun Enterprises Ltd went through a major restructuring during 2014-15, which set the course for the next 10 years of growth for Welspun Enterprises Ltd. Pre-2015, this company was listed in the stock exchanges as Welspun Projects Ltd. Welspun Projects Ltd. was a major EPC player participating in private EPC and PPP (Public Private Partnership) infrastructure projects. At the time, the infrastructure environment in India was not very healthy and this company was also saddled with debt on its balance sheet and was struggling to generate sufficient profits and cash flows.

Welspun Enterprises Ltd. was a subsidiary of another listed Welspun entity called Welspun Corp Ltd. (WCL). While WCL was a pipes manufacturing company, the subsidiary, Welspun Enterprises Ltd., acted as a holding company for various infrastructure investments made by WCL, such as BOT Toll projects. Welspun Enterprises Ltd. also had ownership interests in oil and gas blocks. This subsidiary was quite cash-rich.

In order to unlock synergies in the infrastructure companies across the Welspun Group and bring together cash rich units with units which had extensive experience of executing EPC projects, the Welspun Group decided to merge Welspun Enterprises Ltd. (which was first demerged from WCL) and Welspun Projects Ltd. The merged company was called Welspun Enterprises Ltd., and that’s how the company, in its current-day form, came to exist in May 2015. Before the merger, each entity sold non-core assets to generate further cash and strengthen the balance sheet of the merged entity.

Welspun Enterprises limited Company Structure

Diagram to be added

Welspun Enterprises Limited has a complicated subsidiary structure due to the nature of its operations. It undertakes several HAM/BOT projects for which it has to float SPVs (special purpose vehicles). Let’s take a look at the major revenue-generating subsidiaries and associate companies of Welspun Enterprises Limited.

Subsidiaries

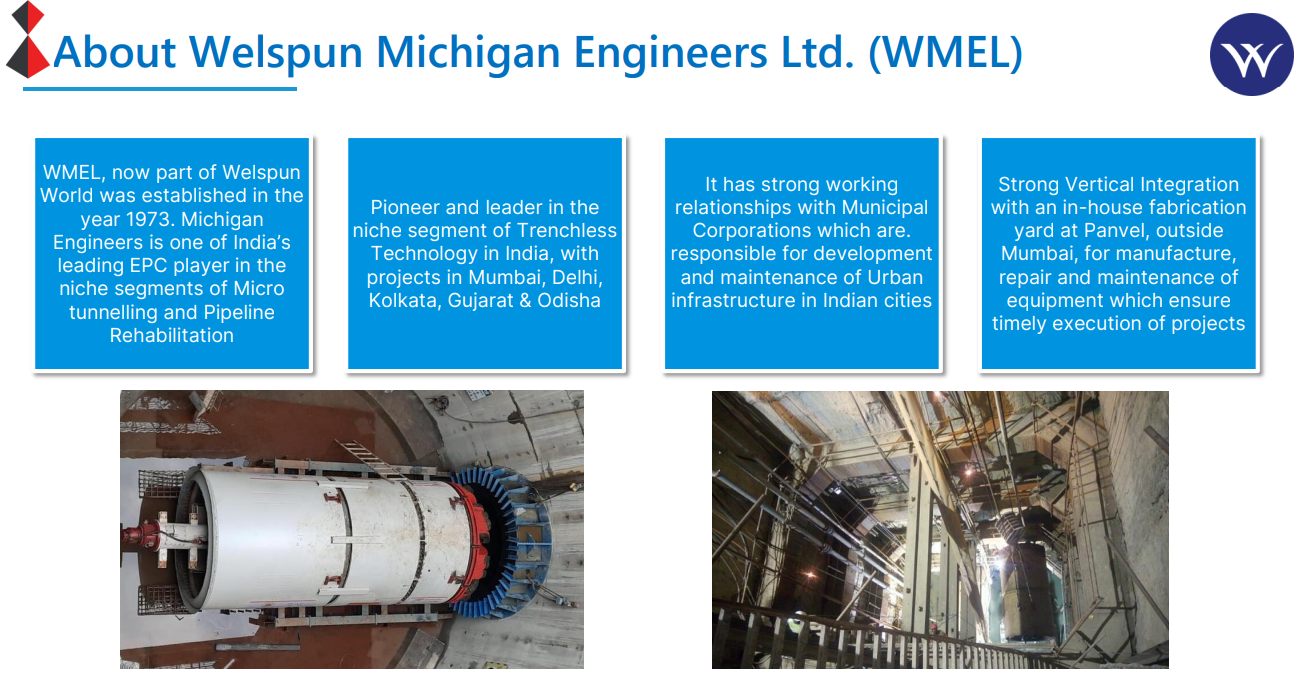

Welspun Michigan Engineers Limited – Welspun Michigan Engineers Limited is the specialty tunneling company in which Welspun Enterprises bought a 50% stake in FY24, which later increased to 60% in FY25. This subsidiary brings in critical tunneling capabilities to support and supplement Welspun Enterprise Limited’s water sector projects.

Welspun Sattanathapuram Nagapattinam Road Private Limited – This is an SPV for pursuing the Sattanathapuram Nagapattinam HAM road project. Welspun Enterprises holds a 70% stake in this SPV.

Welspun AuntaSimaria Project Private Limited – This is an SPV for pursuing the Aunta-Simaria HAM road project. Welspun Enterprises holds a 74% stake in this SPV.

WelspunKaveri Infra Projects JV – This is a JV with Kaveri Infraprojects Limited, under which the company is pursuing the Jal Jeevan Mission order won in UP in 2021. Welspun Enterprises Limited owns a 70% stake in the JV.

Welspun EDAC JV Private Limited – This is a JV with EDAC Engineering Limited, under which the company is pursuing the Dharavi Waste Water Treatment facility project that it won in May 2022. Welspun Enterprises Limited owns an 80% stake in the JV

Dewas Waterprojects Works Private Limited – This is a subsidiary that completed and commissioned the Dewas Industrial Water Supply Project. It presently earns O&M revenues from the project. Welspun Enterprises Limited owns 76% of this company.

Associate Companies

Adani Welspun Exploration Limited – This is a JV between Welspun Enterprises Limited and the Adani Group, formed for the purpose of exploration and production of Oil and Gas. The JV owns 3 O&G blocks in Western India which are waiting for approvals for exploration to start. Welspun Enterprises Limited is the junior partner in the JV and owns a stake of 35%.

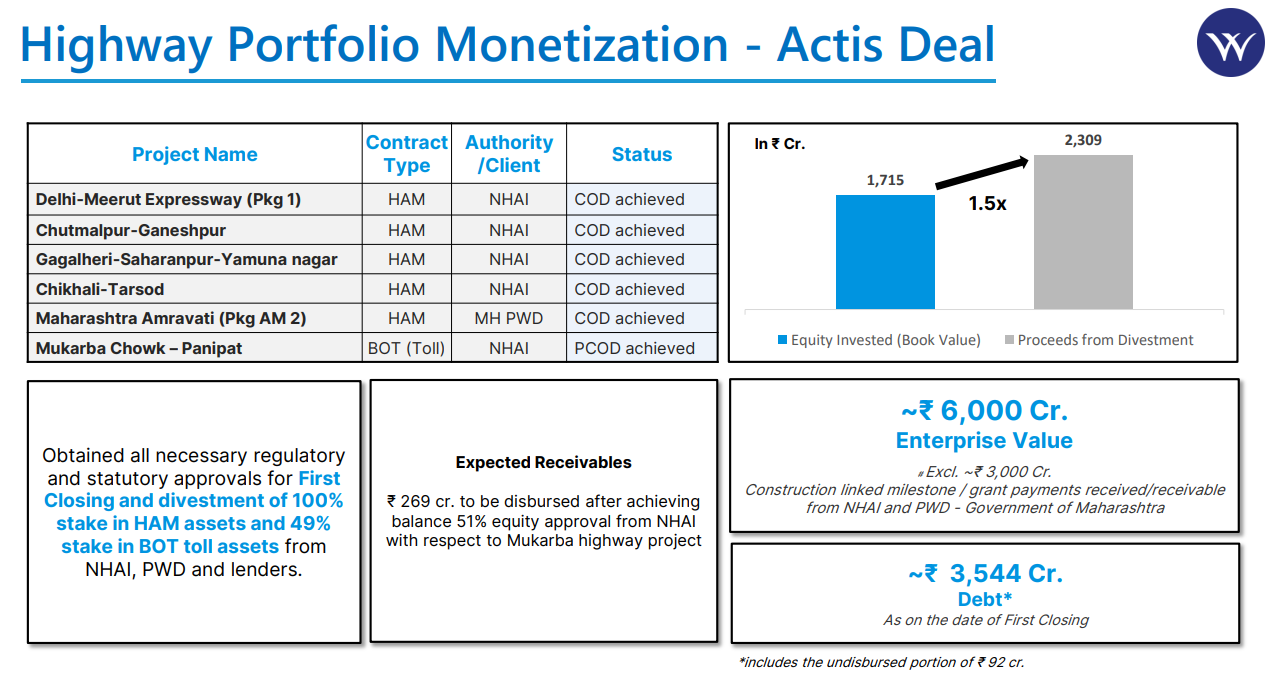

NXT-Infra MCP Highways Private Limited – Welspun Enterprises Limited owns 49% of this JV. This JV was part of the asset monetization deal signed by Welspun Enterprises Limited with Actis in FY23. Under the deal, 49% of the stake in this company was sold to Actis by Welspun Enterprises Limited. There is an agreement for Actis to buy the remaining 49% stake as well; Welspun Enterprises Limited is awaiting approval from NHAI to go ahead with the transaction.

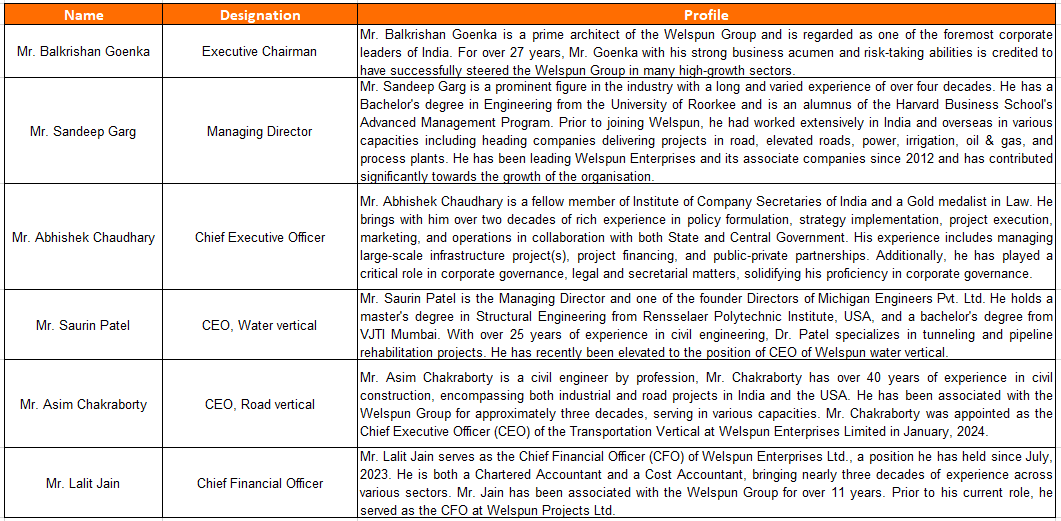

Welspun Enterprises limited Management Details

Welspun Enterprises limited – Industry Overview

Water sector

Water is one of the most precious resources on earth. Not only is it essential for human life in the form of potable water, but large amounts of water are needed for human use outside of drinking and for industrial use. India is an especially water constrained economy with 18% of the global population but only 4% of the global water resources to sustain this population. The annual per capita availability of water for 2031 in India has been assessed to be 1367 CuM, respectively, significantly lower than the 1700 CuM considered absolutely necessary for dignified sustenance.

Given this imbalance, it becomes critical for the country to be able to increase efficiency in the usage of water and enhance the efficiency and effectiveness of recycling wastewater to make it fit for human and industrial usage.

The Government has placed a lot of importance on improving water infrastructure in the country since 2014. There are several Govt programs being run in the water sector. Let’s take a look at them.

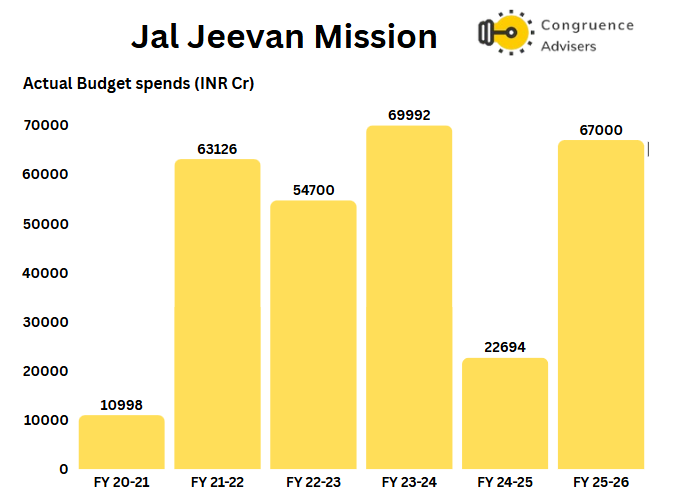

Jal Jeevan Mission [Launched in 2019] – Jal Jeevan Mission aims to provide safe and adequate drinking water through individual household tap connections to all households in rural India. As of Jan 2025, the Mission claims to have provided tap water connection to ~80% of all rural households.

The program has consistently received budgetary support with high allocations. The drop in FY 24-25 was due to sluggishness in actual fiscal spending in an election year; the budget estimates for FY 24-25 were high at INR 70k Cr.

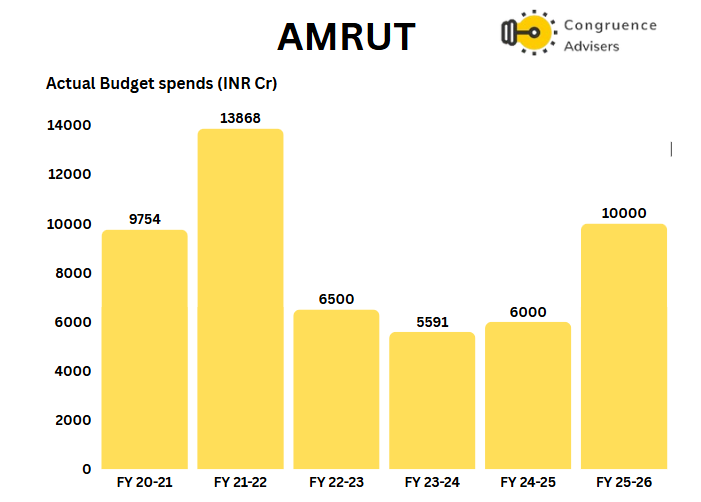

AMRUT and AMRUT 2.0 (Atal Mission for Rejuvenation and Urban Transformation) [Launched in 2015 and 2021] – The Atal Mission for Rejuvenation and Urban Transformation (AMRUT) was launched in June 2015 with the aim of transforming the urban infrastructure in 500 major cities and towns burdened with an ever-growing population. It intends to provide basic services in the domains of tap water connections, sewerage and septage treatment solutions, storm-water drainage systems, improvement of urban transport systems, and increasing green cover and parks, etc. The AMRUT scheme was relaunched in 2021 as AMRUT 2.0 for 5 years from 2021-2026.

While budget allocations to AMRUT have reduced since peaking out in FY22, there has been a significant increase in allocation for FY26.

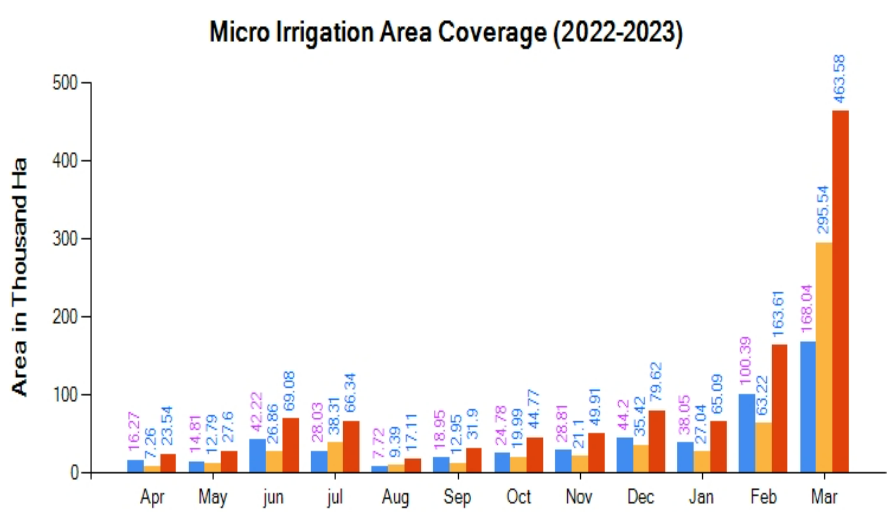

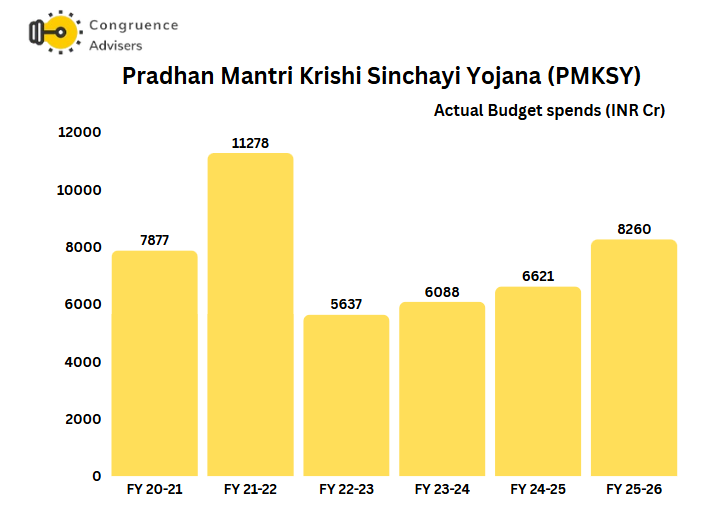

Pradhan Mantri Krishi Sinchayi Yojana (PMKSY) [Launched 2015] – The Pradhan Mantri Krishi Sinchayi Yojana has been formulated with the vision of extending the coverage of irrigation ‘Har Khet ko pani’ and improving water use efficiency ‘More crop per drop’ in a focused manner with end to end solutions on source creation, distribution, management, field application and extension activities.

There have been consistent budgetary allocations towards this scheme over the last several years.

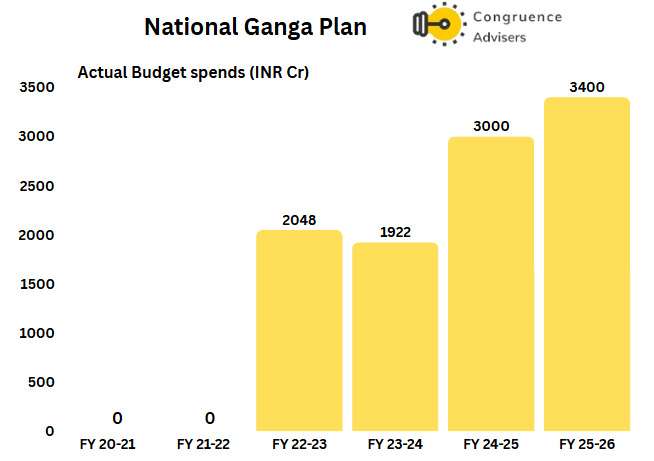

Namami Gange [Launched 2014] – Namami Gange is an Integrated Conservation Mission, approved as a ‘Flagship Programme’ by the Union Government in June 2014 with a budget outlay of Rs.20,000 Crore to accomplish the twin objectives of effective abatement of pollution, conservation, and rejuvenation of National River Ganga

The sewage and wastewater treatment landscape in India is still developing, with only 50-60% of India’s wastewater currently undergoing treatment and recycling. According to India Infrastructure Research, as of March 2024, more than 460 projects with a combined capacity of around 16,500 MLD (Million Litres per Day) are planned in the wastewater segment in the coming years in India.

Industrial usage of water is also undergoing a transformation. There is an increasing propensity to use recycled water for industrial use cases rather than freshwater, in line with water conservation efforts to prevent shortages. The installation of captive zero liquid discharge (ZLD) plants is gaining momentum. Wastewater reuse projects for industrial and non-potable applications have reduced reliance on freshwater.

Digitalization is emerging as a key solution for achieving water resilience and improving operational efficiency in water management. Many cities are increasingly using technology solutions like SCADA, the internet of Things (IoT), GIS systems, artificial intelligence, digital twins, and satellite surveillance for monitoring, collection, and treatment systems. This is expected to facilitate holistic planning of infrastructure and allocation of resources effectively.

Tunnel construction is becoming an integral part of water infrastructure development. The introduction of initiatives such as the Pradhan Mantri Krishi Sinchayee Yojana, the Interlinking of Rivers Programme, and the Jawaharlal Nehru National Urban Renewal Mission for the exploitation of water resources have aided the growth of tunnel construction for irrigation, water supply, and sewerage. India has over 2,500 km of completed tunnel length, with the hydropower sector dominating with over 1,200 km of completed tunnels in addition to irrigation (more than 470 km) and water & sewerage (more than 230 km).

Road sector

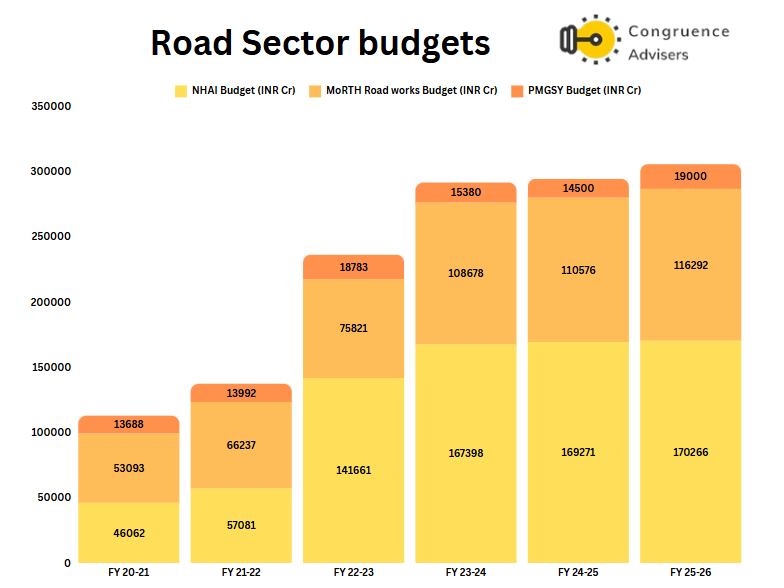

There has been a very significant Government budget outlay on road infrastructure development over the last several years. As depicted below, the budget for the construction of national highways, state highways, and rural roads taken together has almost tripled from FY21 to FY26.

The key Government programs driving road infrastructure development are as follows.

Bharatmala Pariyojana [2017] – This was a highway development plan launched by the Government in 2017 with a view to building 50000 KM of highways across the country with a total outlay of ~INR 10 Lakh Cr. Under Phase I of the program, about 35000 KM of highways are to be constructed by 2027. As of Dec 2023, about 26.5k KM was awarded under the program and about 16.5 KM of highways had been constructed already.

PM Gatishakti and National Infrastructure Pipeline (NIP) [2019 and 2021] – PM Gati Shakti is an integrated infrastructure development initiative launched by the Government of India in 2021. It aims to enhance multimodal connectivity and reduce logistics costs as a % of GDP from 14% to 8% to bring it in line with developed economies. The total outlay for the plan was INR 111 Lakh Cr via the National Infrastructure Pipeline program launched in 2019. The NIP aims to create world-class infrastructure across roads, railways, airports, ports, and energy to be funded partially by the Central Government, partially by State Governments, and partially by the private sector.

Pradhan Mantri Gram Sadak Yojana [2000] – Pradhan Mantri Gram Sadak Yojana (PMGSY) is a rural road connectivity program launched by the Government of India in 2000 to provide all-weather road connectivity to unconnected villages, thereby improving rural infrastructure and boosting economic development. Total roads built under this program as of 2023 amounted to 7 Lakh kms. The scheme is funded by a 60:40 mix of Central and state funds.

These schemes have together resulted in an increase in the highway network in India from ~91000 KM in 2014 to ~146000 KM in 2023. This rapid increase in the National Highway in India has resulted in a lot of business for road infrastructure and construction companies.

Welspun Enterprises limited Business Segments

Welspun Enterprises Limited operates across two main verticals – Water infrastructure & tunneling and Road infrastructure. Apart from this, the company also has a minority share in an oil and gas exploration joint venture.

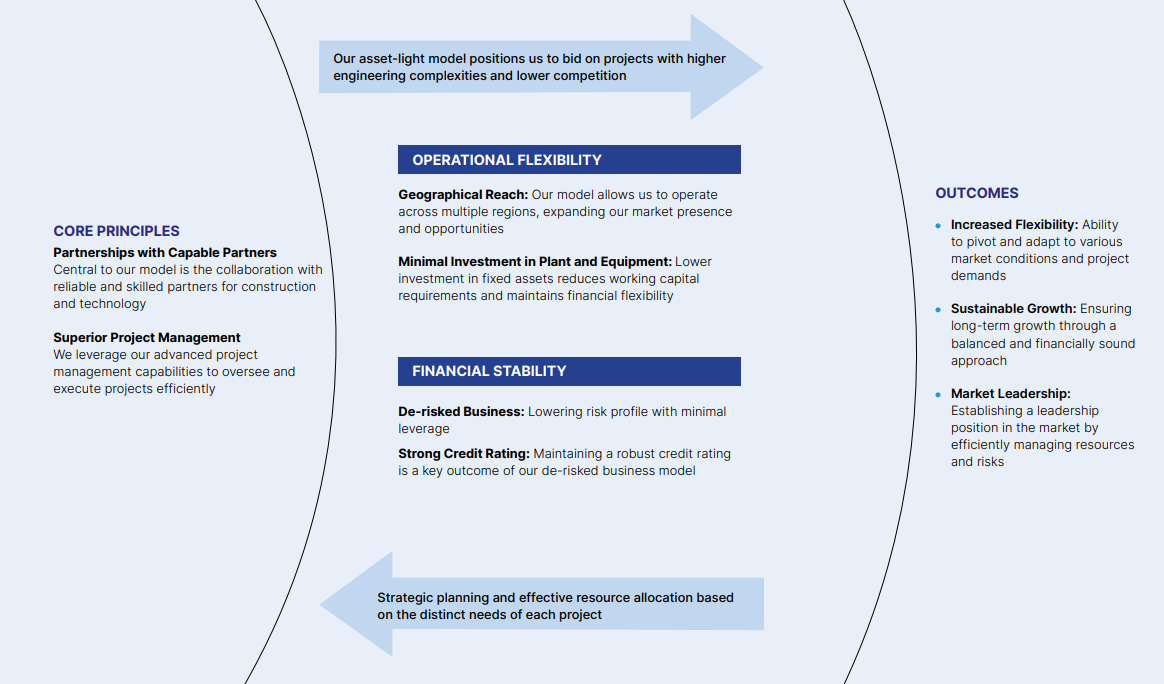

Unlike most other infrastructure EPC companies, Welspun Enterprises Limited likes to operate in an asset-light manner. As a result, the standalone entity does not invest in plants and equipment and outsources most of the construction work to its network of subcontractors. Therefore, Welspun Enterprises Limited focuses on superior project management and nurturing a good network of capable subcontractors. This asset-light approach provides them added flexibility and enables them to operate without much leverage.

The asset light approach of Welspun Enterprises Limited is reflected in the following numbers

- Standalone gross asset turns ratio of 43x

- Standalone debt to equity ratio of 0.08x

- Extremely high PBT to EBITDA (including other income) flow through ratio of 90% for the standalone entity

- Standalone working capital days of ~100

- Very high standalone and consolidated PAT margins of ~11.6% and ~11.1% respectively

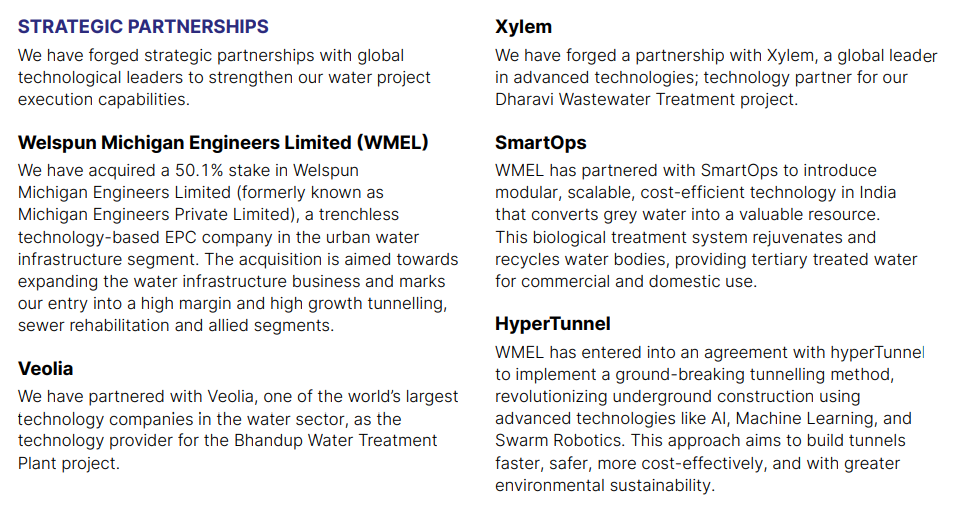

Welspun Enterprises Limited likes to undertake large projects with high technical competence involved, which allows them to leverage their project management skills and, at the same time, reduce competitive intensity. In order to execute complex projects, the company believes in technical tie-ups with the largest domain expert companies in their respective fields. A few examples of such tie-ups are as follows.

Acquisition of Michigan Engineers Limited – Welspun Engineers Limited acquired a 60% stake in Michigan Engineers Limited to gain exposure to their specialized tunnelling capabilities

Technical tie-up with Veolia – one of the largest water technology companies in the world, for the water treatment plant project in Bhandup.

Technical tie-up with Xylem, also another leading water technology company, for the Dharavi wastewater treatment project.

Technical tie-up with SmartOps via Welspun Michigan Engineers Limited – WMEL has signed a JV with SmartOps to bring their modular bio-catalysis-based greywater treatment technology called S.A.B.R.E. to India. Using this technology, modular wastewater treatment plants can be erected at a fraction of the time and cost of traditional projects.

Technical tie-up with hyper tunnel – Tie-up with UK-based startup hyper tunnel to deploy AI, machine learning, and swarm robotics in underground tunnel construction

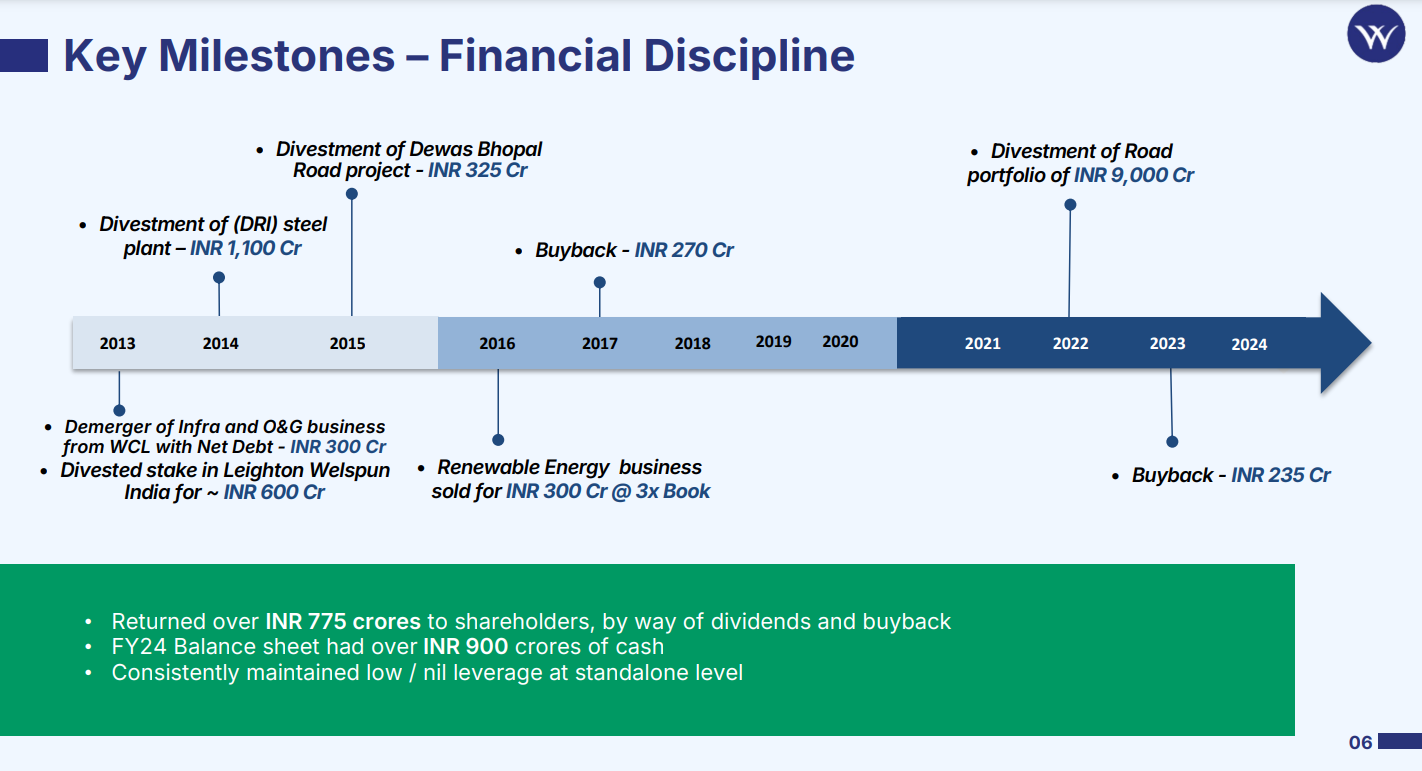

Welspun Enterprises Limited believes in regular asset monetization to recycle capital for pursuing further growth opportunities. Welspun Enterprises Limited has also regularly returned excess cash to shareholders via buybacks.

The most recent such example was in 2023 when Welspun Enterprises Limited sold 6 HAM/BOT road assets to Actis for an EV of ~INR 6000 Cr. In the process, the company managed to get INR 2309 Cr of equity via the deal on an invested base of INR 1715 Cr of equity, a 1.5x return, resulting in a mid-single-digit IRR.

As a result of this regular monetization approach, Welspun Enterprises Limited believes that its true PAT margin and return on equity are realized over a cycle of 5 years. Hence, it may be more prudent to measure the Welspun Enterprises Limited’s PAT and ROE performance as an average over 5 years.

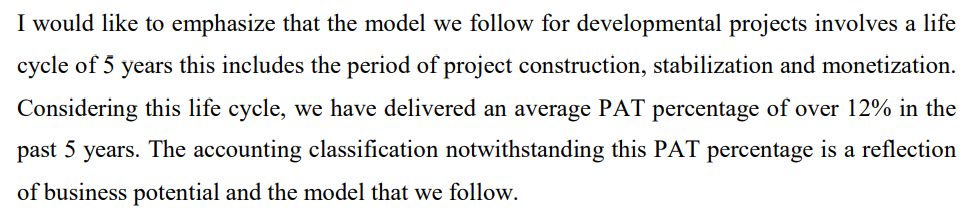

The current order book of the company stands at ~INR 15200 Cr net of GST. The standalone order book is ~INR 13600 Cr, and the WMEL order book is ~1600 Cr. The order book excludes about ~INR 2000 Cr of orders for which Welspun Enterprises Limited has been declared L1 but is awaiting the letter of award. Of the ~INR 15200 Cr order book, about ~INR 4400 Cr is towards Operations and maintenance, and the rest is towards EPC. The O&M revenues accrue as annuities over a period of 10-15 years after the construction of the project is over and the project becomes operational.

Given the large order book, which is ~5x FY24 revenues, Welspun Enterprises Limited has clear growth visibility for the medium term.

Let us take a detailed look at the two main verticals of Welspun Enterprises Limited – water & tunneling and road. We will also treat the oil and gas JV as a separate vertical and take a brief look at it.

Water and tunneling vertical

Under the water & tunneling vertical, Welspun Enterprises Limited undertakes projects across the water value chain, i.e., water treatment, transmission as well as distribution. Welspun Enterprises Limited’s standalone has a water vertical order book of ~INR 9633 Cr and a tunneling order book of ~INR 1989 Cr. Of the water vertical order book, ~INR 4400 Cr is towards operations and maintenance. The tunneling subsidiary, WMEL, has a separate order book of ~INR 1570 Cr.

Orders in the water vertical are usually of 4-5 year duration, while tunnelling orders are of 8-9 years duration. The EBITDA margins in the water and tunnelling vertical are higher than the road vertical. As the proportion of water & tunneling projects has increased in the order book for Welspun Enterprises Limited, EBITDA margins have gradually inched up. Water & tunneling represent ~87% of the current order book.

The water & tunneling order book consists mainly of four projects.

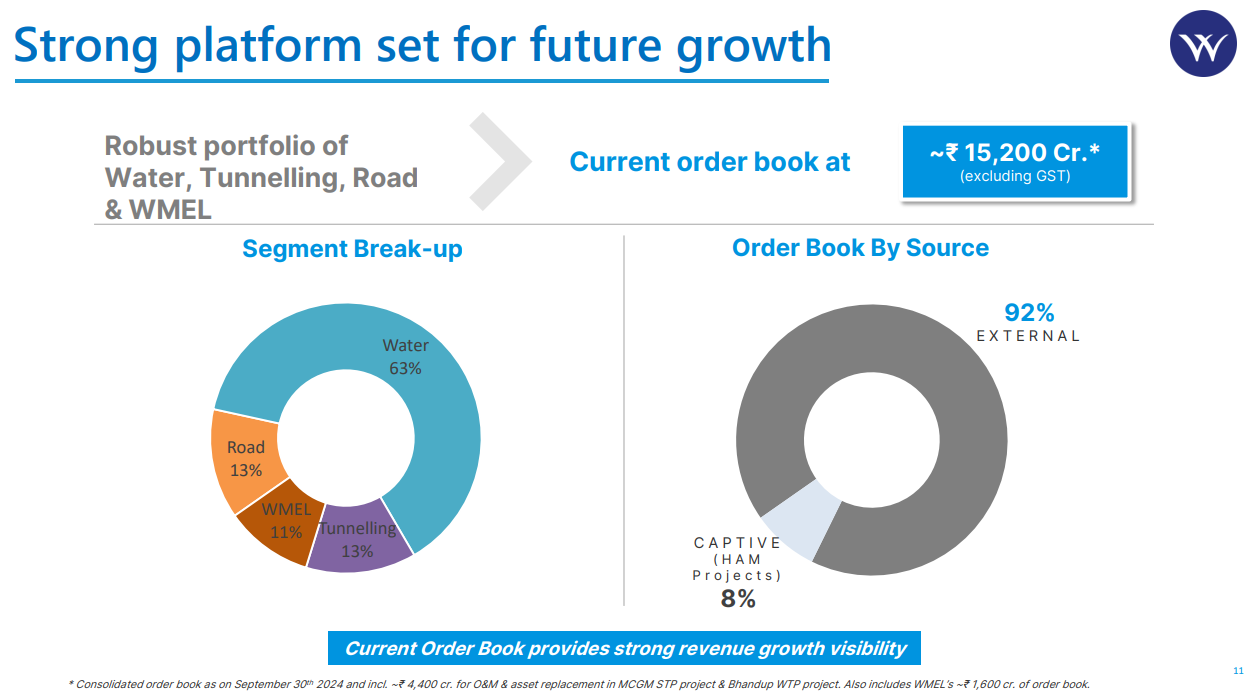

Uttar Pradesh Jal Jeevan Mission project – This was an EPC order received in 2021 from the sanitation department of Uttar Pradesh under the Jal Jeevan Mission to provide tap water to ~2500 villages across districts of Uttar Pradesh. The total order value ex of O&M was INR 2900 Cr. As of H1 FY25, 50% of the project has been executed and the rest is expected to be executed within 18 months. The project is being executed in a JV with Kaveri Infraprojects, where Welspun Enterprises Limited is the lead partner with a 70% share.

Dharavi wastewater treatment project – This is an EPC project received under the DBOM (Design, Build, Operate, and Maintain) model from Brihanmumbai Municipal Corporation (BMC). The order value is ~INR 4636 Cr and is being executed in a JV with EDAC Engineering Limited, where Welspun Enterprises Limited is the senior partner with an 80% stake. Xylem is providing technical assistance for this project. The design and build part of the contract is to be executed in 5 years, and the O&M contract is to be executed over 15 years after the completion of the design and build.

Bhandup water treatment plant project – This is an EPC order received in the DBOM mode from BMC for the construction of a water treatment plant in Bhandup. The order value is ~INR 4124 Cr and is being executed solely by Welspun Enterprises Limited with technical assistance from Veolia. The design and build part of the order is worth INR 2240 Cr and is to be executed in 4 years, whereas the O&M part of the order is worth INR 1880 Cr and is to be executed over 15 years.

Dharavi Ghatkopar wastewater tunnel project – This is a design and build EPC contract received from BMC worth INR 1989 Cr to build a 9 KM long water tunnel that will connect the Dharavi and Ghatkopar Wastewater Treatment Plants with each other. The order is to be executed over 8-9 years.

Competition in the water and tunneling vertical is less as compared to the road vertical, especially in the large, technically complex water projects that Welspun Enterprises Limited targets. Primary competitors in the EPC space are companies such as Va Tech Wabag, Ion Exchange, EMS Limited, Triveni Engineering Limited, SPML Infra Limited, etc.

Road vertical

Under the road vertical, Welspun Enterprises Limited executes EPC, HAM, and BOT contracts. Road projects are usually 2.5-3.5 years in duration and have an EBITDA margin of 13-14%. HAM and BOT projects require an investment of equity from Welspun Enterprises Limited. These projects are monetised by the company post completion of construction. The current order book under the road vertical is ~INR 2033 Cr, with another order worth ~INR1850 Cr as L1, awaiting the letter of award.

The major road projects under execution are as follows.

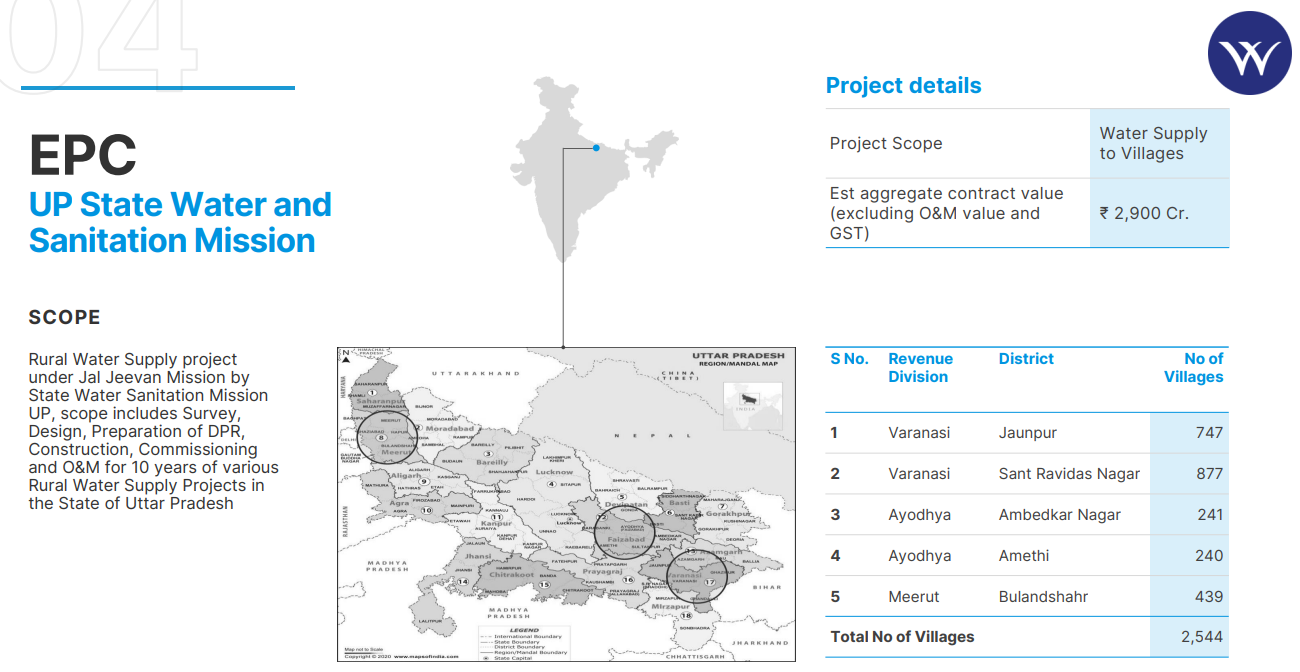

Aunta Simaria HAM project

Sattanathapuram Nagapattinam HAM project

Varanasi Aurangabad NH2 EPC Project

The road vertical is quite commoditized with a number of competitors. Competition in HAM projects is a little lower than in EPC projects, as the project owner is required to inject equity into the project upfront. A few major competitors of Welspun Enterprises Limited in the road sector are L&T, Afcons, Ashoka Buildcon, HG Infra Limited, PNC Infratech Limited, GR Infraprojects Limited, IRB Infra Limited, etc.

Oil and gas JV

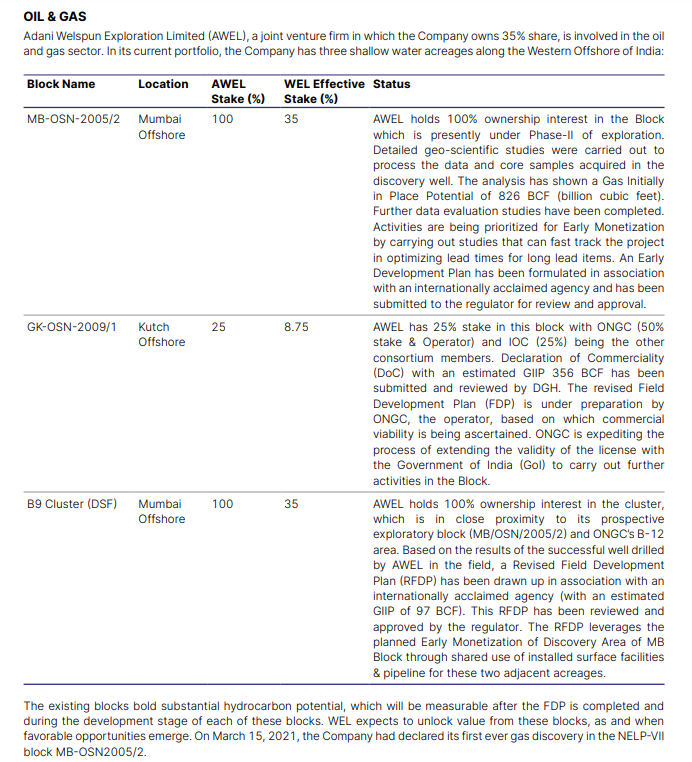

Welspun Enterprises Limited holds a 35% stake in the Oil & Gas JV company with Adani Group, called Adani Welspun Enterprises Limited (AWEL). So far, Welspun Enterprises Limited has invested ~INR 450 Cr in this JV. The JV owns 3 offshore oil and gas blocks on the West Coast. The details of these blocks are given in the image below. Currently, the Mumbai Offshore block’s Field Development Plan is being discussed with the regulator. If the FDP is approved, then the oil and gas reserves in this block will be officially certified. At this point, Welspun Enterprises Limited has the option to invest in further capex to get the field ready for O&G extraction or monetize the asset by selling its 35% stake to a strategic buyer.

Welspun Enterprises limited Corporate governance

Board Composition – The Board of Directors of Welspun Enterprises Limited comprises 10 Directors, 6 of whom are Independent. The Lead Independent Director at Welspun Enterprises gets to share his views about the developments at Welspun Enterprises Limited via a 1-page note which is carried in the Annual report. This is not a common practice in Indian companies and is good to see. The Chairman of the Board is non-independent.

Promoter Remuneration – The promoter and Chairman, Mr. BK Goenka, draws a salary of INR 7.5Cr a year. In addition to that, he draws a commission equal to 2% of the net profits of Welspun Enterprises Limited for the year. Hence, his total remuneration for FY24 amounted to ~INR 14Cr for the year. Mr. Sandeep Garg, the Managing Director of the company who also owns ~2% stake in Welspun Enterprises Limited, draws a total salary of INR 5 Cr. Between the Promoter and Chairman, the total remuneration drawn is INR 19Cr, which amounts to ~6% of the PAT of the company for FY24, which is well within prescribed limits.

Related Party Transactions – The only related party transactions worth mentioning are those conducted with related Welspun Group companies that are not subsidiaries or associate companies of Welspun Enterprises. The sum total of such transactions amounted to ~INR 8.3 Cr in FY24 across items such as CSR expenses, retainers, sales promotion, royalty expenses, and purchase and sale of the property. As a % of total sales for FY24, this amounted to only ~0.3% and is hence not material.

Contingent Liabilities – The total contingent liabilities amount to INR 55 Cr and are mostly related to tax disputes. The total contingent liabilities amount to only ~2.2% of the net worth of Welspun Enterprises Limited and is hence not material.

Complicated subsidiary structure – Welspun Enterprises Limited has 13 subsidiaries and 2 associate companies and hence has quite a complicated subsidiary structure. However, this complicated structure is a function of the nature of the business they are into, which necessitates the creation of SPVs and JVs to bid for large projects. Hence, this is not a red flag, in our opinion.

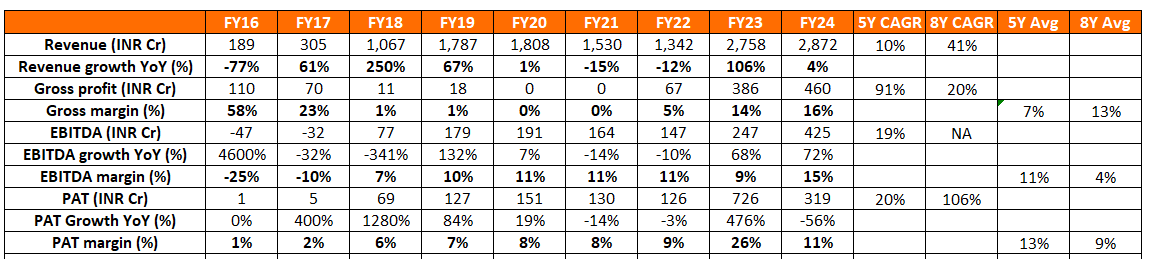

Welspun Enterprises limited Financial Performance

Given the context of the major business restructuring, it may be prudent to analyze welspun Enterprises Ltd’s history starting FY16. Over the last 8Ys, Welspun Enterprises Ltd has compounded revenue at 41% CAGR and PAT at 106% CAGR. These figures are a little skewed due to the extremely low revenue and PAT figures in the base year of FY16. The last 5 years are more representative of Welspun Enterprises Ltd’s actual performance. Over the last 5 years, Welspun Enterprises Ltd has grown revenues, EBITDA, and PAT at a CAGR of 10%, 19%, and 20%, respectively. This is a very healthy clip of growth.

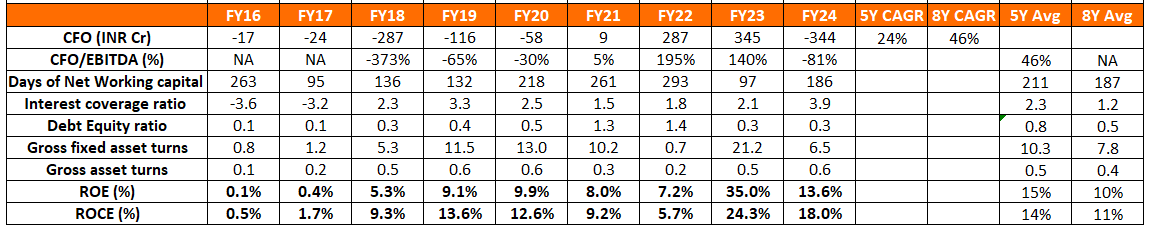

Welspun Enterprises limited Return Ratios, Working capital, Debt and cash flow Analysis

Not only that, over the last 8 years, Welspun Enterprises Ltd has continuously improved its return on capital metrics. From printing sub 1% ROE and ROCE at the start of this journey, Welspun Enterprises Ltd has now been printing 15%+ ROCEs for the last two years. Yearly return metrics can be volatile in a company such as Welspun Enterprises. In a year that monetizes assets, return metrics can be inordinately high (FY23 is an example), whereas in a year that invests heavily in HAM (Hybrid annuity model) or BOT (Build Operate Transfer) projects, the return metrics can appear depressed (FY21 and FY22).

Welspun Enterprises Ltd has managed to grow its revenues 15x over the last 9 years while maintaining a robust balance sheet. Debt to equity ratio at consolidated levels has consistently been below 0.5x except for a couple of years in FY21 and FY22 when they acquired a large under-construction road project from the Essel Group. The interest coverage ratio has also been quite comfortable, and cash generation has improved significantly in the last 5 years. Net working capital days have largely been under control. Welspun Enterprises Ltd has very high gross asset turns due to its asset-light nature of operations.

Welspun Enterprises limited Comparative Analysis

To understand Welspun Enterprise Limited investment potential, we have conducted a comprehensive analysis. This analysis includes comparing Welspun Enterprise Limited to its competitors (peer comparison) on various fundamental parameters and Welspun Enterprise Limited share performance relative to relevant benchmark and sector indices.

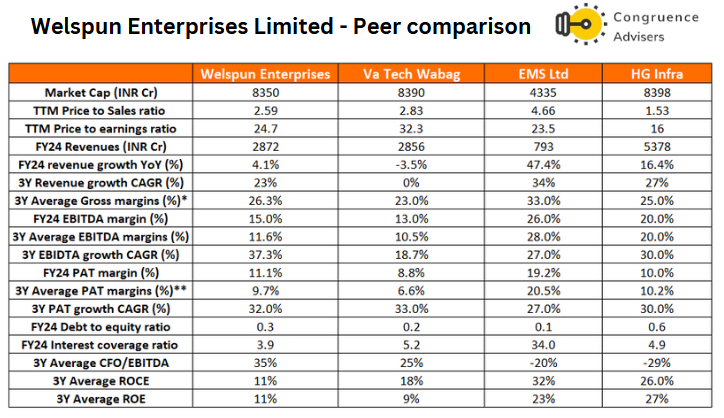

Welspun Enterprises limited Peer Comparison

Welspun Enterprise Limited is into the water and road infrastructure verticals. Hence, it’s prudent to benchmark it against other EPC players in the road and water sectors. Let’s benchmark Welspun Enterprise Limited against HG Infra Limited and PNC Infra Limited, which operate in the road sector, and Va Tech Wabag Limited and EMS Limited, which operate in the water sector.

* Gross margins including manufacturing costs

** One off Other income or loss has been removed before arriving at PAT figures

As evident from the table above, all four companies in this list have very healthy metrics, reflecting the momentum of Govt capex spending in road and water verticals. EMS Limited is a newly listed company and stands out against its water sector peers by virtue of its higher margins and return on capital ratios coupled with strong growth. However it remains to be seen whether EMS Limited is able to grow fast because of its small size or if it does really have some sustainable competitive advantages against its peers.

Compared to its water sector peer, Va Tech Wabag, Welspun Enterprises Limited has been growing fast in the last few years with stronger margins and a higher return on equity. The balance sheet of both players is quite strong even as cash generation is lukewarm, suggesting relatively low capex intensity in their respective business models.

Welspun Enterprises limited Index Comparison

Welspun Enterprise Limited share performance vs S&P BSE Small cap Index as the index benchmark comparison is a fundamental tool for understanding the investment potential and making informed decisions in the context of the broader market

Why you should consider investing in Welspun Enterprises limited

Welspun Enterprise Limited offers some compelling reasons to track closely and to consider investing if one is looking to play on India road infrastructure and water infrastructure.

Strong momentum in water projects with good budget allocations – The government continues to allocate high-budget resources towards the Jal Jeevan Mission Yojana. Compared to a revised budget of INR 22k Cr in FY25, the budget for FY26 has been fixed at INR 67k Cr. Therefore, while order inflows in the water sector may be slower in FY25, they are expected to pick up strongly in FY26.

Asset-light nimble operations – Gross asset turns for Welspun Enterprises Limited are quite high at ~7-10x due to its asset-light operations. Welspun chooses to focus on resource allocation and project management while outsourcing construction activities to its trusted sub-contract partner ecosystem. This enables Welspun Enterprises Limited to not invest in heavy machinery and plants and, hence, retain the flexibility to pivot as necessary in response to business and market conditions.

Strong PAT accretion – Due to its asset-light business model, Welspun Enterprises Limited has low depreciation and finance costs relative to other infrastructure companies. This enables a high flow-through of EBITDA to PBT, resulting in very strong PAT margins of ~12%. Such high PAT margins for infrastructure companies are not common.

Welspun Michigan Engineers Limited adds key competencies – The acquisition of a 60% stake in Michigan Engineers Pvt. Ltd. over FY24 and FY25 has added key competencies to Welspun Enterprises Ltd. that gives it an edge over its competitors. Welspun Michigan Engineers Ltd. specializes in tunneling solutions for underground sewage systems and other water infrastructure. In addition to tunneling, Welspun Michigan Engineers’ Ltd.’s recent JV with SmartOps UK has also given its capabilities for setting up small-scale, quick-turnaround, bio-catalysis-based sewage treatment plants, which can get a lot of traction in India due to the cost and time savings associated with setting up such plants.

Technical tie-ups with Veolia and Xylem – The Welspun Group’s size, pre-eminence, and network allow Welspun Enterprises Limited to tie up with global leaders in water infrastructure solutions such as Xylem and Veolia for its projects. These tie-ups bring technology inputs from these global leaders that may not be accessible to Welspun Enterprises Limited’s competitors. Hence, it may allow Welspun Enterprises Limited to bid for and win more complex water infrastructure projects.

Valuations seem reasonable considering growth prospects – Welspun Enterprises Limited is currently trading at ~24x TTM EPS. Considering management guidance of 20-22% revenue growth in the medium term, coupled with Welspun Enterprises Limited’s robust balance sheet and decent return metrics, the current valuations seem fair. Especially when compared to the richer valuations enjoyed by its competitors in the water sector.

What are the Risks of Investing in Welspun Enterprises Limited

Investors need to keep the following risks in mind if they choose to invest into this business. Risks needs to be weighed in combination with the advantages listed above to arrive at a decision that is optimal for your portfolio construct

High dependence on Govt capex momentum – Being an infrastructure company, Welspun Enterprise Limited’s order book and execution momentum is largely dictated by Government budgets allocated to the water and road infrastructure segments. Post Covid, the Government of India has meaningfully ramped up capital formation in the country. This has brought serious tailwinds to infrastructure players like Welspun Enterprises Limited. However, the tailwind can become a headwind if the Indian Government starts pulling back on its capex programs. The total capex budget for FY25-26 in the recently announced budget is flat compared to the capex budget for FY24-25 and 10% higher compared to the revised budget for FY24-25. Hence, the Govt capex growth momentum seems to be flattening out. However, as long as the Govt keeps the capex number reasonably high, order books for infrastructure companies should keep growing.

HAM/BOT projects need equity infusion – Welspun Enterprises Limited participates in HAM (Hybrid Annuity Model) and BOT (Build Operate Transfer) projects in the road sector, where the company needs to infuse upfront equity into the projects. Returns are received via periodic payments during a concession period of 10-15 years after construction or via asset monetization. This is in contrast to EPC projects, where the contractor gets paid for the work done on a milestone basis and does not need to invest its own equity. The HAM/BOT model, therefore, carries some equity risk for Welspun Enterprises Limited.

Heavy dependence on Mumbai municipality in the water sector – Three large water sector projects received by Welspun Enterprises Limited since 2022 have been from BMC (Brihanmumbai Municipal Corporation). The total value of these 3 orders received is over INR 10k Cr, and they constitute a bulk of their current order book. While these are all very critical projects for the Mumbai Municipal Area and were won fairly by competing in tenders, it does expose them to some client concentration risk and geographical risk. Any unforeseen event affecting Mumbai or its Municipal corporation can impact Welspun Enterprise Limited’s revenues and profits.

Oil and gas is a risky business and capital intensive – Welspun Enterprise Limited has a 35% equity stake in a joint venture with the Adani Group which owns 3 oil and gas blocks in Western India. The JV is currently trying to get FDP (Field Development Plan) approval from MoPNG. Post approval, the JV can go ahead with capex to prepare for commercial extraction of oil and gas. Oil and gas exploration is a capital-intensive business that has uncertainties in terms of the final availability of O&G resources in the designated fields and also uncertainties around global oil prices. Welspun Enterprises Limited has already invested upwards of INR 400 Cr towards this JV. We hope it is able to monetize its investments after FDP approval rather than sinking more capital into developing the field.

Welspun Enterprises limited Future Outlook

The outlook for Welspun Enterprises Limited looks quite bright, with an order book equal to ~5x FY24 revenues. Management has guided for ~INR 3000-3300 Cr standalone revenue and ~INR 4000 Cr of consolidated revenue in FY25 with a consolidated EBITDA in the range of INR 700-750 Cr (17.5%-18.8%, this includes other income).

In the medium term, Welspun Enterprises Limited expects to grow revenues by 20-22% CAGR. Management is confident about this due to the large existing order book and the opportunity size in water and tunneling that it sees going ahead. According to management, in the medium to long term, Welspun Enterprises Limited will have a total addressable order pipeline of INR 3 Lakh Cr across the water and tunneling verticals.

Welspun Michigan Engineering Limited is expected to grow revenues at ~30% CAGR and print EBITDA margins in the 21-23% range. For WMEL, the SmartOps JV holds significant promise. The JV has received its first order for a 10 MLD treatment plant already. The order value is INR 25 Cr. In FY26, Welspun Enterprises Limited expects the JV to execute anywhere between 50-150 MLD of orders, implying a revenue potential of ~INR 125-375 Cr with EBITDA margins ranging between 20-30%. Since WMEL has a 50% stake in this JV, Welspun Enterprises Limited shareholders are entitled to only 30% of the profit from this JV (WEL holds a 60% stake in WMEL, So the effective stake in this JV is 30%)

Higher revenue contribution from WMEL coupled with operating leverage from increasing revenues could expand EBITDA margins further for Welspun Enterprises Limited from the current levels of ~15%. At current valuations of 24x trailing EPS, Welspun Enterprises Limited stock seems fairly valued considering the growth prospects and management guidance.

Welspun Enterprises limited Technical Analysis

We consider technical analysis to be a useful input in taking medium-term investment decisions. Many a time price action tends to lead to fundamental developments; this is too important an aspect to be ignored by retail investors who do not have access to management outside of common forums like investor calls & AGM.

At Congruence Advisers we like to consider both the long-term weekly chart and the daily chart to arrive at a view on price action. Combined with our understanding of fundamentals, we usually end up being better placed to be able to judge both the business cycle and the stock cycle. Playing the stock cycle right is extremely important for investors looking to extract significant alpha over the medium term.

Welspun Enterprises limited Price charts

Over the last 3 years, on weekly charts, one can see that Welspun Enterprises Limited stock has tended to move in an upward parallel channel with one break to the downside in the broader market corrections of Mar-Apr 2023 and one break to the upside in July-Aug 2023 in the subsequent bull run when Welspun Enterprises Limited reported 15% EBITDA margins for the first time in a quarter. After strong up moves, Welspun Enterprises Limited stock has tended to consolidate for a few months before the next up move. As long as the Government capex environment remains strong and Welspun Enterprises Limited continues to execute well, Welspun Enterprises Limited stock is expected to keep the uptrend intact.

Over the last 1Y, on daily charts, one can see that Welspun Enterprises Limited stock has traded well above its 200 DMA levels. The 200 DMA levels have been tested only twice in the last 1Y, both during broader market corrections, in March 2024 and Nov 2024. Welspun Enterprises Limited stock bounced back from support levels in the 434-444 zone. Subsequently Welspun Enterprises Limited stock moved up ferociously in late Nov and Dec 2024 to create all time highs in early Jan 2025. During the brutal small and microcap market correction in Jan 2025, Welspun Enterprises Limited stock re-tested the breakout levels and has since been consolidating around it. In Jan, 2025 the stock is barely down 2% while the S&P BSE Smallcap index is down ~10%, showing great relative strength. Any positive news on a large order win is a high probability event for creating fresh ATH.

Welspun Enterprises limited Latest Latest Result, News and Updates

Welspun Enterprises limited Quarterly Results

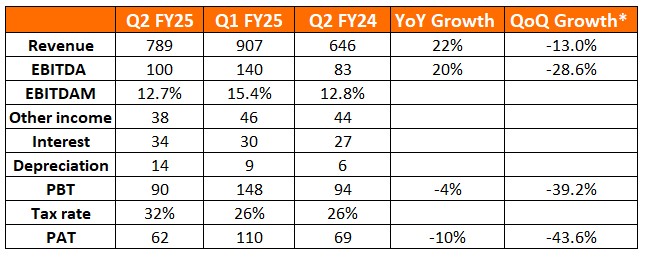

Q2FY25 was a strong quarter for Welspun Enterprises Limited, with 22% growth in revenues and 20% growth in EBITDA YoY. PAT was down ~10% YoY due to lower other income and higher depreciation and interest expenses. Management guided for a strong H2FY25, indicating consolidated revenues for FY25 could be ~INR 4000 Cr and consolidated EBITDA could be between INR 700-750 Cr.

* QoQ numbers are not comparable due to seasonality

Disclaimer – This note is part of a business research & analysis series on small companies, there is no BUY/SELL recommendation or target price issued as part of this. There is no assurance that this stock makes for a good investment, there is no guarantee that this stock will be included in the coverage universe of Congruence Advisers. The note contains some forward-looking statements and insights drawn from the historical results, annual reports and investor presentations; they are to be viewed only within this context and not as a prediction of future performance of the business or the stock covered.

While due care has been taken to ensure that the information here is as accurate as possible, Congruence Advisers disclaims any liability in case of any unintentional inaccuracies.

The content does not constitute investment advice.

Disclosure (Updated as of Dec 31, 2024) – No position in the stock in personal portfolio